If you are relying on bonds to protect your portfolio from stock market swings, persistent inflation may force a rethink, according to Anthony Rayner, co-manager of Premier Miton Cautious Monthly Income.

“Bonds are great diversifiers when we have a period of disinflation,” he said. “During these time periods, central banks are very happy to cut rates, so you get equity markets going down while bonds rally – meaning there is a beautifully efficient diversification over that whole time period.”

But in today’s inflationary climate, bonds are behaving differently and moving in closer step with equities. This undermines the traditional 60/40 portfolio, which has been a cornerstone of balanced investing and relies on fixed income to cushion equity drawdowns, not amplify them.

Bonds react negatively to inflation because it erodes purchasing power for bondholders, reducing the real value of fixed interest payments. At the same time, central banks typically raise interest rates to combat inflation, causing existing bond prices to fall as newer bonds offer higher yields.

Longer-duration bonds are especially sensitive to these shifts, locking in lower rates, prompting investors to favour shorter-duration debt – as seen in the US treasury market in recent months – or to look beyond bonds altogether.

“We are more cautious about bonds diversifying equities at the moment because inflation has been here for a sustained period of time,” Rayner said.

In contrast, he noted that “commodities tend to diversify equity well during inflationary periods”, pointing to their low correlation with stocks and potential for outperformance during times of geopolitical tension.

They often benefit from inflationary pressures because they represent physical assets whose prices rise with input costs and supply disruptions. Gold, for example, is seen as a store of value, while energy and industrial metals are highly responsive to geopolitical and economic shifts.

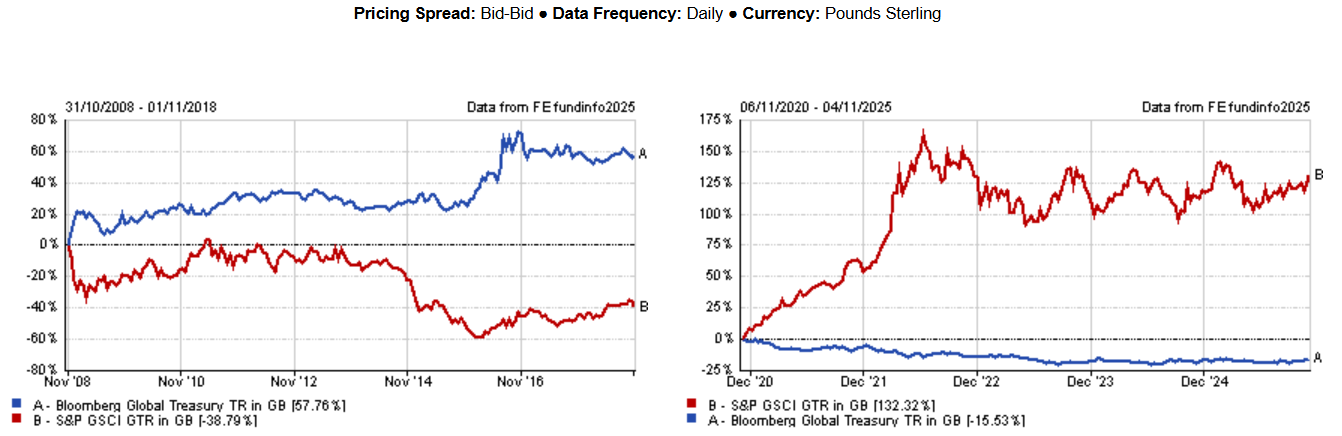

To illustrate how bonds and commodities behave in different inflation regimes, Trustnet compared their performance across two distinct periods.

One of the graphs below covers the decade following the 2008 financial crisis, when central banks launched aggressive quantitative easing and inflation was subdued. The other begins in late 2020 from ‘Vaccine Monday’, which many argue marked the start of what has become a sustained inflationary period.

To compare, we have used the S&P GSCI, which is a commodity index that is weighted by production, versus the Bloomberg Global Treasuries index, which tracks the performance of government debt from investment-grade countries.

Commodities vs bond performance during inflationary vs disinflationary periods

Source: FE Analytics

For investors, this shift in asset behaviour does underline the importance of rethinking strategies to hedge equity risk. Although commodities offer more protection from inflation, they do still carry volatility and sector-specific risks. As such, investors don’t need to stay away from bonds entirely when inflation spikes.

The Premier Miton fund currently holds shorter duration bonds alongside commodities, with Rayner explaining that bonds “will still dilute equity volatility even if they don’t diversify it”.

But it also doesn’t mean investors should be going all-in on commodities, as they are far from homogenous and their internal dynamics can vary significantly.

As an example, second quarter analysis for the Goldman Sachs Commodity Strategy Fund found that energy prices fell by 10.9% and resulted in a sell-off in crude oil and refined products – largely prompted by the introduction of US tariffs – while precious metals rose 4.9%, buoyed by safe-haven flows.

However, commodity performance can also shift rapidly due to price volatility.

