As life expectancy rises and core systems like healthcare come under increasing strain, investors looking beyond short-term cycles may well be focused on investment opportunities surrounding the ageing populations of developed countries.

These themes include increased healthcare spend, financial services that cater for older cohorts, robotics and wider technologies increasing efficiency, as well as leisure and consumer companies tapping into the habits and spending power of older consumers.

Below, Rob Morgan, chief analyst at Charles Stanley, shares the funds he favours and his ideal asset allocation to get exposure to this megatrend, which could work well within a broader, well-diversified portfolio.

To target the theme specifically, he went 100% equities, meaning that “capacity and risk tolerance would require careful consideration for the asset allocation of the overall portfolio”, he said.

Morgan first allocated 30% of the portfolio ageing-population sleeve to the $628.6m iShares Ageing Population UCITS ETF – a passive fund which replicates the performance of the Stoxx Global Ageing Population index.

It tracks almost 350 companies across developed and emerging markets which are generating at least 50% of their annual revenue from the growing needs of the world’s ageing population – defined as individuals aged 60 or over.

Within this, there are 66 sub-sectors, including biopharmaceuticals, life and health insurance, biotechnology, hospital facilities and travel.

“This is a broad-based way to express a positive view on the trend of an ageing population, though it does come with significant differentiation from a standard global fund and should still be thought of as a satellite position in a broad portfolio,” Morgan said.

Despite the exchange-traded fund tracking 342 equities, it only has a 5% overlap with the S&P 500, Morgan noted, meaning it is well-diversified at an individual stock level.

Sector-wise, it is heavily tilted towards healthcare (45%) and financials (44%), with most of the remainder split between travel and leisure.

The fund has underperformed the S&P 500 over three and five years but has gained 12.7% over one year versus 8.9% for the index.

Performance of the fund versus sector over 5yrs

Source: FE Analytics

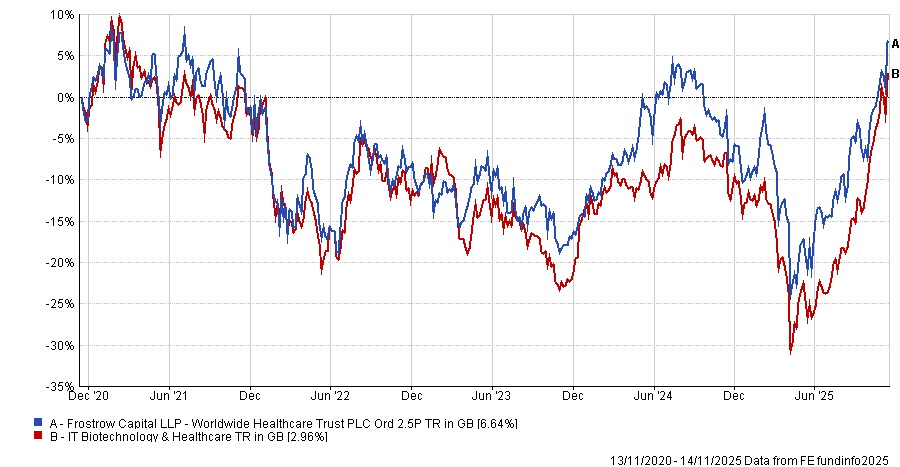

Healthcare is a core theme to include when targeting opportunities surrounding an ageing population. As such, Morgan also allocated 20% to the £1.5bn Worldwide Healthcare Trust, which was launched in 1995.

“The portfolio of this specialist investment trust evolves to reflect the shifting opportunity set, which ranges from pharmaceuticals, biotech, life science tools, med-tech devices and healthcare services,” he said.

He noted that the managers – Sven Borho and Trevor Polischuk – add material value in what is “a niche asset class with an evolving opportunity set”.

Top holdings include big pharmaceutical names such as Eli Lilly and AstraZeneca. It has delivered second-quartile returns in the IT Biotechnology and Healthcare sector over five and 10 years, gaining 127.8% over the decade.

“As such, it’s worth considering as a one-stop shop for global healthcare exposure which can also pursue opportunities in the private markets, as well as listed companies.”

Performance of the trust versus sector over 5yrs

Source: FE Analytics

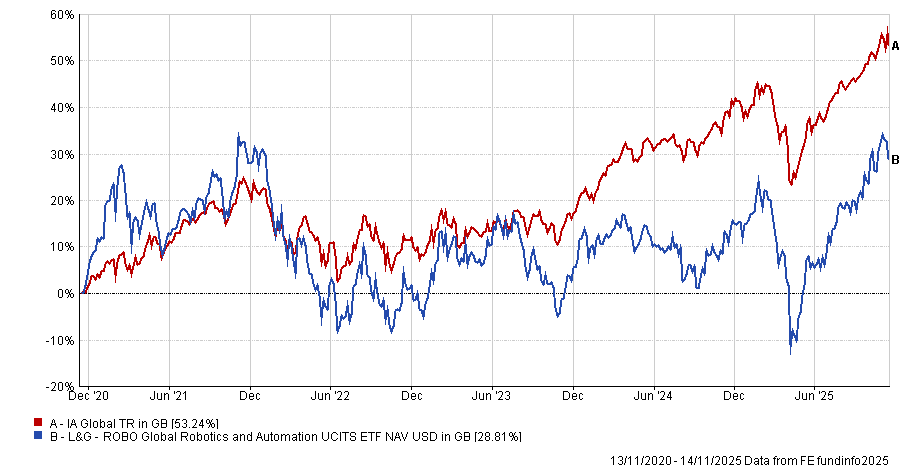

Morgan also allocated 30% of the portfolio to the $748.7m L&G ROBO Global Robotics and Automation UCITS ETF.

Alongside the need for healthcare, innovations in robotics and automation are expected to drive productivity gains in the future and enable the global economy to grow in spite of an ageing population and shrinking workforce.

“Simply put, companies will be able to use automation to drive expansion as well as efficiency, especially with the assistance of artificial intelligence (AI),” said Morgan.

Launched in 2014, the ETF invests in companies globally that are actively engaged in delivering technologies and applications utilising advancements in robotics, automation and AI to transform core sectors such as healthcare, manufacturing and consumer goods.

It tracks a basket of 76 companies involved in robotics and automation.

“These companies capture not only the traditional industrial robotics hardware but also those developing the latest technologies and software in robotics and deploying those technologies into new applications,” said Morgan.

Performance of the fund versus sector over 5yrs

Source: FE Analytics

Morgan allocated the final 20% in the portfolio to the Cohen & Steers Global Real Estate Securities fund. It has more than doubled the average IA Property sector returns over 10 years, gaining 90% versus 39%. It has also beaten the sector average over three and five years.

The $260.5m global property equity fund, which is managed by Jon Cheigh, Jason Yablon, Ji Zhang, Rogier Quirijns and William Leung, taps into several broad and long-term themes, including the construction of data centres which are needed to prop up AI systems.

“The fund is also of interest in this portfolio owing to significant allocations in healthcare property, hotels and self-storage, which are all expected to be areas in demand as baby boomers age, and their needs and desires evolve,” said Morgan.

The real-estate fund also ensures diversification and resilience to an otherwise highly concentrated portfolio skewed heavily to healthcare, he concluded.

Performance of the fund versus sector over 5yrs

Source: FE Analytics