Speculation over pension tax relief triggered a surge in lump-sum withdrawals but the government has now reportedly confirmed that the 25% tax-free allowance will remain unchanged ahead of the Autumn Budget next week.

With Labour standing by its manifesto pledge to leave income tax untouched, rumours have been swirling around the fate of a variety of pension tax incentives, including pension tax-free cash.

Chancellor Rachel Reeves was reportedly considering slashing the allowance from 25% of a private pension pot (up to £268,275) to £100,000 – with pensions minister Torsten Bell suggesting an even steeper cut to £40,000 – in a bid to plug the £30bn fiscal shortfall.

Uncertainty triggered panic. Recent polling of independent financial advisers (IFAs) revealed that 58% said their clients have taken pension lump sums due to speculation.

Tom Selby, director of public policy at AJ Bell, said: “Attacking tax-free cash at the Budget would have been a massive own goal from the chancellor, raising little money and causing uproar.”

Analysis conducted by the platform shows that individuals choosing to take their pension tax-free lump sum earlier than planned could lose a significant amount of money.

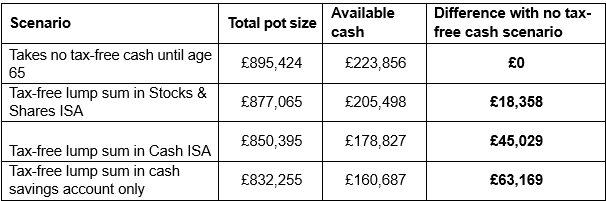

As shown in the table below, a 55-year-old with a £500,000 pension pot who chooses to withdraw their full 25% tax-free sum and move it into a cash savings account paying 4% could lose out on £63,169 in tax-free cash by age 65.

Even if the individual moved the lump sum into a cash ISA or stocks and shares ISA, they would be worse off by £45,029 or £18,358 respectively.

Difference in lump sum available by age 65

Source: AJ Bell. Assumes 6% investment growth, while cash savings account and cash ISA assume a 4% interest rate.

Although the Treasury appears to have put fears to bed on this front, Adrian Murphy, chief executive of Murphy Wealth, warned that other changes for pensions are on the horizon.

“What is almost certain – pending the relevant legislation – is that pensions will become part of people’s estates from April 2027 for inheritance tax purposes,” he said.

Salary sacrifice pension arrangements are also in Reeves’ crosshairs, with the chancellor considering capping the tax break offered to staff and employers that pay money into their workplace pensions.

AJ Bell’s Selby said the “constant debate” and uncertainty about changing pension tax rules is “wearing down people’s trust in the government and putting them in danger of making knee-jerk decisions which may not prove to be the right ones”.

To combat this, the platform launched a Parliamentary petition in October calling on the government to commit to a Pension Tax Lock – essentially a commitment not to change the rules on pension tax relief or tax-free cash for at least the remainder of this parliamentary term.

Support reached over 20,000 signatures, enough to elicit a response from government.

“In its initial response, the government refused to commit to the Pension Tax Lock, thereby effectively subjecting anyone spooked by pre-Budget rumours on the fate of tax-free cash to a potential headache worth thousands of pounds,” said Selby.

“But there is still an opportunity for Reeves to grasp the nettle at the Budget and announce a tax lock, not least since the Petitions Committee called on the Treasury to provide a ‘revised response’ to the petition.”

The Treasury has yet to issue this response.