Funds with exposure to precious metals dominated the list of top-performing strategies in 2025, Trustnet found.

Gold soared last year, benefiting from increased purchases from central banks, a weakening US dollar and investors hedging against risk.

The gold spot price rocketed up by more than $1,700, peaking at more than $4,500 per ounce, while silver also rallied from $56 per ounce at the start of the month to finish the year at an all-time high of $71 per ounce.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, said: “For miners and precious metal funds, this has translated into strong earnings momentum and investor interest.”

Gold was not the only story of 2025, with Korean equities and funds in some “unfashionable sectors” such as Europe “delivering the goods”, according to Ben Yearsley, director at Fairview Investing.

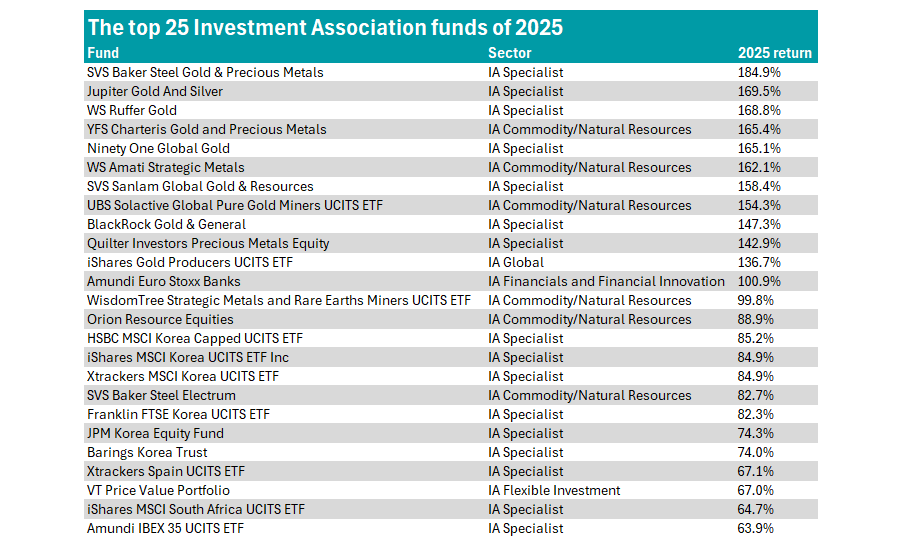

The table below displays the 25 best-performing funds in the IA universe in 2025, with a top 10 full of precious metal funds.

Source: FE Analytics. The table is ranked by total return in sterling

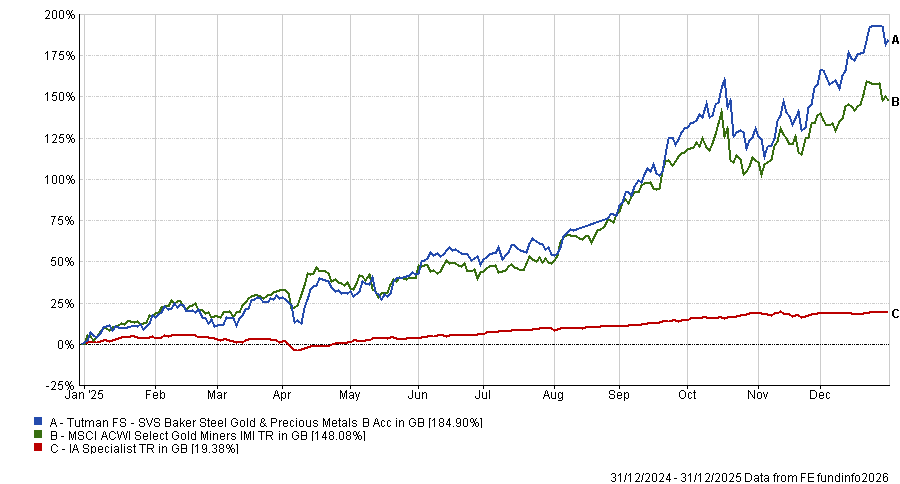

Topping the table is Mark Burridge’s SVS Baker Steel Gold and Precious Metals. It invests 70% of its assets in companies with direct exposure to gold or metals, or involved in production and mining.

