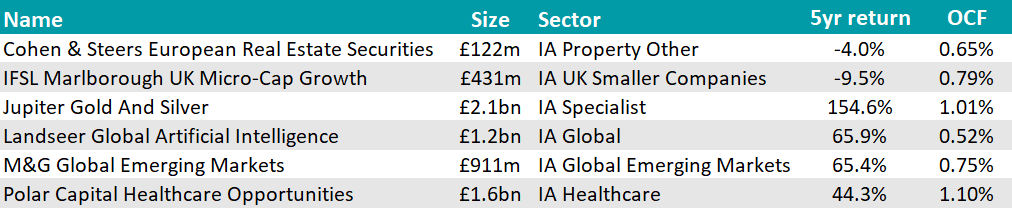

The new year has started with renewed geopolitical worries and a promise of further volatility ahead. According to Chelsea Financial Services managing director Darius McDermott, investors are facing “elevated valuations and the late stages of the interest rate cycle”, with the opening week of the year reinforcing the need for selective exposure.

Against this backdrop, he has identified six funds in areas where valuations, fundamentals and portfolio characteristics warrant investor consideration.

Emerging markets

The first of those areas is emerging markets, which he highlighted on the basis that they have been out of favour for an extended period and could benefit from a less supportive backdrop for the US dollar and easing global financial conditions.

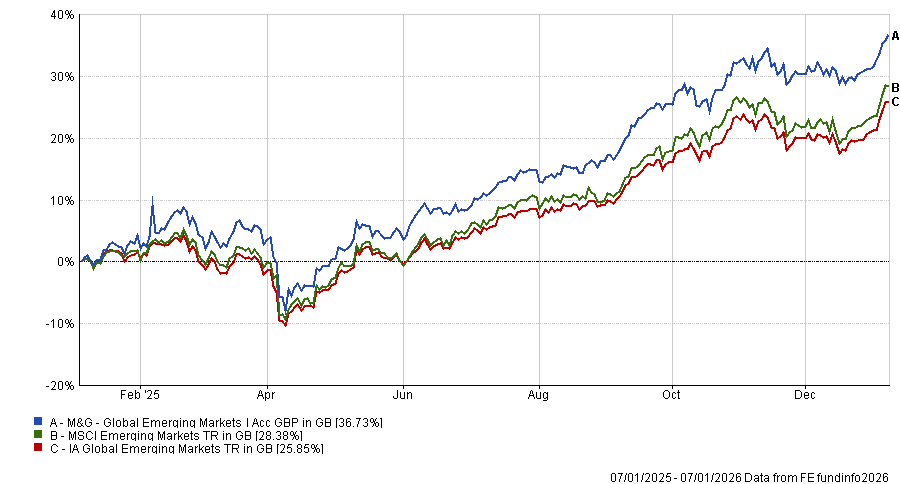

M&G Global Emerging Markets was his preferred option as “a standout in this sector”. With a maximum FE fundinfo Crown rating of five and $1.2bn of assets under management (AUM), the fund is run by Michael Bourke, who emphasises real cashflow.

McDermott said is particularly important given the volatility and unpredictability that can characterise emerging economies.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Its long-term track record and clearly articulated process are cited as reasons for its inclusion, with McDermott viewing this approach as a way of balancing growth opportunities with financial resilience.

UK smaller companies

UK smaller companies have endured a prolonged period of weak performance, remaining well below their 2021 peak. For McDermott, this has left valuations depressed and sentiment extremely low, creating the potential for recovery if conditions stabilise.

