Relations between Washington and Beijing have been increasingly volatile, swinging between fragile truces and renewed flare-ups.

US president Donald Trump and China’s president Xi Jinping’s recent agreement to lower tariffs and suspend Chinese export curbs on rare earths temporarily calmed markets but, if the past few years have taught investors anything, this impasse is fragile and periodic tensions are likely to persist.

As with any global disruption, winners and losers will emerge, with companies racing to localise production, diversify sourcing and ensure supply chain resilience as the two superpowers draw new lines in the sand.

For investors, this means new opportunities are emerging as companies position themselves to benefit from these trends.

For example, Frederik Bjelland, portfolio manager of SKAGEN Kon-Tiki, sees Shenzhou International – one of the world’s largest integrated apparel makers – as benefiting from ongoing US-China trade tensions. Around 80% of its sales come from global brands such as Adidas, Nike, Puma and Uniqlo.

“The company is Hong Kong-listed and its shares have tended to sell-off when Chinese tariffs are deemed to be high despite its broad manufacturing footprint, with production facilities across Asia, including Cambodia and Vietnam where most of its products are made,” Bjelland said.

Only 17% of Shenzhou’s sales come from the US, with a similar proportion from Japan, 20% from Europe and around a quarter generated domestically.

Earlier this year, the company opened a joint venture apparel manufacturing facility with US materials science and manufacturing company Avery Dennison in Vietnam.

“We believe the company’s geographic expansion, R&D and automation efforts position it to gain further share with existing clients and attract new customers,” he said.

The company also reported strong results for the first half of 2025, achieving a 15.3% increase in sales and 7.9% increase in gross profit.

Shenzhou’s share price is up over 15% year-to-date but has almost halved over the past five years.

“Its valuation therefore offers a margin of safety and looks compelling,” Bjelland said.

Shares are trading at 12 times 2026 earnings and offer a 5% dividend yield.

Stock price performance YTD

Source: Google Finance

Meanwhile, Daniel Lurch, portfolio manager of the JSS Sustainable Equity Strategic Materials fund, sees opportunities in strategic materials.

“The global landscape for strategic materials is increasingly tense,” he said.

“The US imposed tariffs on steel aluminium and copper imports, while China leveraged its dominance in rare earth production to restrict exports and the European Union also proposed significantly cutting the import quotas on steel.”

Against this backdrop, he said that companies in the strategic materials value chain are poised to benefit.

As such, his first stock pick is Lynas Rare Earths – one of the world’s largest non-Chinese rare earth producers, which stood out to him for its processing capabilities, especially for heavier rare earths.

“The company has a strong track record of production, with sites in Australia and processing facilities in Malaysia,” he said, adding that a new rare earths processing facility is also under development in the US.

“While other non-Chinese companies are developing rare earth projects, they have yet to demonstrate the ability to process heavier rare earths at scale, [whereas] Lynas’s capabilities make it a leader in the sector,” Lurch said.

“By contrast, Lynas’s closest peer, MP Materials, which is listed in the US, continues to rely on Chinese processors.”

The company’s share price is up over 111% in the year to date and over 320% over five years.

Stock price performance YTD

Source: Google Finance

Lurch’s second pick was mining equipment company Metso.

As a provider of critical equipment, Metso is “well-positioned to benefit from the rush to secure access to essential materials through localisation of critical material production and supply chains”, he said.

“Additionally, the company’s focus on environmental sustainability, including reducing water usage and carbon emissions, makes it an attractive player in the industry.”

In particular, Metso’s exposure to crucial metals for batteries, such as copper and lithium, also positions it for growth in the renewable energy sector and broader global electrification efforts, he said.

Last month, the company introduced a new life cycle services (LCS) framework, which includes solutions for parts, equipment and process island scopes.

The company’s share price is up 59.1% year-to-date and almost 120% over five years, with a current dividend yield of 2.6%.

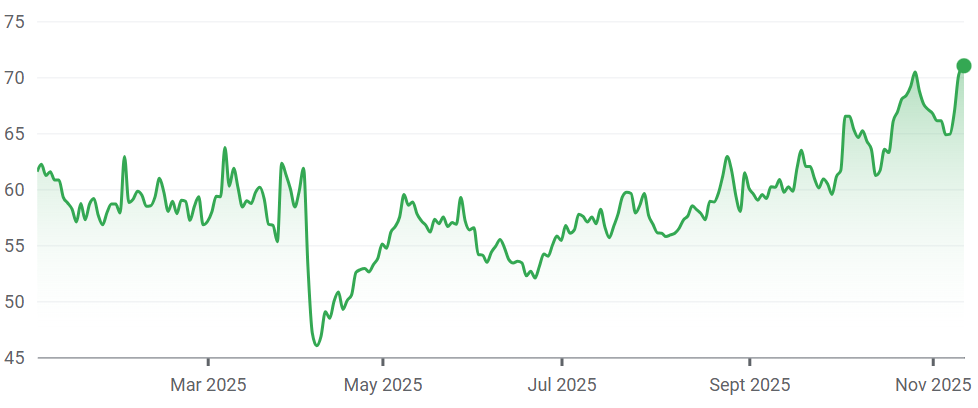

Stock price performance YTD

Source: Google Finance