With the November Budget fast approaching, investors may be concerned about potential tax rises, but a hike in national insurance (NI) appears unlikely, according to some experts.

Tom Selby, director of public policy at AJ Bell, said chancellor Rachel Reeves may even decide to reduce NI rates this year, not increase them.

He explained that she could choose to pursue a “two up, two down” shift in the Budget, where income tax rates are raised by 2%, but NI rates fall by 2% to offset this.

In theory, this would allow Reeves to claim that the government is still “protecting the pay packets of working people” because the NI cut would cancel out the impact for employees and the self-employed.

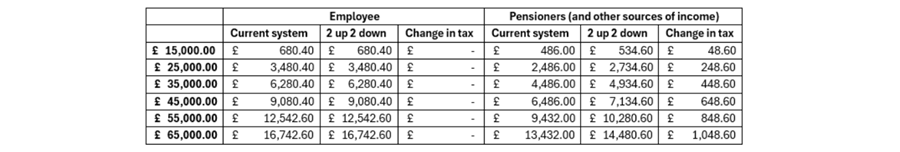

However, under the terms of this plan, retirees would be comparatively “clobbered” as they are not subject to National Insurance. Pensioners with a taxable income of more than £25,000 would experience a triple-digit tax rise, while someone with a pot of £65,000 would have to pay £1,000 extra in tax.

Source: AJ Bell analysis based on current income tax and NI rates compared to a 2% rise in income tax rates and 2% cut to NI

“While hitting pensioners in the pocket will clearly be unpopular, it may be viewed as the least bad option to raise a chunk of the tens of billions of pounds the chancellor needs to balance the books,” Selby noted.

However, ‘two up and two down’ is not the only option for a change in NI.

Selby said she may consider equalising the NI rates paid by employees and the self-employed, with the latter paying 6% national insurance on profits between £12,570 and £50,270, compared to the 8% paid by employees across the same spread.

“The government would face accusations of being anti-growth if it attacked the self-employed in this way, but in a world of increasingly tough fiscal choices that may be viewed as a price worth paying,” Selby noted.

Not all were as optimistic, however, with Lindsay James, investment strategist at Quilter, noting that “hole” in the public finances is too large to be closed with “tinkering” and the chancellor is likely to have to raise at least one of the three main taxes of income tax, NI and VAT, but could look at two or even all three.