One in three women likely to be in pension poverty after career break, study finds

Unequal pay, career breaks when having children, lack of shared parental leave and wider structural differences all impact the pension gap.

More than one in three women (36%) risk falling into pension poverty, according to the Scottish Widows Women and Retirement report, with career breaks as the main reason for the shortfall.

Among the women at or near retirement, more than half have taken a career break, leading to loss of income and gaps in their pension contributions, the survey found.

Scottish Widows calculated the median total private pension for women at retirement is £173,000, some £113,000 short of the average male savings pot (£286,000) – a gap of 32%, and up from £100,000 (30%) a year ago.

Women are also projected to achieve a median annual retirement income that is 32% lower than men’s after expected housing costs (£13k for women vs £19k for men).

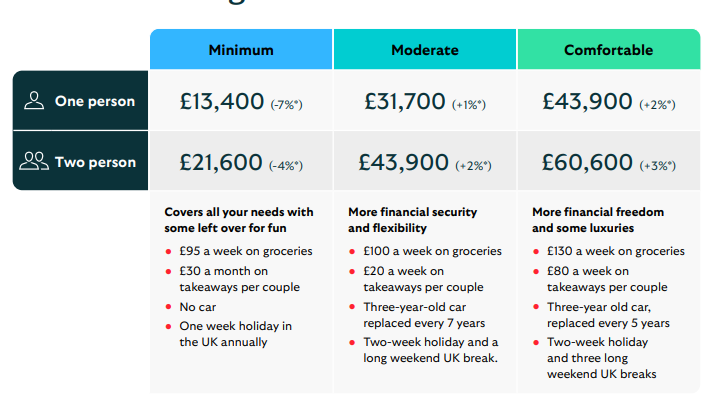

It means more than a third of women are not on track for achieving a ‘minimum lifestyle’ in retirement. For individuals, this figure stands at £13,400 and is calculated based on living expenses for different retirement living standards defined by Pensions UK. For those in a couple, it is £21,600 total, or £10,800 each.

Source: Scottish Widows Women and Retirement

Less than a quarter of women are expected to afford a comfortable retirement (24%), compared with 36% of men.

Jill Henderson, head of workplace strategic relationships at Scottish Widows, said: “That 32% gap is a stark reflection of the realities of unequal pay, career breaks when having children, lack of shared parental leave and wider structural differences that have worked against women.

“Arguably the biggest driver of the gap is the impact of taking a break from working to raise a family on a woman’s career, income and pension contributions.”

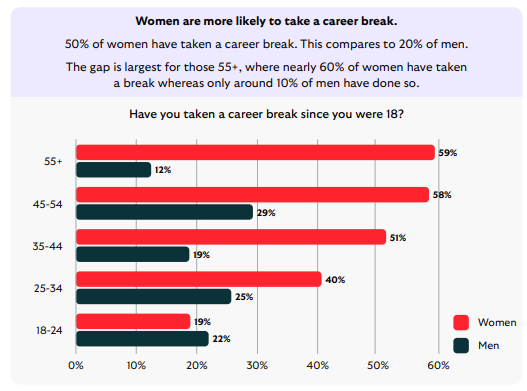

The research found half of all women have taken a career break, with a quarter of over 55-year-olds taking breaks totalling five or more years.

Source: Scottish Widows Women and Retirement

Henderson said: “During that time, pension contributions are paused, often without an understanding of the long-term impact. Emergency savings take priority. Investment opportunities are missed. And retirement planning is pushed to the bottom of the list.”

In particular, women are 12 times more likely to take a break for childcare, with data suggesting mothers lose around £65,600 in earnings by their first child’s fifth birthday, with the biggest drop in income seen during the first year after birth.

Health reasons, such as the menopause, further education and travel are in joint second place as the main reason for a career break, at 6% each.

Susan Hope, business development director at Scottish Widows, said: “The gaps hit women at multiple stages of their lives. They begin to open when we take time off to have and raise children. They widen when we return on fewer hours or with a career that has potentially stalled, and deepen again with health issues or further caring responsibilities as we go through life.”

Outside of pensions, women are more likely to prioritise rainy day savings. Around 44% said they prioritise emergency funds, compared with 39% of men.

This can have a knock-on impact on investing. Although women are equally as likely to invest in their pension as men, they are less likely to prioritise putting their cash to work outside of the retirement wrapper.

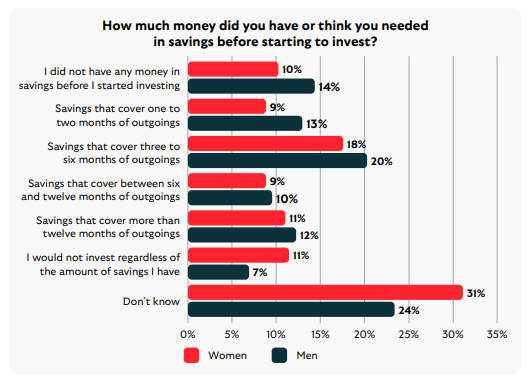

Source: Scottish Widows Women and Retirement

Women are more likely to ensure they have savings in place before investing, with fewer women (10%) willing to invest despite having nothing in savings, compared with 14% of men.

Additionally, a higher proportion said that they did not know how much they should have saved before investing, showing significant confusion about how to balance savings and investments, the report said.

Rebecca Leiper, pensions retirement expert at Scottish Widows, said: “Right now, 50% of women still feel that investing isn’t for them. Why is that? I think it’s because society continues to frame investing as something complex, risky and male-dominated.

“The perception gap is just as significant as the pension gap itself. We need to shift how society views financial empowerment and make it clear that what we’re striving for is simple: gender parity.”