Emerging markets have surprised this year with a remarkable turnaround in performance, but investing in this vast and diverse area can be daunting.

To provide some clarity, Trustnet asked experts why emerging markets have a place in portfolios and how big the allocation should be, as well as how to invest in them. We included funds and trusts picks and a review of the expensive funds that justified their higher costs.

Today, we are putting all this into practice by building an emerging markets portfolio, with Matthew Read, senior analyst at QuotedData, taking on the challenge.

A core allocation for a defensive investor

The highest-recommended allocation to emerging markets for a cautious investor can vary between 2.5% and 10%. Read said 5% is a good measure and should be distributed across Fidelity Emerging Markets, JPMorgan Global Emerging Markets Income, Templeton Emerging Markets and Utilico Emerging Markets, with the Utilico and JPMorgan trusts providing “a useful anchor for most portfolios”.

The former is a “strongly differentiated” vehicle focused on infrastructure, utilities and related sectors.

“While its definition of infrastructure is quite broad – it has exposure to airports, digital infrastructure and logistics ports, as well as the usual candidates such as electricity, water, waste and rail – these are fundamentally assets that society needs,” Read explained.

“As a result, these assets’ cashflows tend to be resilient, while the underlying growth outlook tends to be strong – emerging markets need considerable investment in infrastructure and this helps to drive their growth.”

In contrast, the JPMorgan trust focuses on income, which leads it towards cash-generative businesses with good growth prospects, giving investors “some comfort” that it will hold up well in difficult periods.

Investors should not confuse the trust with JPMorgan Emerging Markets, which is proposing to change its name to JPMorgan Emerging Markets Growth & Income.

They should also note that there is a chance that these trusts are merged, something that James Carthew, head of investment company research at the firm, said he would be “unhappy with”. For now, however, Read is content to include it in his suggested portfolio.

The diversification provided by JPMorgan Emerging Markets Income and Utilico Emerging Markets should be enough for most cautious investors, especially those with smaller portfolios.

However, those who have the budget should also include the other strategies named above, which might look similar to each other but were highlighted as “solid performers that help broaden the exposure”.

Templeton Emerging Markets has been a solid long-term performer underpinned by “a very well-resourced team”. It comes with “a sensible yield” and its ongoing charges of 0.95% are “competitive”.

Meanwhile, the Fidelity Emerging Markets trust is “not quite getting the appreciation it deserves,” Read said, highlighting its recent performance, which has shown a noticeable turnaround under new managers Chris Tennant and Nick Price.

It is a “very good” size with more than £600m of assets under management, making it the third-largest vehicle in the IT Global Emerging Markets sector.

“There is clear water between it and the colossuses that are the Templeton and JPMorgan trusts, yet Fidelity boasts the lowest ongoing charges ratio while also paying a respectable 2% yield.”

Frontier markets and emerging EMEA for balanced investors

A balanced investor with approximately 10% in emerging markets could also look to add BlackRock Frontiers and/or Barings Emerging EMEA Opportunities, which “should provide additional diversification” when alongside the holdings discussed above.

The former focuses on ‘frontier’ markets such as Vietnam (which might be promoted to a secondary emerging market in September next year), Morocco, Romania and Slovenia – and was also picked by Killik associate portfolio director Andrius Makin as a strategy that should be on more investors’ radars.

On the other hand, the Baring trust invests mainly in companies from the Middle East and Africa (42.7%), emerging Europe (27.5%) and South Africa (27%), and has achieved a maximum FE fundinfo Crown rating of five.

“The broad rationale is that these funds are for balanced rather than cautious investors, whose portfolios have the scale to accommodate these holdings,” said Read.

Over the longer term, frontier markets tend to be less correlated to developed markets than emerging ones, but in times of distress, correlations increase, the senior analyst warned. Therefore, these investments are “best suited to investors who are able to take a longer-term view and look through the short-term noise.”

The overall allocation to the two should range between 1% and 3%, depending on investor scale and risk tolerance.

Vietnam or a China/India skew add more risk

Within an emerging-markets allocation of up to 20%, adventurous investors should still allocate 50% to the core ideas in the cautious bucket. They can then add 30% in frontier markets and the rest in Vietnam or an additional skew towards either China or India.

For Vietnam, Read went for the Vietnam Holding trust, which has the strongest returns over five years in its peer group, the IT Country Specialist sector.

It is run by managers at Dynam Capital, who are particularly excited about the prospects of the country following its index upgrade, which would automatically include Vietnam in indices such as the FTSE All-World, FTSE Emerging Markets and FTSE Asia, requiring passive funds benchmarked to these indices to purchase Vietnamese equities.

On top of that, “fundamentals are strong, reforms are taking hold and market positioning looks compelling”, they said.

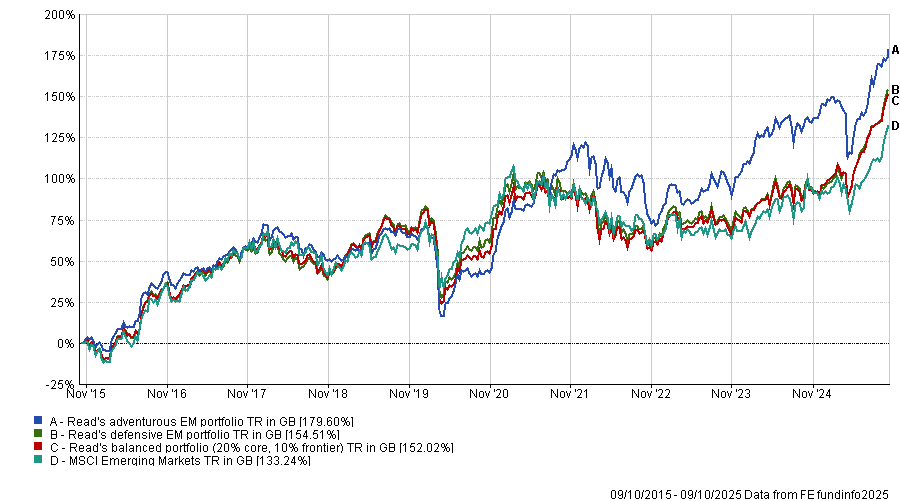

Performance of portfolios against index over 10yrs

Source: FE Analytics

Read’s picks to skew towards China or India were Fidelity China Special Situations and Ashoka India Equity, although it will depend on individual preference on which market to back.

“There are good long-term structural growth stories in both, and some investors just really like one or the other. I have favoured India in the past, and I still think there is a great long-term story there but right now, having been in the doldrums, China looks to be getting its act together and has been resurging,” Read said.

“Its valuations are still more compelling and I think its recovery still has some way to go so, personally, I would tend to favour that at the moment. But I certainly wouldn’t count India out.”