For investors with a long time horizon and hearty appetite for risk, going all-in on equities typically offers the best chance of compounding strong returns.

In recent years, such investors will have benefited from simply tracking indices dominated by US tech-focused mega-caps, which have logged meteoric returns.

Nick Hyett, investment manager at Wealth Club, said: “Companies such as Nvidia, Microsoft and Alphabet are some of the best companies to ever exist and cheap tracker funds mean investors can access them at a lower cost than ever.”

Yet relying solely on these giants leaves investors vulnerable to concentration risk, whereas a more active, balanced and globalised approach allows for strong returns and less volatility, he argued.

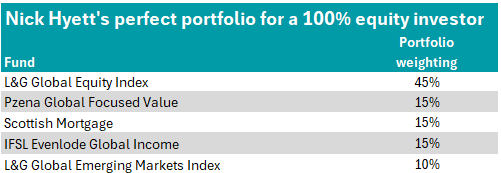

Below, he put together the perfect portfolio for a 100% equity investor that does not lean too heavily into the US tech giants.

Source: FE Analytics

Almost half (45%) of Hyett’s 100% equity portfolio is allocated to the L&G Global Equity Index fund, which tracks the FTSE World index.

Hyett said the £1.7bn vehicle will still give investors exposure to these mega-cap tech stocks and “capitalise on their success”, but also includes emerging players helping to drive the speedy global adoption of artificial intelligence (AI), such as Broadcom and Taiwan Semiconductor Manufacturing, which also feature in the index fund’s top 10 holdings.

As the FTSE World index becomes “increasingly concentrated” in mega-cap stocks, Hyett said it is increasingly important to diversify – and that is where active funds come into play in the portfolio.

To complement the tracker, Hyett selected three active global funds, allocating 15% to each, noting their “distinctive investment style and investment philosophies that percolate throughout their firms”.

As well as ensuring diversification, Hyett said they also provide exposure to three major investment styles: value, growth and quality.

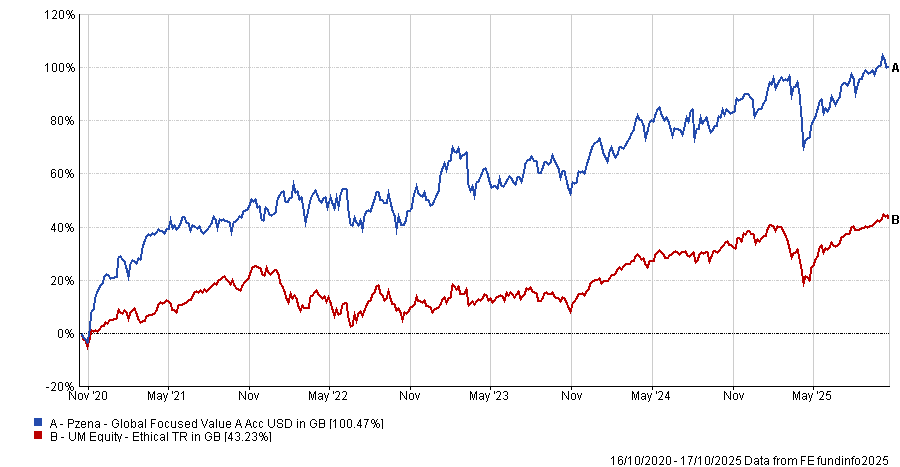

The value-focused $346.4m Pzena Global Focused Value fund should make up 15% of the portfolio, according to Hyett.

Although 44% invested in North American stocks, some of its top holdings are borne out of the Asia-Pacific region, including Samsung Electronics and Alibaba.

In addition, more than a quarter (26%) of the fund’s assets are invested in financials, with just 13% targeting the telecom, media and technology sector.

The fund has an FE fundinfo Crown Rating of five out of five and is managed by John Goetz, Carolin Cai and Benjamin Silver.

“The US-based asset manager runs a dedicated deep value strategy – targeting only the cheapest 20% of companies worldwide,” Hyett explained, noting that employee ownership gives the investment team the freedom to execute a strict investment process – “even when value is out of favour for long spells”.

The fund has outperformed the FTSE World over five years, gaining 100.3% compared to the index’s 87.1%.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

