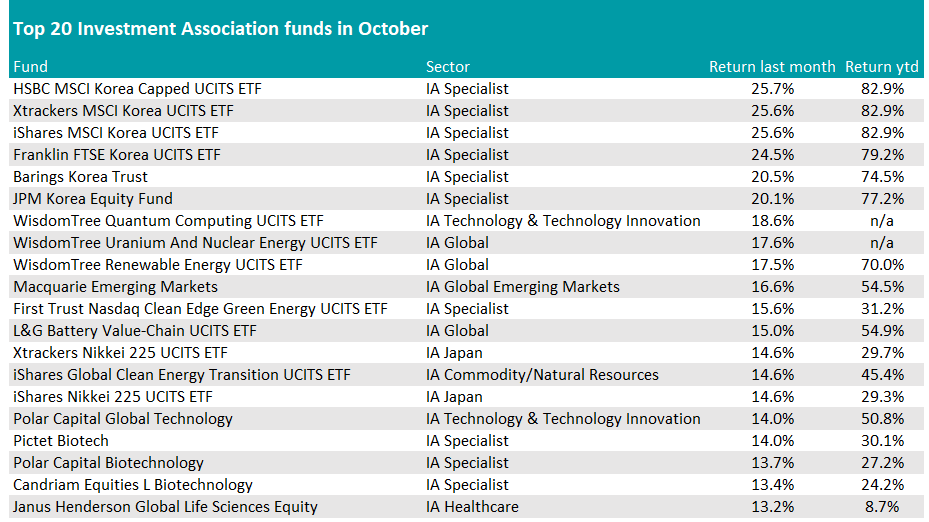

Korean investments topped the open-ended fund rankings last month, taking hold of the top six positions both through exchanged-traded funds (ETFs) and actively managed portfolios.

The top three strategies were all MSCI Korea trackers, up 25.6% in October and a whopping 82.9% over the year to date, while a fund tracking the corresponding FTSE index was marginally lower, as the table below shows.

Source: FE Analytics

Barings Korea Trust and JPM Korea Equity were the active strategies to profit the most – up 20.5% and 20.1%, respectively.

Fairview Investing director Ben Yearsley attributed these results to easing China-US tensions, a potential truce in the trade war and further optimism around artificial intelligence (AI) and semiconductors, all of which “fuelled a surge with Korean funds”.

India also had a positive month, with the average fund adding 5.8% and the average trust 7.7% (the third-best figure across the closed-ended universe).

The best funds to beat the average were Comgest Growth India (7.3%) and Ashoka WhiteOak India Leaders (7.2%), but both have negative performance over the year to date (down 8.2% and 3.3%, respectively). Ashoka WhiteOak India Opportunities was the third-best of the month, up 7.1%.

JGF Jupiter India Select and Jupiter India grew less this month (6.7% and 6.4%) but are the only two strategies in the sector posing a positive return in the year so far, both up 4.5%.

Korea’s impressive performance and a rebound in Indian equities all helped push emerging markets higher, with the average IA Global Emerging Markets fund achieving a 6.3% growth (the third-best in the open-ended universe).

Top names here were Macquarie Emerging Markets (with a 16.6% growth in November and the best performance year-to-date of 54.5%), RBC Funds (Lux) Emerging Markets ex-China Equity (11%) and HSBC MSCI Emerging Markets ex China Equity Index (10.5%).

