Morgan Stanley US Advantage and Barclays GlobalAccess US Small & Mid Equity are the two top-rated funds that offer the best diversification to the wider S&P 500 index, according to Trustnet research.

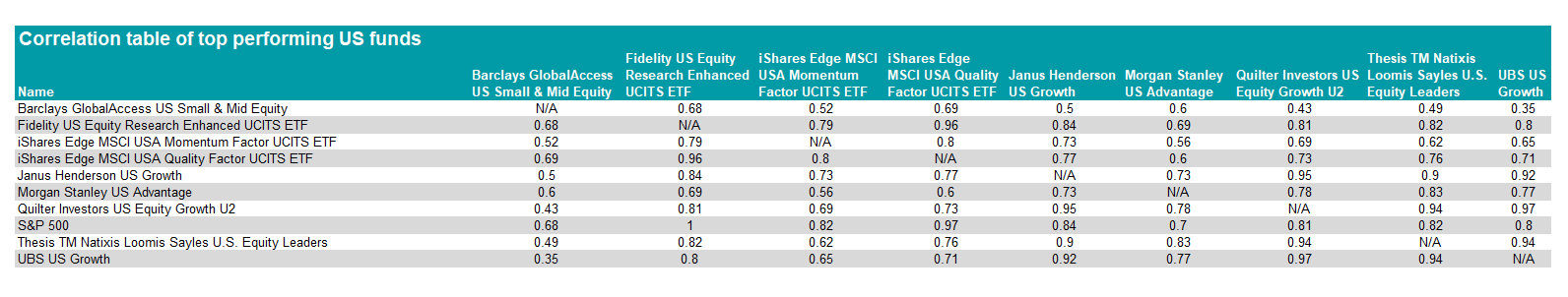

In this series, we used the FE fundinfo Crown Rating system, compiling funds with the highest score of five, then created a correlation table to see which have performed differently from one another. Here we have identified a score of 0.7 or below as being sufficiently lowly correlated.

For the US, we have also included their correlations to the wider S&P 500, as passively tracking the main American market is a common way investors access stocks from across the pond.

Of the nine funds across the IA North America and IA North American Smaller Companies sectors with a five-crown rating, Barclays GlobalAccess US Small & Mid Equity is the least correlated to the premier US market, with a score of 0.68.

The fund is in the IA North American Smaller Companies sector, delivering a top-quartile 39.5% return, although it is in the second quartile over one and five years and slips to the bottom quartile over the past decade.

Benchmarked against the Russell 2500 index, the £98.3m fund is overseen by Ian Aylward but managed by three external companies. The first is Wellington, which accounts for around 45% of the portfolio; Kennedy Capital Management is then given 35% of the assets under management (AUM) to invest; and The London Company the remaining 20%.

The other fund with low correlation to the S&P 500 is Morgan Stanley US Advantage, which has a score of 0.7 to the premier US index. The £61.1m fund has made 96.8% over three years and is also in the top quartile of the IA North America sector over the past year, although it slipped to the bottom quartile over five years.

Run by a six-person investment team including Dennis Lynch, the fund is overweight technology, but the only member of the ‘Magnificent Seven’ (Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla) among its top 10 holdings is Elon Musk-led Tesla.

Conversely, Fidelity US Equity Research Enhanced UCITS ETF has a perfect correlation of 1 to the S&P 500, while iShares Edge MSCI USA Quality Factor UCITS ETF sits just behind, with a score of 0.97.

Turning to funds that are lowly correlated to other top performers in the two US sectors, two familiar names are at the top of the list, as the table below shows. Barclays GlobalAccess US Small & Mid Equity has a score below 0.7 to every other five-crown-rated US fund, while Morgan Stanley US Advantage is lowly correlated to four other portfolios.

Source: FE Analytics

The other fund acting as a differentiator from other top performers is iShares Edge MSCI USA Momentum Factor UCITS ETF, which has a correlation score of below 0.7 to five funds on the list.

It invests in companies where the share prices are on an upward trajectory, with its top 10 currently dominated by tech names including Broadcom, Palantir Technologies and Netflix. Its largest holding, however, is banking group JPMorgan Chase.

The lowest correlation among the top-rated funds is between Barclays GlobalAccess US Small & Mid Equity and UBS US Growth, with a score of 0.35.

Run by Peter Bye and Katie Thompson, the latter fund invests in companies with strong technology, market leadership and scalable business models.

Recommended by analysts at RSMR, they said it is run by an experienced manager who is “capable of working in the areas of the market which traditional metrics might classify as expensive”.

“The ability to see beyond short-term valuations and to focus on the prospects for long-term growth and the degree to which a company can defend and build on its position requires a particular skillset,” they added.

However, they noted that it is best suited as a “satellite investment” alongside a broader fund or a value-oriented portfolio.

The second-lowest correlation is between Barclays GlobalAccess US Small & Mid Equity and Quilter Investors US Equity Growth, which is managed on behalf of the firm by JPMorgan Asset Management.

All of the ‘Magnificent Seven’ names appear in the top 10 of the Quilter fund, which is rounded out by tech firm Broadcom, streaming service provider Netflix and payments business Mastercard. Despite this, it has a correlation to the S&P 500 of 0.81 – lower than others on the list.

This is the third article in our series looking at lowly correlated top-rated funds. Previously, we have looked at the UK sectors and the IA Global peer group.