“We like gold, for example, because it is a good hedge in this inflationary period, but we don’t like the fact it can grow into quite a big position in the portfolio when it is volatile,” Rayner said.

As of late October, gold made up around 1.9% of the portfolio – down from over 3% three weeks prior.

“We have been fairly aggressive in cutting back the things that have done well because, when markets have an episode, it tends to be those assets that have done the best that suffer the most,” he said.

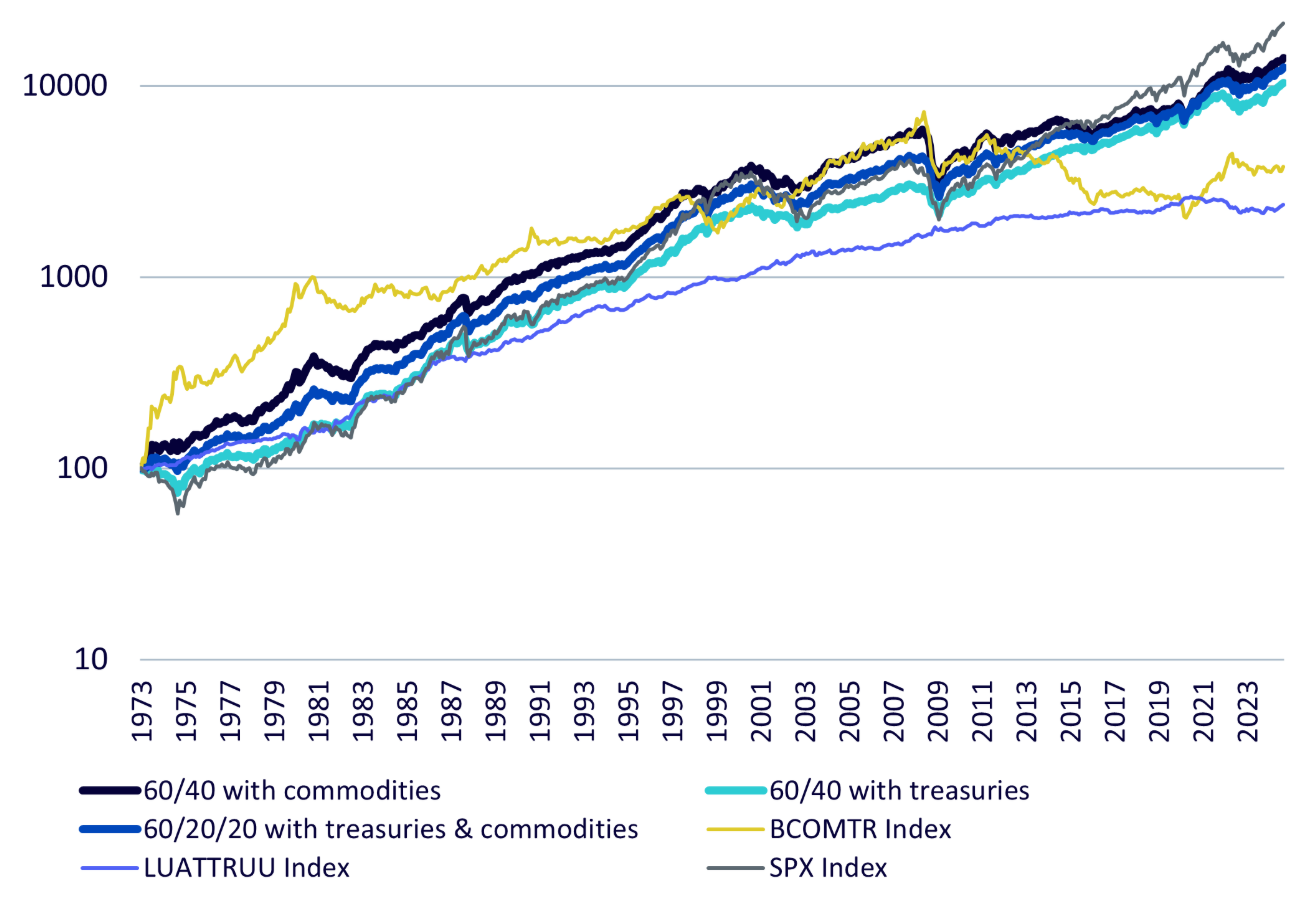

An optimal balance may lie in combining both asset classes.

Research conducted last year by WisdomTree showed that an allocation of 12% to commodities within a 60/40 portfolio – meaning 28% remains in bonds – made the same risk-adjusted return as a traditional equity/bond split but with better performance, as shown in the graph below.

Different combinations for a 60/40 portfolio

Source: WisdomTree, Bloomberg. Starting January 1973 and ending September 2024.

The Premier Miton Cautious Monthly Income fund leans slightly more into commodities than the WisdomTree research suggests.

It currently has just over 15% of the portfolio allocated to physical commodities and commodity-linked equities, and 40% in fixed interest.

“The nice thing about it is that, when bonds aren’t correlating with equities, commodities are, and vice versa,” Rayner added.