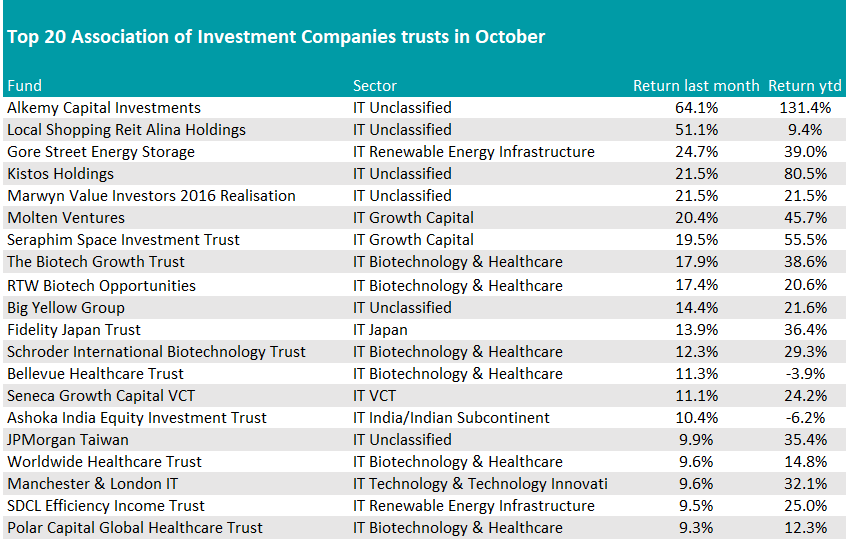

Looking at single investment companies, Yearsley highlighted Gore Street Energy Storage, which was recently under fire from 5% shareholder RM and has now been joined in the 5% ranks by activist investor Saba.

The shares gained 24% last month but still sit on a near 40% discount to net asset value (NAV).

“Can the trust survive independently with two activist shareholders?” Yearsley asked.

Source: FE Analytics

There were two biotech trusts at the top of the list again last month, The Biotech Growth Trust (17.9%) and RTW Biotech Opportunities (17.4%), with “investors waking up to the exciting prospects on offer”.

Indeed, the biotechnology sector topped the trust sector rankings last month with a gain of over 11%.

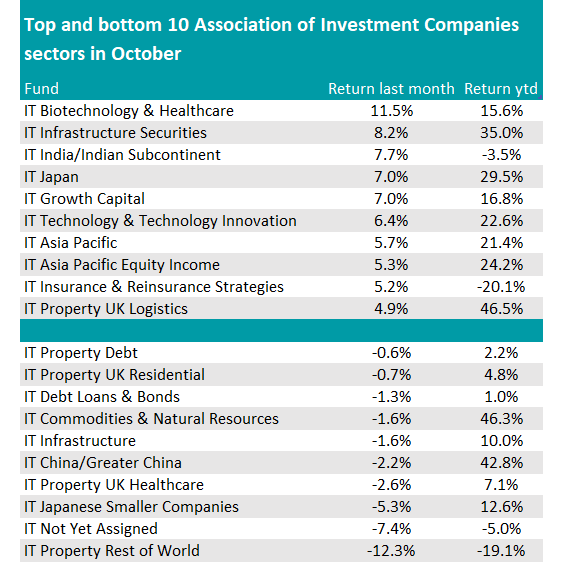

Source: FE Analytics

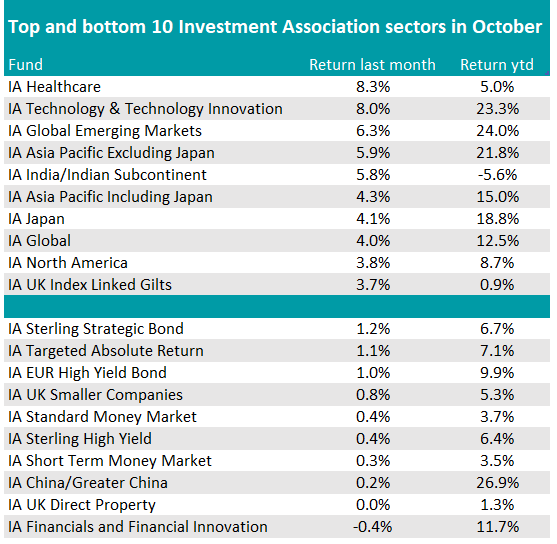

The same trend was evidenced in the IA Healthcare sector too, which had a reverse of fortunes and, after years in the doldrums, topped the sector performance table in October with a 8.3% return.

Yearsley was unsurprised, given the pick-up in mergers and acquisitions.

“Sectors like biotech have been ignored since the Covid years. The flurry of deals in the last few months has reignited interest and has highlighted the value on offer,” he said. “With big pharma on the edge of a huge patent cliff and with cash to spend it feels like the outlook is good.”

While it is unclear whether an inflection point has been reached, asset allocators have been highlighting how cheap the sector is. Yearsley also noted how this area is not linked to AI, giving investors a way to diversify from overcrowded spaces.

Source: FE Analytics

The top funds in this area were Janus Henderson Global Life Sciences Equity (13.2%), T. Rowe Price Health Sciences Equity (11.9%) and the L&G Healthcare Technology & Innovation UCITS exchange-traded fund (ETF) (11.4%).

