The growth fund that cut its US exposure by about 8% last week

Nutshell Growth has cut Nvidia and reassessed its whole portfolio.

Investing in the US market has been a rollercoaster this year, with headlines about on-and-off tariff wars, the Trump trade and TACO Tuesdays generating a lot of noise, alongside fears about artificial intelligence being in a bubble and driving tech companies to disconcerting valuations.

This continuous turning of tables and uncertainty can be disconcerting for many investors, who as a result have pulled out of equities so far this year, perhaps without realising that markets were recovering as they were doing so.

However, fund managers are more used to and better equipped to navigating tough times – some have even designed a process that is able to adapt live to ever-evolving market forces.

Nutshell Growth refreshes its portfolio twice a month, every time starting almost from scratch to look for “the most exceptional quality companies for the best possible price”, as manager Mark Ellis explained.

“It's the valuation factors that drive a lot of the turnover in the portfolio. When things get rich, they drop down our rankings and when they get cheap, they come back up.”

Unsurprisingly perhaps, the fund’s allocation to the US has moved about a lot this year. Typically at 70%, it eased to 50% at the start of 2025, its lowest level ever.

“That was purely because our purely bottom-up process identified that Europe was cheap at the start of the year,” the manager said. “When the market outperformed, it was up 20% more than the US and we gradually took profit, pivoting back into the US”.

Nutshell Growth was back at its 70% average again, but during the latest portfolio recalibration, which took place last Monday, Ellis took profit from tech names, resulting in about an 8 percentage-point decrease in US exposure.

Mainly, this was done by cutting GPU and AI chip company Nvidia, which is in the portfolio “purely because of the growth factors”.

“Nvidia is an interesting one because we didn't have it for the initial phase of its run. We pivoted into it in the first quarter of last year, when it had its real, first set of explosive growth,” Ellis said.

“Its growth factors were off the charts and that made the valuation factors pretty compelling. We bought it on a PEG ratio [price-to-earnings ratio against expected earnings growth rate] of less than 1x, and last year it was our number one contributor.”

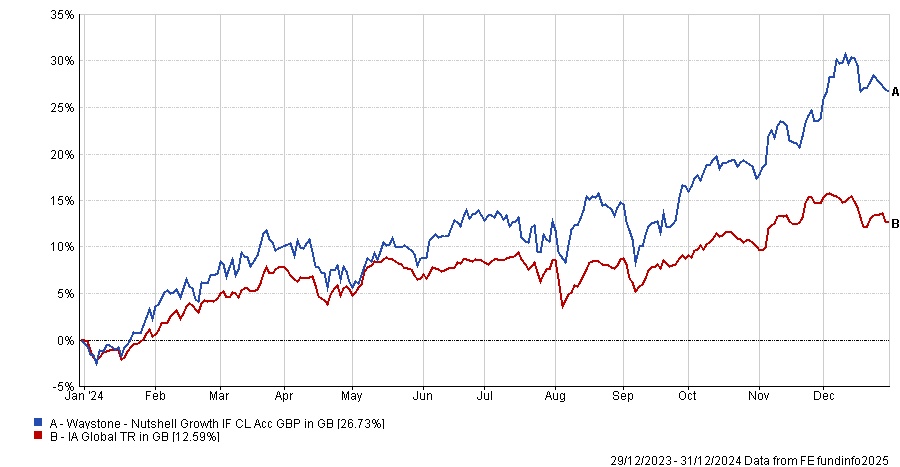

Nutshell Growth returned 27% in 2024, with 4 percentage points added by Nvidia.

Performance of fund against index and sector in 2024

Source: FE Analytics

The stock has now been cut from 6.5% to 4.5%. Other tech mega-caps were also trimmed, including Alphabet and Meta.

While Meta has been “on the cusp of [the] portfolio”, coming in and out of it because it is “quite expensive”, Ellis didn’t think any of these names are anywhere near bubble territory.

“Microsoft, Alphabet and even Nvidia – those names seem fair to us relative to the potential growth,” he said. “Where I would say there could be a bubble, however, is on the peripheries, where speculative names with unproven track records abound.”

Ellis stressed that Nutshell Growth isn’t about betting on Nvidia, Meta and similar names, as the fund had 16 different stocks that added more than 1 percentage point to the 27% return of 2024.

In last week’s reshuffle, MasterCard was another name that was cut, while on the additions side Canadian company CGI Inc was added back after some absence and US data provider Fact Set entered the portfolio for the first time.

The frequent portfolio reassessments are necessary, Ellis argued, because the days of ‘buy-and-hold’ are over. The manager has been in the press last year for challenging veteran fund manager Terry Smith and his model of investing.

“When Fundsmith launched after the great financial crisis, you could probably have bought Microsoft on a P/E multiple of 8.5x, so you could get it on extreme cheapness and then hold for a decade to get a nice return.

“That decade is over, the regime has completely changed, and buying and holding is wasted capital at today’s valuations,” he concluded.