Passive funds were the main choice for retail investors in 2025, with new net flows data from AJ Bell confirming a widespread preference for low-cost and no-fuss exposure to markets.

However, a small number of active portfolios convinced the platform's DIYers of their worth – chief among them JPMorgan Global Growth & Income.

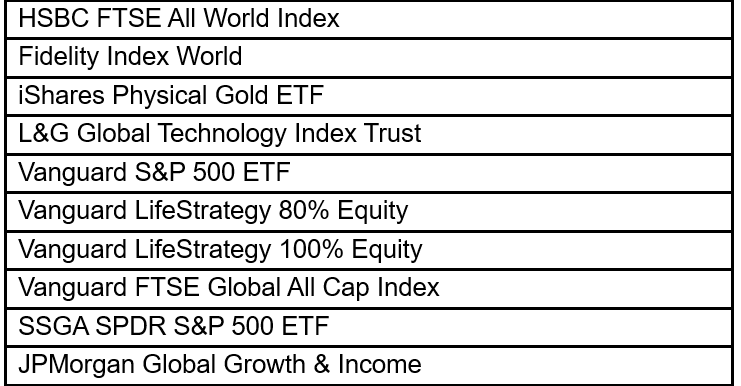

Looking at the table below, which is based on net flows between 1 January 2025 and 2 December 2025, the growth in popularity of passive funds is “plain to see”, said Dan Coatsworth, head of markets at AJ Bell.

Most popular funds and trusts (all types) with AJ Bell’s DIY investors in 2025

Source: AJ Bell

The most popular passive funds were ones providing broad exposure to companies around the world, gold, the technology sector and to the UK and US markets.

HSBC FTSE All World, Fidelity Index World, Vanguard FTSE Global All Cap Index and Vanguard FTSE All World all do a similar job – tracking a specific basket of global shares. This is useful for most investors, who chose to cast their nets wide and prefer a simple and low-cost way to invest.

“Tracking a global equities benchmark is like buying an assorted box of biscuits,” Coatsworth explained. “Rather than spending ages in the supermarket choosing which brand or product type to buy, you just put the collection in your basket and get a multitude of different tastes and flavours.”

Technically, there were three active strategies in the top 10 funds listed above, but Vanguard Lifestrategy 100% Equity and Vanguard Lifestrategy 80% Equity are only active by name, as they make active asset allocation decisions but then put them into practice through passive vehicles.

So effectively, the only pure active strategy making the table is the JPMorgan Global Growth & Income trust.

Managed by FE fundinfo Alpha Managers Helge Skibel and James Cook together with Sam Witherow, the strategy is yielding 4% and has featured several times in Trustnet's coverage this year, including for consistently outperforming on Sharpe ratio and as an alternative to Fundsmith Equity and Lindsell Train Global Equity.

Over 40% of its £3.2bn portfolio is invested in the telecommunications, media and technology sector, followed by banks (9.7%) and industrials (8.8%).

Five of the Magnificent Seven companies appear in the trust’s top 10, led by Nvidia (7.1%), prompting some analysts to warn against the trust’s high growth/tech weightings.

Performance has been positive across the board, as it outperformed the MSCI All Country World index in every calendar year in the past decade except 2018 – but it had a more troubled 2025, as Coatsworth noted.

“JPMorgan Global Growth & Income took the top spot even though its performance has lagged the market this year, returning 2.6% versus 14.6% from the MSCI All Countries World index in pounds,” he said.

“Notably, it has traded at a discount to the value of its underlying assets since the summer, having previously been at a premium. It adopted a more cautious tone earlier this year, which might have surprised some investors who thought the investment trust was a perma-bull.”

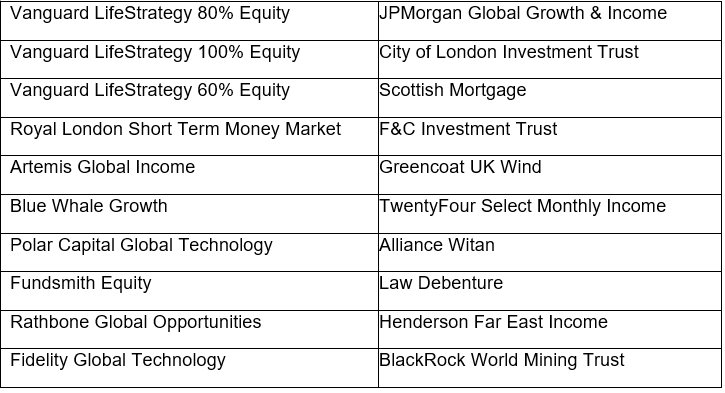

Broadening the scope of the list, AJ Bell identified the most popular active funds among DIYers, as shown below.

Most popular active funds and trusts with AJ Bell’s DIY investors in 2025

Source: AJ Bell

It’s noteworthy, said Coatsworth, that a money market fund (Royal London Short Term Money Market) appears high up the list of active fund preferences for DIY investors.

This fund category aims to deliver a return just above cash, “suggesting some caution among investors or a preference to blend some lower-risk investments with higher-risk ones in a portfolio”.

Fundsmith Equity managed to keep a space in the top 10 most popular active funds despite ongoing underperformance, while Artemis Global Income caught investors’ attention in a year when some people’s appetite for US exposure started to wane.

“The Artemis Global Income fund has much lower exposure to the US than the broader global stock market, and that was precisely what many individuals sought for their portfolios,” said Coatsworth, who hoped the results would be a wake-up call for the industry.

“Active managers hoping to keep investors on board and attract new ones are going to have to work their magic in 2026, otherwise the big migration to passive will gather pace,” he concluded.