Tech funds also did well, with vehicles posting the universe’s second-best result of the month on average (8%).

The winner of the month was the WisdomTree Quantum Computing UCITS ETF, which was launched at the end of August and last month added 18.6%. However, Polar Capital Global Technology has won the year so far, grabbing the top spot in the table with a stellar 50.8% return in 2025. It also had an impressive 31 days in October, with a 14% growth. Herald Worldwide Technology had the third place over the month (12.7%).

There are only four trusts in the IT Technology and Technology Innovation sector, with average returns of 6.4% skewed by Shard Capital Partners Sure Ventures, which lost 1.8% against gains of about 9% of the three other constituents.

India, Asia and Japan had positive months too.

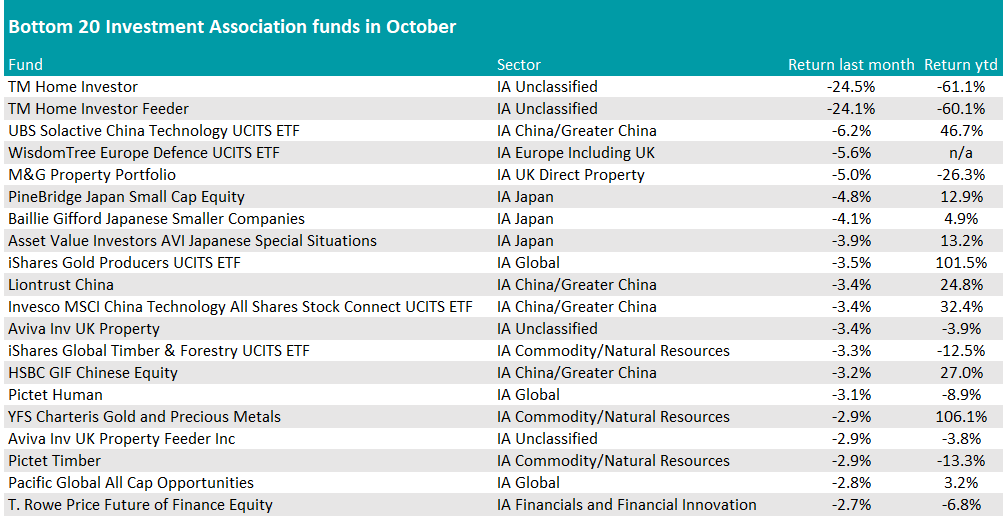

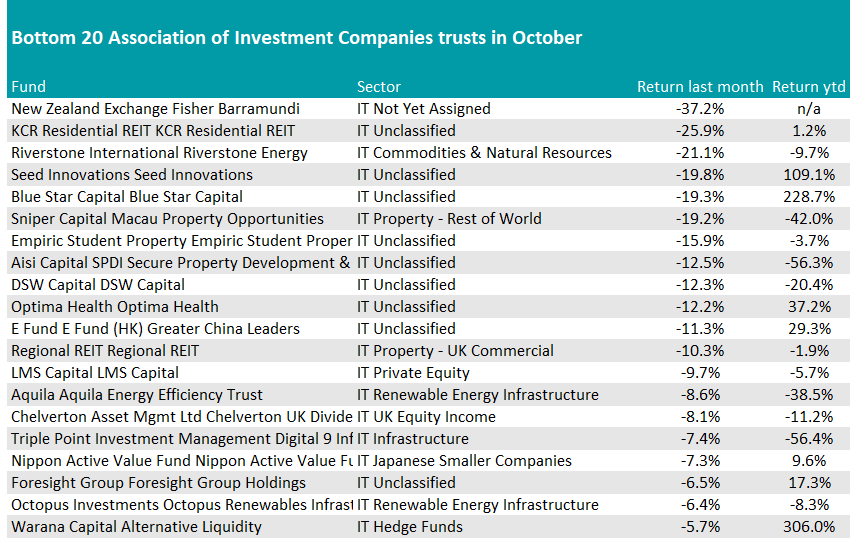

As for the worst performers, a number of China funds featured at the bottom of the open-ended table, but there was no pronounced trend beyond that – even less so in the closed-ended space, as the charts below show.

Source: FE Analytics