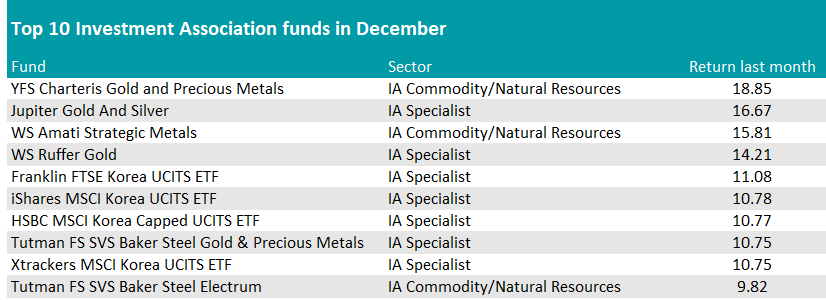

Gold and Korea were the most successful investment themes in December, dominating the list of the top 10 funds of the month, data from FE Analytics has shown.

Funds focusing on commodities, precious metals and gold in particular took centre stage, with the top vehicle of the month being YFS Charteris Gold and Precious Metals, up 18.8%.

It was followed by Jupiter Gold And Silver, WS Amati Strategic Metals and WS Ruffer Gold, as the commodity has continued to rise since April 2025 due to geopolitical tensions and the depreciation of the dollar.

Gold rose about 60% in dollar terms in 2025, but after being in the doldrums for several years, silver had “a much more substantial gain”, as Fairview Investing director Ben Yearsley noted.

“Silver gained 45% in the last two months of the year,” he said. “These stratospheric rises pushed gold, silver and precious metals funds up strongly.”

Korea has been another success story, where a change in government has sparked enthusiasm among shareholders. The top vehicle here (in fourth position overall) was the Franklin FTSE Korea UCITS exchange-traded fund (ETF), surrounded by a number of other trackers of Korean indices, which completed the top 10.

Source: FE Analytics

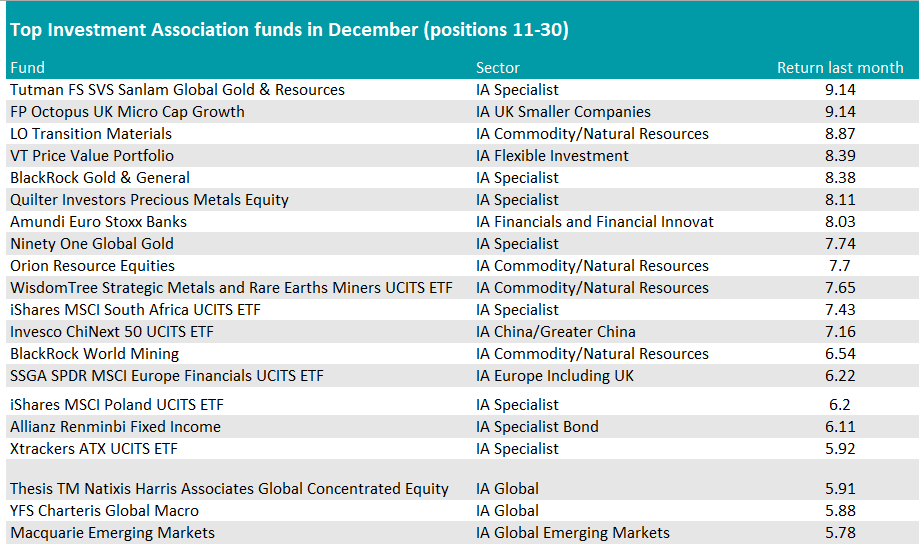

A handful of other themes were interspersed among these two dominating stories.

In 12th position, the small (£68m) FP Octopus UK Micro Cap Growth fund stood out within the IA UK Smaller Companies sector, returning 9.1% in the month – well above the next-best peer, the IFSL Marlborough Nano-Cap Growth fund (4.8%).

Octopus UK Micro Cap Growth has been a volatile performer. It had a weak November, when it posted -3.2% total return and the past one, three and five years were also difficult; however in the past three and six months, it reached the first performance quartile against its peers.

Value funds have also been on the rise, as the VT Price Value Portfolio testified with a 8.4% return. The fund topped the IA Flexible Investment sector in almost all standard timeframes – the only exceptions being over the past 10 and five years, when it came second-best.

It is an unconstrained, multi-asset strategy focussing on “exceptional-quality businesses trading at undemanding multiples” which managed to jump onto the gold-train early. Nine of its top 10 holdings are gold-related investments, miners or physical commodities.

Helped by rate cuts, financials – especially European banks – were also a lucrative area, with the Amundi Euro Stoxx Banks fund returning 8%, followed by Jupiter Global Financial Innovation (5.7%).

Europe continued to do well, particularly Polish and Spanish indices such as the iShares MSCI Poland UCITS ETF Xtrackers Spain UCITS ETF.