Its top holding is the FTSE 100 precious metals company Fresnillo, one of the world's largest silver and gold producers. This has been a boon for the portfolio, as Fresnillo has been among the best-performing stock on the UK market in 2025.

The fund delivered a total return of 184.9%, turning a £10,000 investment into more than £28,000 by the end of the year.

Performance of the fund vs the sector and benchmark in 2025

Source: FE Analytics. Return in sterling.

The remainder of the top five were also actively managed gold strategies, including Jupiter Gold and Silver, WS Ruffer Gold, YFS Charteris Gold and Precious Metals and Ninety One Global Gold.

Several exchange-traded funds (ETFs) tracking gold also posted strong returns last year.

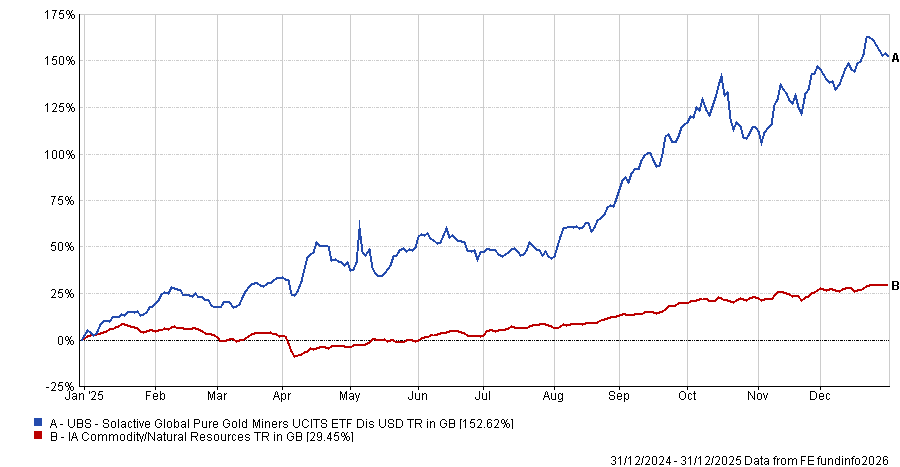

The UBS Solactive Global Pure Gold Miners UCITS ETF was the best-performing passive fund on the list, up by 153%. The fund tracks an index of global large caps that generate at least 90% of their revenue from mining the yellow metal.

Performance of fund vs sector in 2025

Source: FE Analytics.

The other precious metal ETFs to appear on the list are the iShares Gold Producers UCITS ETF and the WisdomTree Strategic Metals and Rare Earth Miners UCITS ETF.

We move on to Korea, where six equity funds broke into the top 25.

Korean equities rallied in the latter half of the year after the election president Lee Jae Myung in June and his efforts to reduce the ‘Korea discount’ that plagued local stocks. Additionally, easing tensions between China and the US as well as further optimism about artificial intelligence were a boon for Korean stocks in the final quarter of 2025, Yearsley said.

As a result, the Kospi (Korea Stock Exchange Composite) posted its best year of performance in more than a decade, according to FE Analytics.

For actively managed options, JPM Korea Equity and Barings Korea Trust were up 74.3% and 74% respectively.

Four passive funds also made the table – three tracked the MSCI Korea, one the FTSE Korea.