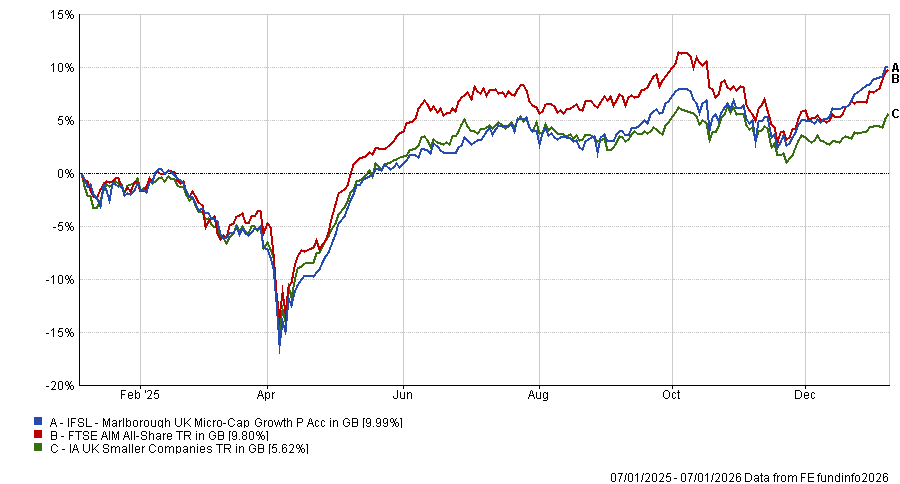

IFSL Marlborough UK Micro Cap Growth is his chosen vehicle for accessing this part of the market. Another five-Crown scorer and “a stellar performer”, it is run by Guy Feld and Eustace Santa Barbara, whom McDermott pointed to for their long-standing focus on UK small- and micro-cap stocks, selected from the bottom-up rather than with macroeconomic calls.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The fund picker also noted the structural features of the fund, including that it is a unit trust investing in smaller companies, which can lead to wider bid–offer spreads at times of heavy inflows or outflows.

Specialist equities

Chalsea Financial has increased exposure to specialist equity areas that have lagged while investor attention has been concentrated elsewhere. In particular, it is backing healthcare as a sector offering diversification and cashflow visibility.

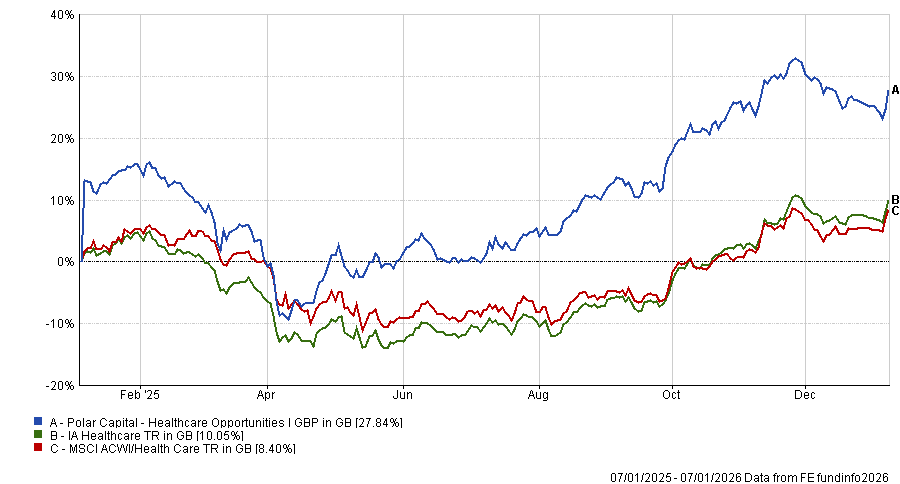

The five-Crown holder Polar Capital Healthcare Opportunities is recommended as a way to access the breadth of the healthcare universe, with Gareth Powell running a concentrated and unconstrained portfolio spanning large pharmaceutical companies through to biotechnology.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The complexity of the sector makes specialist expertise essential, according to McDermott, who viewed the fund’s structure as a means of gaining exposure to both defensive and higher-growth areas within healthcare through a single strategy.

Real estate investment trusts

After several years of pressure from rising interest rates, parts of the listed real estate market are beginning to look more attractive for McDermott, who said: “Selectivity is key, but we see opportunities where balance sheets are robust”.

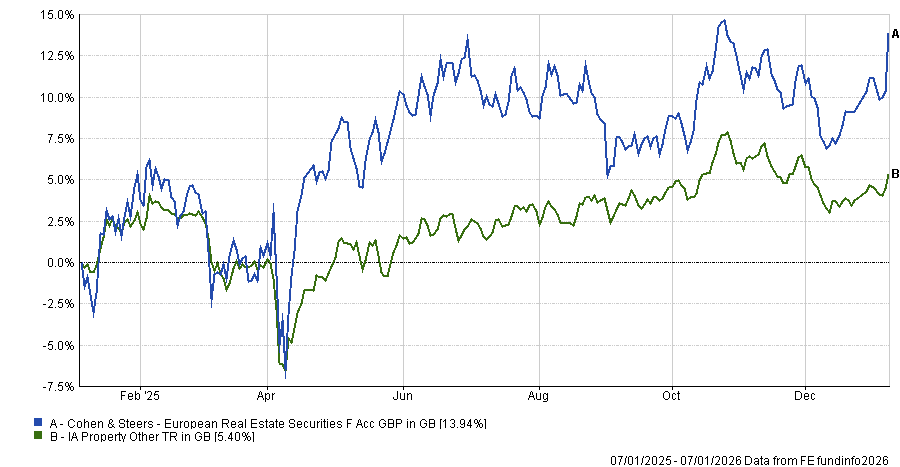

Many real estate investment trusts (REITs) are trading at wide discounts to their net asset value, he noted, with income levels that reflect the reset in valuations. For European property exposure, he pointed to Cohen & Steers European Real Estate Securities, which was selected based on the specialist nature of real estate investing and the resources available to the team in analysing balance sheets, asset quality and local market drivers.

