Roughly half of Templeton Emerging Markets investment trust’s (TEMIT) strong run against the MSCI Emerging Markets index is down to luck, according to its manager, Chetan Sehgal. Track record is important, as are the team and the process, but chance plays a big role too.

“Half of our good performance is luck. The choices are half chance,” he said. “What matters is sticking to the process: aim for companies with sustainable earnings power and learn more about the businesses you own.”

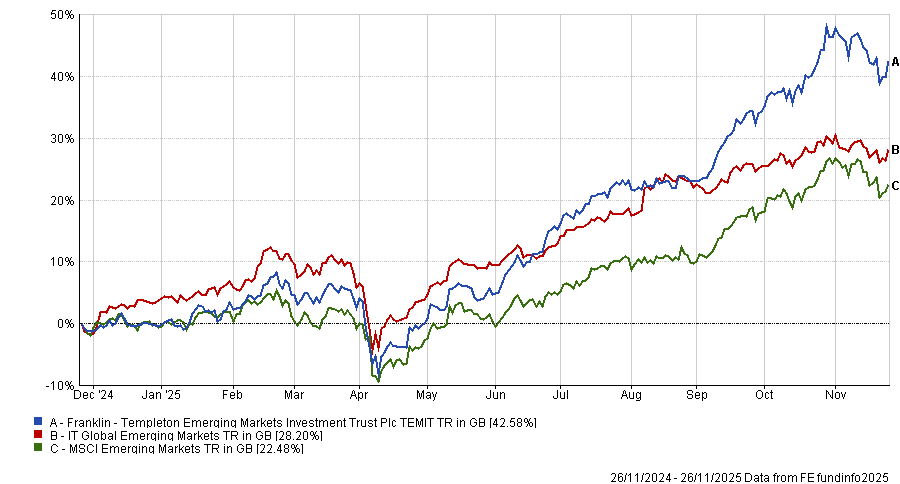

Judging by the chart below, this year has certainly been ‘lucky’ for TEMIT. Yet the trust has also close to doubled the MSCI Emerging Markets index across all standard timeframes, suggesting there is more to it than that.

In calendar years, 2022, 2021, 2018 and 2015 have been negative, with the trust losing more than its benchmark index.

Below, Sehgal discusses why that happened, where he is currently finding opportunities and how guardrails in place limited his exposure to Russia at the outbreak of the war in Ukraine.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Please describe your philosophy and process.

Our philosophy is to look for companies with sustainable earnings power and buy them at a discount to their intrinsic worth. We want to own winners and ride winners, so we avoid the cost of unnecessary churn.

The process starts with structural trends. In past years, demographics in emerging markets was one. Today it includes things like semiconductors, the electrification of everything and the spread of technology into everyday devices. These are trends that last years, even decades.

We combine those trends with companies that have durable earnings. Valuation comes after that. It’s not valuation-first. I need to understand exactly what the competitive advantage is and how a company earns. Only then do we value it in the context of its intrinsic worth.

We don’t run the portfolio country-first, but structural trends often benefit specific countries. If a country is endowed with a resource you’re bullish on, you need to own both the users of that resource and the country itself.

We also use top-down guardrails. I don’t want to have more than a certain weight, no matter how bullish I am on a theme or company. Russia was the example – when everything went to zero, guardrails limited the damage.

Why should investors pick this trust?

About 65% of the world economy is outside the developed world. You need exposure to emerging markets.

And you can buy country funds if you believe one country will outperform, but if you want broader exposure, the best approach is a trust with resources, a long track record and a clear philosophy aimed at structural trends. We are not speculating. Our turnover is low and we do our homework.

We may or may not outperform in any one year, but we do our job consistently. We work with more discipline and lower churn, and that leads to better understanding of the companies we own.

What have been your best and worst calls over the past 12 months?

[South Korean semiconductor company] SK Hynix has been one of the best. We bought it last year as part of the artificial intelligence theme. It makes memory chips for GPUs and is one of the top players globally. The stock has more than doubled since we bought it.

The worst was Delivery Hero, the food-delivery company listed in Germany. It is off-benchmark for us but most of its revenue comes from Korea and the Middle East. The stock fell around 40% from our average cost because of litigation, labour rules and competition from China. Larger players wanted market share rather than profit and that hurt.

Where are you most bullish today?

The biggest trend today is semiconductors. TEMIT has been overweight semiconductors for a long time. Every new generation of chips brings better performance, smaller size, lower power usage and more applications. Artificial intelligence is an example. Tomorrow it could be flying vehicles or humanoid robots.

The second major trend is the electrification of everything. Batteries are improving rapidly and the opportunity set is huge. Even simple penetration trends matter – in some markets only 4-5% of households have air conditioners, so the runway is long.

What do your sector allocations look like right now?

We’ve been bullish Korea, but our guardrails kept us to around 8% overweight.

In China, we shifted from internet names to manufacturing and the electrical grid. In India, we reduced banks and IT services and diversified into smaller names, including initial public offerings such as [fintech] Pine Labs and [the electric scooters business] Ather Energy.

Our underperformance in 2021 and 2022 came from China’s regulatory shift and the Russia write-off. Russia was a 3% overweight that went to zero overnight. That was significant.

How do you think about position sizing and TSMC’s large weight?

TSMC is our largest semiconductor position. It has been around 15% in the trust, but we trim it as it rises. Our active weight is now less than 4%. If it falls to around 10%, it will still be meaningful, but you can’t outperform the index by owning the index. That is why we manage it on an active-weight basis.

How did you manage to almost double the index over all standard timeframes?

Against the benchmark, I would say 50% is luck. You never know what politicians will do and benchmarks contain things you may not understand.

In absolute terms, I would say more than half is skill. If you stay in structural trends, in companies with good governance and good people, you should do reasonably well.

What do you do outside of fund management?

Not much these days. I used to play a lot of table tennis. I play a little chess and meet with friends.