Source: FE Analytics

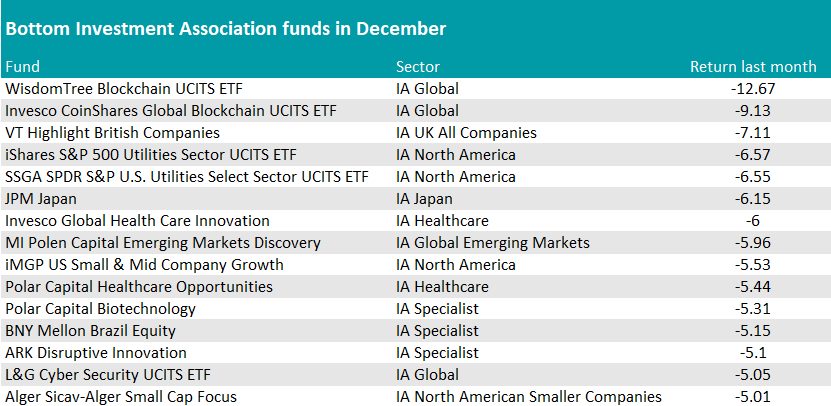

On the other side of the table, only one strategy fell double digits in December – the WisdomTree Blockchain UCITS ETF (-12.7%), with the Invesco CoinShares Global Blockchain UCITS ETF coming second to last at -9.1%.

The Crypto Fear & Greed index, a popular sentiment indicator for digital assets based, stood at 23 out of 100 last month, indicating extreme fear in the crypto market.

The doom and gloom also spread to other thematic, growth-based investments, with healthcare and biotechnology continuing their long-lasting descent (Invesco Global Health Care Innovation was down 6%).

North American small- and mid-caps as well as utilities were also relegated to the foot of the table.

India was another notable underperformer, with funds investing in the subcontinent such as UTI India Dynamic Equity and the two Ashoka WhiteOak India Opportunities and India Leaders funds falling short and stagnating at about the -4.5% line.

The region has been struggling for lack of innovation in relation to artificial intelligence (AI).

Source: FE Analytics

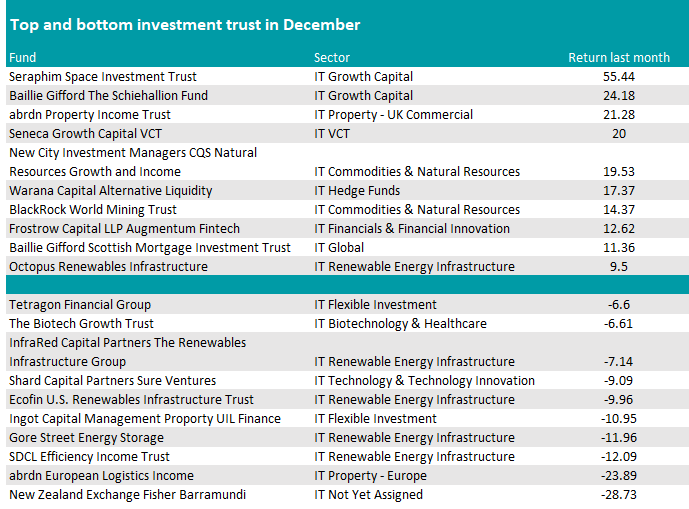

Some of the trends highlighted above were also observable in the closed-ended universe.

Technology, biotech and healthcare-based trusts slumped, similarly to their OEICS counterparts – for example, the Biotech Growth Trust lost 6.6% in December.

Vehicles investing in renewable energy infrastructure were the most negative, making up almost half of the bottom 10 names. Here, the SDCL Efficiency Income Trust is the most challenged (-12.1%).

Octopus Renewables Infrastructure, also a member of the IT Renewable Energy Infrastructure sector, was unaffected by these trends and made a positive 9.5%, propping up the top 10.

Source: FE Analytics

Financial did well here too, with Augmentum Fintech gaining 12.6%, beaten by 2 percentage points by the BlackRock World Mining Trust.

However, the absolute winner was Seraphim Space, which posed an astonishing 55.4% return in December.

Launched in July 2021, it is the world's first listed space tech fund, investing in early- and growth-stage, privately financed space-tech businesses. Since its inception, it has returned 17.6%, but the journey was difficult for early investors, who lost 73.7% in the first three years; however since that trough of July 2023, the trust is up a stellar 347.8%.

Baillie Gifford’s Schiehallion was in second position, at 24.2%.

Managed by Peter Singlehurst, the $1.4bn portfolio is invested in later-stage private businesses that have the potential to become publicly traded.

Its top 10 holdings include TikTok owner Bytedance, Elon Musk’s SpaceX, San Francisco-based software company Databricks and British fintech Wise.

The abrdn Property Income trust completed the top three.