The dominance of artificial intelligence (AI), president Donald Trump’s policies and a sluggish economy are all things investors need to consider when reviewing their US allocations for the next year, according to experts.

Overall, the economy is expected to be weaker in 2026 than this year, but markets are not the economy and, as such, investors may wish to stay the course.

Much of the enthusiasm centres around the ‘Magnificent Seven’ and the ongoing drive of AI, but there are also other pockets of interest too. Below, experts look ahead to what 2026 could bring for the world’s pre-eminent investing region.

A strong economy?

There are two schools of thought on the US economy next year. Cormac Weldon, co-manager of the Artemis US Smaller Companies fund was generally positive, suggesting moderate economic growth and the possibility for “even better” results if incentives such as those included in Trump’s One Big Beautiful Bill act come through.

Not all were as convinced, however. Man Group chief market strategist Kristina Hooper noted that the US is a consumer-driven economy that could come under pressure if inflation remains sticky and households are squeezed.

Meanwhile, business spending has centred around AI capex, accounting for 92% of total GDP growth in the first half of 2025.

“Therefore, continued AI investment is key to an economy that is otherwise muddling along – and to the continued strength of the equity market, since AI stocks have been largely responsible for the rise,” she said.

Felise Agranoff and Jack Caffrey, portfolio managers of JPMorgan American Investment Trust, agreed this was a key theme but were unconcerned.

They said spending is “likely to continue, benefiting both technology leaders and the companies enabling the expansion of digital and physical infrastructure”.

Tariffs

The big talking point of 2025 has been Trump’s tariffs, which have been in and out of the headlines since ‘Liberation Day’ in April.

Hooper said tariffs and immigration policy are likely to be “two strong headwinds” for the US economy in the next year as tariffs “distort trade and create inefficiencies by losing the benefits of comparative advantage”, while current immigration policy is “already resulting in labour shortages, increased costs and lower tax revenue”.

Agranoff and Caffrey agreed, suggesting the US has a “less than rosy outlook” due to Trump’s trade and immigration policies. “The average tariff rate faced by American consumers has jumped from around 3% to more than 10% since ‘Liberation Day’ in April. Meanwhile, a dramatic drop in foreign-born US workers amid the administration’s crackdown on immigration has put pressure on labour supply and therefore prices,” they said.

However, Weldon said he does not expect the policies imposed next year to be “as extreme”, adding that, as there are mid-term elections next year, the president is likely to be “pulling all the levers of power that he has to produce a strong economy to get Republicans re-elected”.

Interest rates

All experts agreed that interest rates are likely to come down over the next 12 months. Agranoff and Caffrey said they expect the Federal Reserve to deliver fewer interest rate cuts than markets expect, with just one further cut in the Fed funds rate to 3.75% by the end of 2026.

“That could set up some disappointment in the bond market, where the consensus sees rates dropping to 3.0% over that same period,” they said.

However, Weldon said weak labour markets could cause the Fed to cut interest rates even more aggressively.

“Another key point will be who Trump nominates to be head of the Federal Reserve,” he said. “We will certainly be keeping a close eye on bond markets for their reaction to who that nominee might be. Any sell-off in bonds certainly could produce volatility.”

The US market

Agranoff and Caffrey said the backdrop for US equities remains constructive despite ongoing debates around growth, inflation and the path of monetary policy, with large-cap companies continuing to demonstrate strong fundamentals, resilient balance sheets and a capacity to invest through uncertainty.

“The breadth of opportunities across US industries also remains compelling, particularly as companies continue to allocate significant capital to areas such as technology, financials, industrials and healthcare,” they noted.

As such, the managers anticipated earnings growth of around 14% in 2026, supported by massive investment in AI and the infrastructure powering it.

This sentiment was echoed by Weldon, who said balance sheets are in “good shape”, adding that companies have been able to produce strong earnings growth even amid moderate economic growth.

“For 2026, we would expect the market to be able to grow earnings of 10% or more,” he said.

