Lansdowne Partners, formerly one of Europe’s largest hedge funds, dropped the shorting aspect of its portfolios five years ago to become a long-only asset manager.

While a big call at the time, Peter Davies, co-manager of the Lansdowne (Lux) Developed Markets fund, said “there is no doubt we would have done a lot worse running a hedge fund than running a long-only portfolio over the past five years”.

There were several reasons in 2020 that the firm decided to pivot away from shorting. The first, he said, was that “really good shorts” come when there is an excess of capital being pumped into projects, creating a “fundamental deterioration in return”.

However, in the lead-up to (and during) the pandemic, the firm noted how almost every industry had a shortage of money rather than an excess.

“If I think back to tech in the 2000s, banks [in the global financial crisis] or even energy in 2015, normally we get very excited and very confident on shorts because the capacity in the real world is excessive, and that is usually stimulated by stock markets having overvalued things,” he said.

“That definitely hasn’t been true for the first five years of this decade.”

The second reason the firm decided to move away from shorting was the uncertainty in how the market valued stocks. To show this, Davies used the examples of online fitness firm Peloton and video link company Zoom Communications as stocks that were “the kind of thing we might have been short five years ago”.

“It was very hard to know whether the shares could peak at $200 or $500. In order to have a good short, you need to know how much money you can lose, and that requires you to understand the short-term trading dynamics as well as the long-term fundamentals,” he said.

“We felt that the trading-risk management was much harder in the market we were seeing then than the market we had seen for the prior 20 years.”

The third reason the firm pivoted its strategy, he noted, was because their house view was that, in a world of very low bond yields and potentially more inflation, the best place to invest is in real assets.

While a long/short fund is a good option “if your major risk to wealth is equity volatility”, in a world of higher inflation and low bond yields, you have to own real assets”.

“Those three things we said fairly explicitly five years ago had largely been vindicated,” Davies said.

Will the firm return to shorting?

Davies said that, for the foreseeable future, all three of the above factors – a need for capital rather than an oversupply; hard-to-predict fundamentals; and inflationary pressures – remain in place.

However, he added: “When we see massive capex spending, one’s instincts about the probability that at some stage that creates an opportunity on the short side is pretty real.

“If it becomes really obvious that too much capex has gone into the ground, does that create opportunities on the short side? If the analysis changes in the next five years, we will adapt to that.”

For now, while “you can increasingly see how it might be true at some stage in the future,” he noted that it is “definitely not the case now”.

Indeed, the manager noted that, while the firm has many products, the Lansdowne (Lux) Developed Markets long-only UCITs fund has “the best expected returns we can possibly deliver for the next few years”, adding it was “by a long way”.

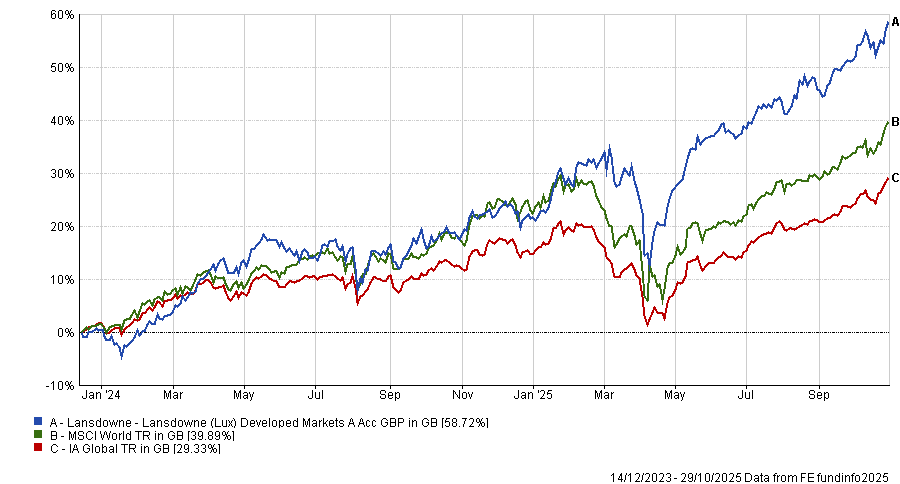

So far, the fund has already made a strong start to life, up 58.7% since its launch in 2023, beating both the IA Global sector and the MSCI World index (although it is not benchmarked to the latter).

Performance of fund vs sector and MSCI World since launch

Source: FE Analytics

Last week, Davies outlined how investors haven’t moved their portfolios since the 2010s, creating opportunities in non-consensus areas such as European builders.

“While intellectually it is very interesting to discuss what we might do in the future, the reality is that, with the product we have today, we are barely at the start of people observing the opportunity that we are talking about. It is far too premature to think about what comes after that,” he concluded.