Chancellor Rachel Reeves could overhaul the state pension in the Budget to address the government’s well-documented fiscal blackhole, which could have a range of consequences for savers, according to experts.

Tom Selby, director of public policy at AJ Bell, said: “For a chancellor desperately digging down the back of the sofa for spare cash, the £150bn and growing cost of providing the state pension will always be a tempting target.”

Currently, state pension benefits account for more than 80% of the £175bn pensioner welfare bill. Without changes, state pension costs could surge to almost 8% of GDP over the next 50 years, data from AJ Bell suggests.

While the state pension age is set to rise to 67 by 2028, with a further increase to 68 planned in the 2040s, the government may be tempted to accelerate this as an attempt to cut costs, Selby said.

“However, Reeves might not want to grasp that particular nettle, given the political storm she is already having to weather.”

The other option available is to reconsider the triple lock, which Keir Starmer has committed to keeping in place for the duration of this parliament.

Under this policy, the state pension will rise by the highest of the following figures: earnings growth in May to July, September’s inflation figure or 2.5%.

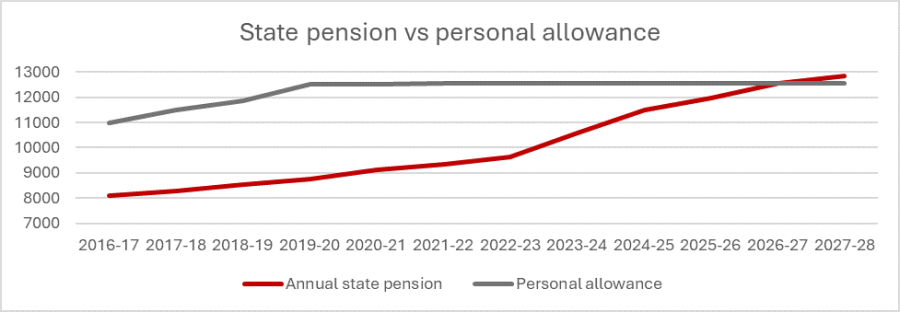

Under these terms, the state pension is set to rise by 4.8% (earnings growth) from next April, meaning the new state pension will sit just £22 below the frozen personal allowance (£12,570).

Source: AJ Bell, HMRC

Adam Cole, retirement specialist at Quilter, said although this rise will be welcome for retirees, it “underlines how expensive it has become to maintain the triple lock in its current form”.

A policy originally conceived as a “simple idea” to ensure pensioners' income keeps up with living standards has become a “rigid and costly mechanism” that forces the government to spend more on pensions regardless of the economic picture.

Kinder Brown, senior financial planner at Rathbones, added: “With a multibillion-pound fiscal black hole to fill and a ballooning welfare bill, the chancellor may yet reconsider the generosity of the triple lock.”