Performance of fund against index and sector over 1yr

Source: FE Analytics

This vehicle is proposed as a way of accessing the asset class while maintaining a focus on risk management following a difficult period for the sector.

Artificial intelligence

While cautious about valuations in parts of the artificial intelligence (AI) theme, McDermott opted to retain exposure through a fund he believes has a differentiated approach.

“Despite widespread scepticism, earnings continue to come through, and this does not feel like a late 1990s style bubble,” the fundpicker said. “Don’t be surprised to see AI-related stocks continue to perform if earnings momentum is sustained.”

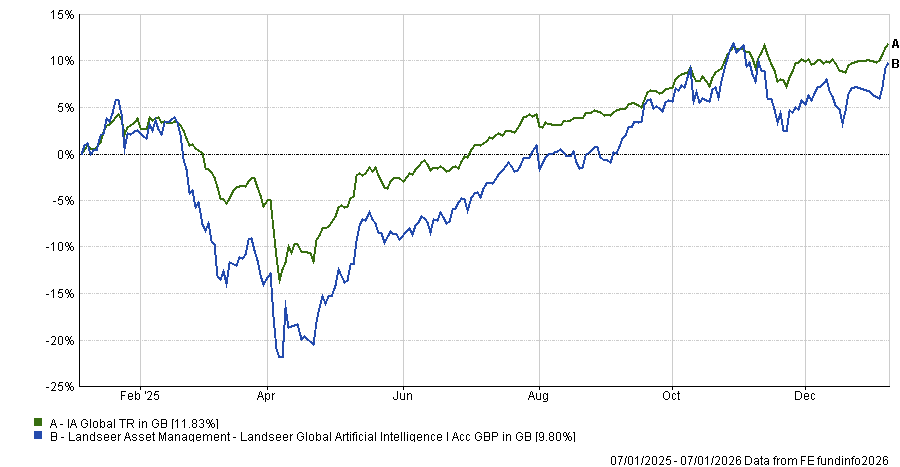

Landseer Global Artificial Intelligence was his fund of choice, which has been operating in the space since 2017, predating the recent surge in interest in the field.

Performance of fund against index and sector over 1yr

Source: FE Analytics

McDermott saw the length of the track record and the systematic approach as key distinguishing features, rather than relying on more thematic or narrative-driven exposure. The fund uses its own AI system to identify companies expected to benefit from AI adoption.

Silver

Silver is described by McDermott as a higher-risk allocation, but one where supply and demand dynamics remain supportive. In a recent Trustnet article, he noted a structural deficit in the market and rising industrial demand, alongside silver’s role as a precious metal during periods of uncertainty.

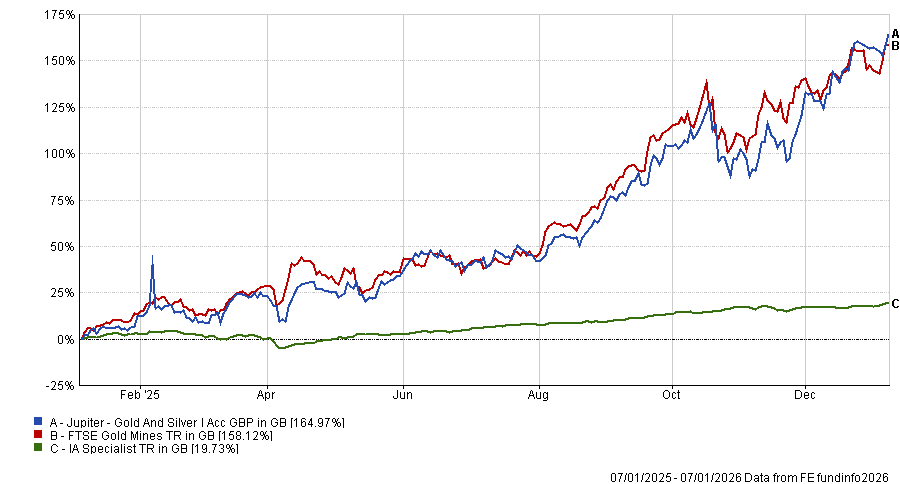

To profit from that dynamic, he picked Jupiter Gold & Silver, “a truly unique fund”.

Performance of fund against index and sector over 1yr

Source: FE Analytics

The strategy invests across physical gold and silver bullion as well as mining companies, with the flexibility to allocate up to 70% to silver.

This stood out to McDermott as a distinctive feature that increases potential upside, while acknowledging the higher risk profile that comes with such concentration.

Source: FE Analytics