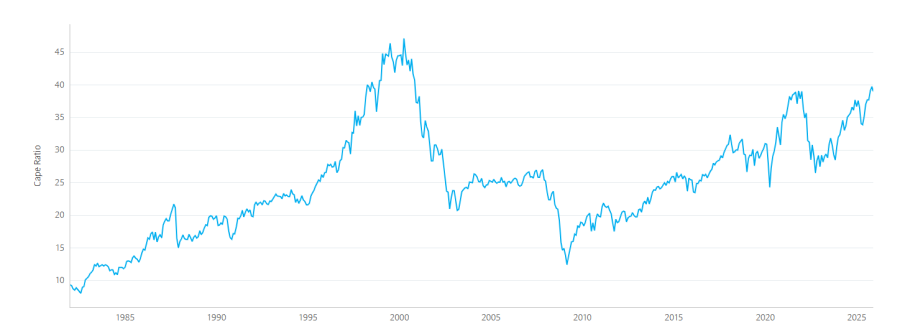

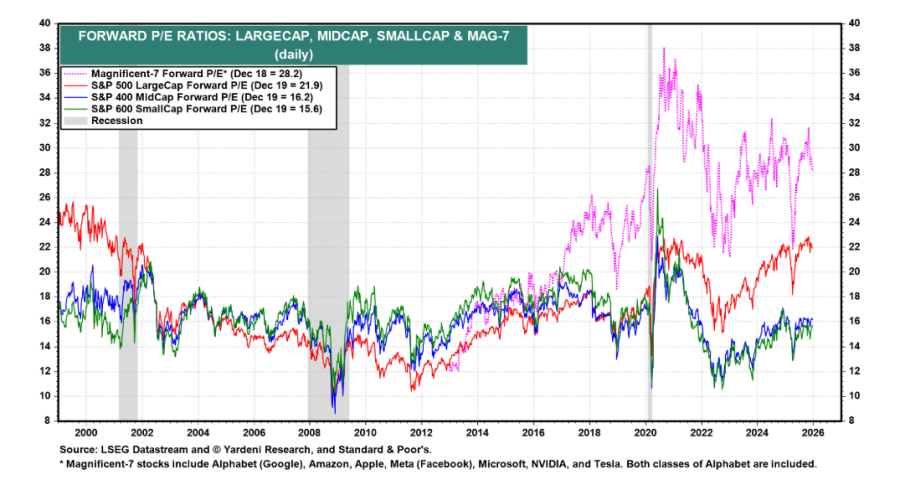

There are concerns that the market is expensive, with the S&P 500 now trading at 23x forward-looking earnings, according to Fidelity International research, while the MSCI USA index is trading on a cyclically-adjusted price-to-earnings (CAPE) ratio of 39x, as the below chart shows.

Historic CAPE ratio of MSCI USA index

Source: Barclays

James Thomson, manager of the Rathbone Global Opportunities Fund, said: “Expensive doesn’t always mean overvalued”.

“Quality, resilience and a broad spread of future-proof companies mean this market will grow through volatile economic cycles,” he said, adding that the US remains the “home of innovation, adaptability, repeatable and mission-critical growth”.

The Magnificent Seven and AI

Weldon said that getting the calls on the Magnificent Seven right “has been and will continue to be very important”, with these companies investing a lot of cash that they believe will benefit their top line and profitability over time.

“So we'll be looking for evidence of that and to make the appropriate investments in winners, and indeed to be underweight the losers.” However, he noted that it is “too early to tell that yet”, and as such investors need to remain “open-minded”.

He also talked down concerns of an AI bubble, noting that these are typically identified as broad-based enthusiasm combined with very high valuations – something he does not see at play currently.

Other sectors to invest in

Agranoff and Caffrey said a range of opportunities continues to emerge across the US large-cap universe beyond the technology theme.

“In financials, companies such as Mastercard show how scalable networks and recurring revenue streams can drive resilient growth as digital payments expand,” they noted.

“Diversified businesses like Loews also illustrate the breadth of potential across insurance, hospitality and infrastructure, where steady cash flows can be reinvested into higher-return assets. Together, these examples highlight how strong franchises and thoughtful capital allocation can create value across different parts of the market.”

They also noted companies with underappreciated assets or business models that can unlock value over time and healthcare companies with large-scale operational data and exposure to essential services as other good themes for investors.

Small-caps

Jonathan Coleman portfolio manager on the US Small/Mid-Cap Growth Team at Janus Henderson, said investors may also wish to consider smaller companies in 2026.

“There's a common belief that small caps need lower interest rates to outperform but history would tell you that that is not the case,” he said.

“The single best decade of performance in the history of US small-caps was a period in the 1970s that was characterised by higher inflation and higher interest rates for longer.”

Now he sees three drivers of outperformance next year. First is the trend of reshoring, which should benefit the lower end of the market as these companies “have a much larger percentage of their revenues derived from domestic sources”.

Next is the appetite for mergers and acquisitions, which is picking up, particularly in the biotech space, where “we have seen quite a flurry of activity”.

Lastly, the number of initial public offering (IPO) is recovering, having previously peaked in 2021 and troughed since. “What is exciting to us is that after a period where the IPO market is closed, it is often the highest-quality companies that are able to come public first, and so that has been a fertile ground for new ideas,” he concluded.