Last year was characterised by mergers, acquisitions and takeovers in the Association of Investment Companies universe, with some sharp share price rises for takeover targets.

This was especially true in the infrastructure and renewables sector, which didn’t stand out for its overall returns (the average funds posted 1.44% in 2025) but had several shooting stars.

Gresham House Energy Storage Fund achieved a 71.9% return in the year, with a spurt in the last few months of 2025 after the battery fund agreed to buy a 100MW battery energy storage system in Elland in West Yorkshire in November. Meanwhile, Gore Street Energy Storage shot up in October following a board refresh and was up 23.6% in 2025.

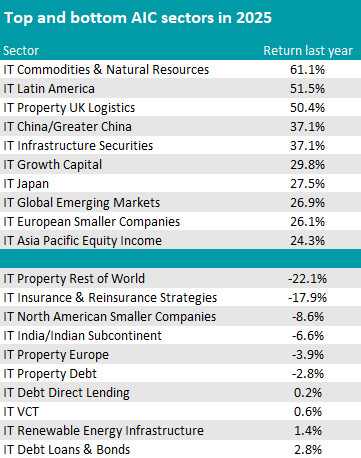

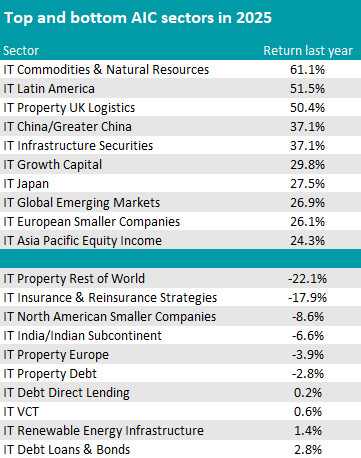

It was commodity trusts, however, that rose the most (as shown in the table below, which excludes the IT Not Yet Assigned, IT Unclassified and IT Hedge Funds sectors), with the IT Commodity & Natural Resources sector gaining 61% in 2025.

Gold was the culprit – it began its rise in the first half of the year and was still record-beating in December 2025, with funds investing in the yellow metal dominating last month’s performance tables.

Up 164%, Golden Prospect Precious Metals was the top-performing trust last year. The same asset manager, New City Investment Managers, also runs the fourth-best investment trust of the year, CQS Natural Resources Growth and Income (101.8%).

BlackRock World Mining Trust has been another standout performer in 2025. In an interview with Trustnet, co-manager Evy Hambro remained constructive on gold but argued that the universe remains “largely untapped”, with investors risking missing out on critical minerals and rare earths in particular.

The second-best trust of the year was Seraphim Space. It gained 55% last month, topping off an exceptional year that saw its total return rise to 120%.

Launched in July 2021, the vehicle was the first publicly listed fund dedicated to space technology, backing privately funded companies from early development through to growth.

Overall, returns since launch stand at 17.6%, though the ride has been far from smooth: investors who got in early endured a punishing 73.7% drop over the first three years. Since hitting its bottom in July 2023, however, the fund has staged a dramatic rebound, surging by 347.8%.

Source: Trustnet

The IT Growth Capital sector is also home to another outperformer, Molten Ventures (58.1%), a vehicle investing in early-stage companies that combine technology and service provision, have significant intellectual property, are scalable and require a relatively modest initial investment.

Other smaller companies funds stood out too. With a 63% total return, the small £80m UK small-cap-focused Marwyn Value Investors trust was the seventh best performer of the year. Founded in 2005, Marwyn is a key sponsor for listed acquisition companies in the UK.

Further afield, Fidelity Emerging Markets stood out with a 57% gain. Managers Chris Tennant and Nick Price warned investors that there are big chunks of emerging markets that they must avoid, especially state-owned enterprises such as Chinese banks. Their bottom-up stock-picking strategy has set them apart from their peer group.

Turning to sectors, as previously mentioned, the IT Commodities & Natural Resources peer group led the way, as the below table shows.

Source: Trustnet

On a similar theme, the commodity-driven IT Latin America was the second sector overall by performance, with the average trust up 51% last year.

The top vehicle in the sector was BlackRock Latin American, which concluded the top 10 of best performers of the year with a 53.7% return.

Brazil is its largest region of exposure (65% of the trust), followed by Mexico (23.6%) and Peru (4.4%). Peru led the last quarter of 2025 on its mining strength and with copper surging amid supply disruptions. Mexico also gained ground, helped by consumer discretionary demand.

IT UK Property Logistics sector fared third overall last year, gaining just over 50%. According to Fairview Investing director Ben Yearsley, this was fuelled by consolidation and takeovers.

He concluded on an optimistic note for the sector: “Property has been so unloved that it feels as if a snapback is inevitable,” he said.

At the other end of the spectrum, investors would have fared particularly poorly if investing in trusts in the IT Property Rest of World sector, where the average return was a 22.1% loss.

It was one of six sectors where investors would have lost money on average last year, with India, North American smaller companies, insurance, European property and real estate debt all areas that were best avoided in 2025.