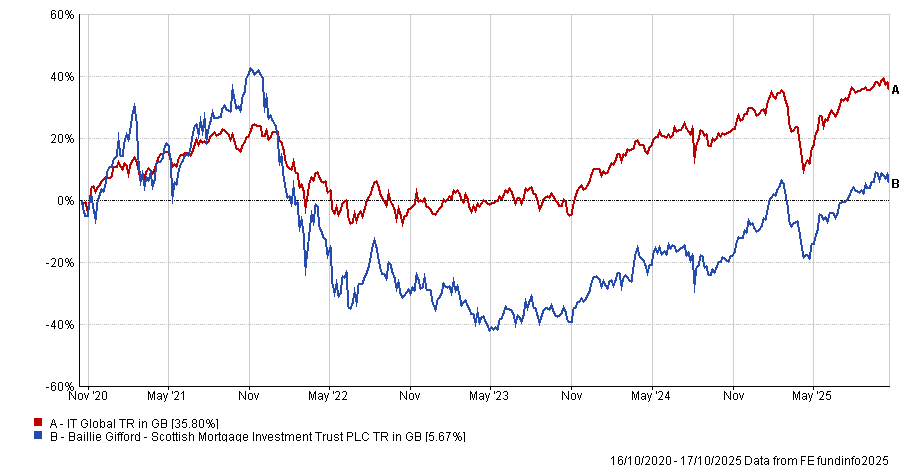

On the growth side, Hyett picked Baillie Gifford’s investment trust Scottish Mortgage, which he described as “the growthiest of growth funds”.

Managed by FE fundinfo Alpha Manager Tom Slater and Lawrence Burns, they take a long-term view and typically own companies for a minimum of five years. The trust has gained 380.7% over 10 years.

The managers look for ‘outlier’ companies, such as Latin American e-commerce giant Mercado Libre – the trust’s top holding at 5.4% – which has performed strongly despite the region’s struggles over the past decade.

“The managers take advantage of the investment trust structure to throw some unlisted companies into the mix – most notably SpaceX and TikTok owner Bytedance,” said Hyett.

Last month, Burns noted that Elon Musk’s SpaceX was the trust’s biggest contributor over the past year.

Hyett said although the trust’s “aggressive positioning can make it volatile”, it is a “price worth paying for exposure to some of the world’s most transformative businesses”.

Performance of the trust vs sector over 5yrs

Source: FE Analytics

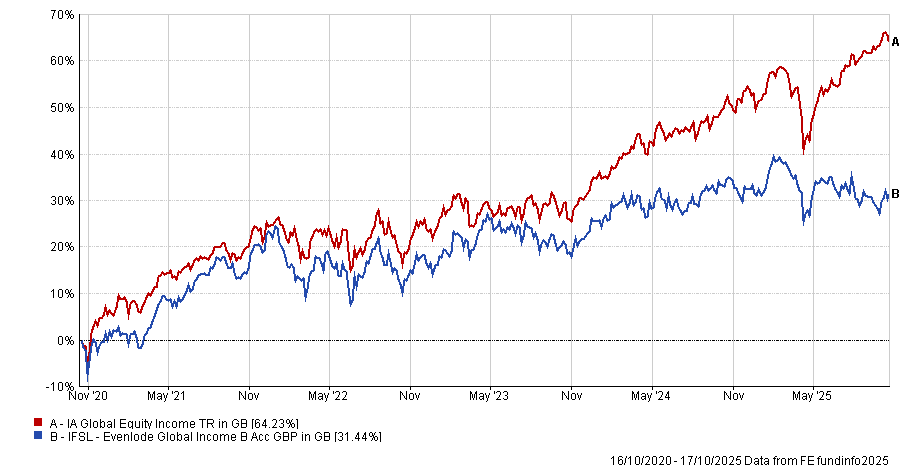

On the quality side, Hyett selected the £1.4bn IFSL Evenlode Global Income fund. It invests in high quality, growing and dividend-paying companies, meaning it is likely to have more of a defensive profile than the broader global equity market and offers a level of downside protection.

The fund has languished in the fourth quartile for total returns in its sector over one, three and five years, gaining 31.4% over the half-decade, compared to the 64.2% average return of the IA Global Equity Income sector.

The fund has had a “pretty grim time recently”, Hyett admitted, due to its large positions in consumer goods and luxury stocks such as L’Oreal and Reckitt.

“However, we continue to believe that the managers’ focus on high quality bond proxies will pay dividends when market conditions are less favourable,” he said.

Hyett’s sentiment is echoed by Titan Square Mile analysts, who said they have a “favourable view” of its outcome-oriented focus and that the fund’s preference for reliable income compounders “should not give investors too many surprises”.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

With emerging markets “notably absent” from most of the funds above, Hyett suggested that 10% of the portfolio should be allocated to the “competitively priced” £2.8bn L&G Global Emerging Markets Index fund.

“Different performance drivers, including the ability to benefit from a weaker dollar, mean [the fund] can help diversify the portfolio – somewhat counterintuitively, these higher risk economies can actually reduce risk when blending into a wider portfolio,” he said. Top holdings include Taiwan Semiconductor Manufacturing, Tencent, Alibaba and Xiaomi.

Although the main point of this portfolio is to ensure investors can enjoy the benefits of equity investing without too much reliance on US mega-caps, given the recent strength of those US-based companies, Hyett warned that this portfolio “might struggle to outperform the [FTSE World] index alone”.

“However, historically, this blend of funds has helped to reduce volatility and mitigate more dramatic market falls,” he said. “If we see a change in market leadership, a more diversified portfolio will serve investors well.”