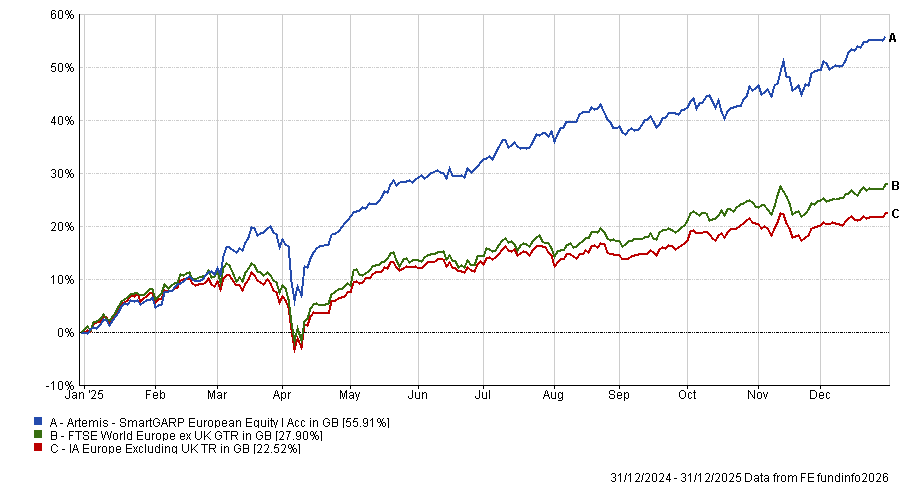

Moving beyond the top 25, Philip Wolstencroft’s Artemis SmartGARP European Equity fund was up 55.9% in 2025, topping the IA Europe ex UK sector. It was the 33rd best performing fund in the IA universe overall.

Performance of fund vs sector and benchmark in 2025

Source: FE Analytics. Returns in Sterling.

The fund uses the ‘growth at a reasonable price’ process, with managers seeking to remove behavioural biases by screening companies based on eight financial and macroeconomic metrics.

Analysts at Titan Square Mile said that Wolstencroft has managed the strategy in a “consistent manner since launch” but has not been afraid to make enhancements to the process over time.

The managers maintain a “pragmatic approach” that avoids being wedded to any single investment style or factor, allowing them to adapt to opportunities to deliver the best returns, analysts said.

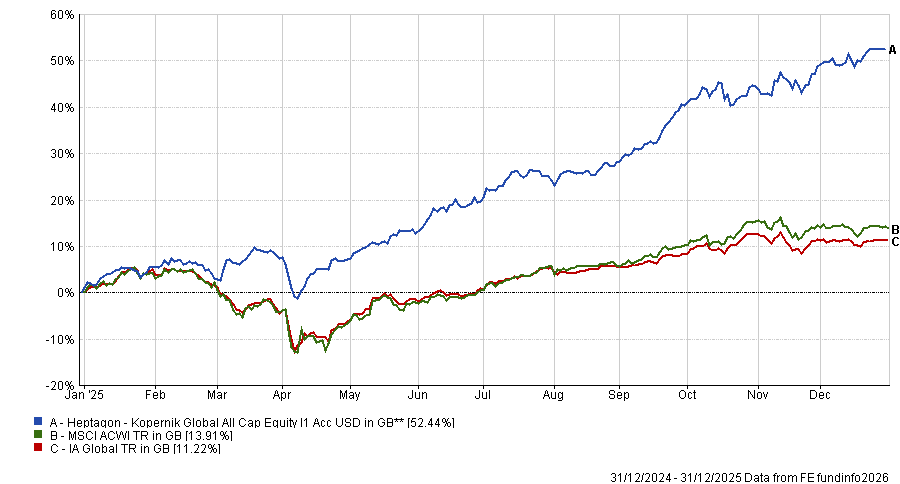

In the IA Global sector, the best-performing active fund was the Heptagon Kopernik Global All Cap Equity fund (up 52.5%).

Performance of fund vs sector and benchmark in 2025

Source: FE Analytics. Returns in Sterling.

The fund has a 39% allocation to basic materials, with the top 10 dominated by gold and platinum producers or energy companies such as Range Resources or Paladin Energy.

In November, Shard Capital’s Ernst Knacke identified the fund as the “first name I would write” when building a portfolio, due to the exceptional performance and record of lead manager Dave Iben.