Tim Lucas, lead manager of the £611m BNY UK Equity fund, doesn’t believe in drawing borders around opportunity, with the UK market full of strong companies that are undervalued with improving fundamentals.

“We think that good ideas can be found in any sector at any time, so we are very open-minded and constantly looking for new opportunities,” he said.

“There are fund strategies that discard whole areas of the market as uninvestable – that is something we will never do.”

He argued that his openness has underpinned the fund’s strong performance.

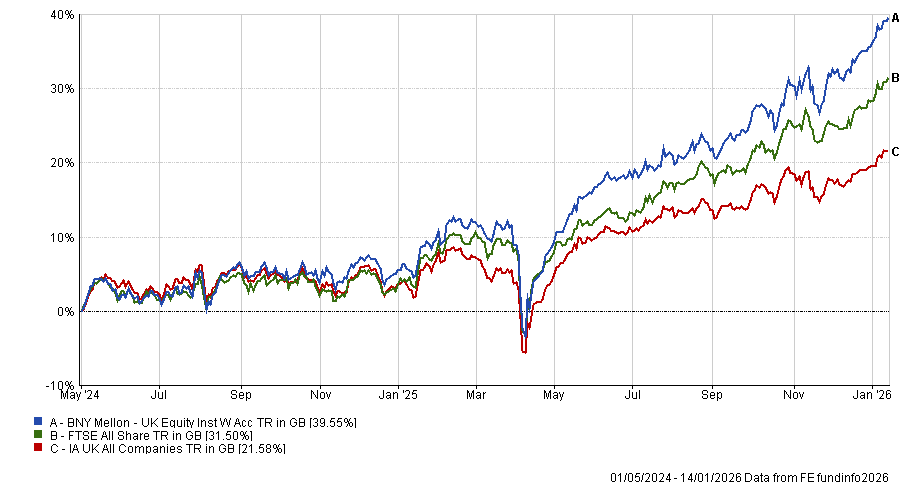

It has delivered a 111.3% return over the past decade, outperforming the IA UK All Companies sector average of 98.2% and securing a second‑quartile position over that period. More recently, the fund has ranked in the top quartile for both one‑ and three‑year returns.

Performance of the fund vs sector since May 2024

Source: FE Analytics

Lucas spoke to Trustnet about BNY UK Equity’s recent performance and how its positioning has evolved since he stepped into the lead manager role.

What has changed about the fund since you became lead manager in May 2024?

When I initially took over the fund, it was much more overweight in the quality companies trading at higher multiples and had a big underweight in financials.

Over the previous 10 years or so, banks had been poor performers, with interest rates held low and banks under pressure to build up a capital ratio following the financial crisis, meaning every bit of profit made had to go back into the banks to be able to improve balance sheets, leaving nothing for investors.

Yet the perception I had around financials coming in to manage the fund was different. I believed that the safety and quality of the earnings stream from banks is far greater and therefore I felt sufficiently undervalued. Over the course of that first six months, I went from heavily underweight financials to heavily overweight.

These companies have since been re-rated and are performing really well, but we think they are still cheap.

Are there any sectors in which you are notably underweight and why?

We try to keep a balance across the portfolio, so we have exposure to virtually all sectors we have access to, with the exception of technology currently.

Tech companies in the UK are primarily software and data companies, like RLEX and Sage. At the start of last year they were trading at high multiples of between 25x to 30x and growing 5% to 10%. To justify multiples like that, we calculated that these companies would have to maintain those growth rates for 10 to 15 years.

Although there have been no earnings downgrades, I believe the level of certainty investors are willing to put upon them is too high relative to what may change in the market 10 years from now.

However, we are able to selectively make global investments and last year invested in SK Hynix, which makes memory chips for AI infrastructure. Crucially, it was trading at 7x earnings, whereas Nvidia was trading on 30x earnings.

The SK Hynix share price doubled and provided a decent amount of performance last year – just shy of 1% of the overall portfolio.

How important is engagement with the fund’s portfolio companies and why?

As an active manager, what else do you have other than engagement? Yes, we have data, which is all over our screens, but the active side of management is more difficult to replicate with machines. Being able to understand the nuances by engaging with companies can give you an advantage.

It needs to be an active conversation. It’s also important that meetings with management are frequent so any changes in the narrative can be detected quickly and easily.

What were your best calls in 2025?

The biggest contributor to the fund last year was Standard Chartered, which I bought around the time I took over the fund.

It has a very strong wealth business in Hong Kong and an increasing number of people in China – a big saving economy – are using Hong Kong as a centre to deposit their money and invest in wealth products. That wealth business has grown very strongly and expanded the profits of the overall business sharply.

Over 2025, the bank contributed 2% to the overall performance of the fund and outperformed the FTSE 100 89% versus 24%.

The other top performer was Barclays, which also contributed 2% to the fund and was up 82% last year. The profitability of the UK business was the big primary driver, as Barclays has increasingly put more capital into the highest returning parts of the bank.

And what were your worst calls last year?

The biggest thing which I didn’t do which I should have done was own Rolls-Royce. It gained 104% through 2025. Not owning it cost the fund 2% relative to if I had an equal weight position. In hindsight, we underestimated the strength of the recovery of the aerospace sector.

An active call that didn’t pay off is the discount retailer B&M, which we bought in June 2025 and has cost me 0.8% of the fund, with the share price declining 40%. The company management has changed and has indicated that it is necessary to reduce its operating margin due to a combination of price declines and operating cost investment. The margins have reset down further than we expected.

It also hasn’t secured loyalty from consumers. Supermarkets like Tesco and Sainsbury’s have utilised loyalty schemes, which are helping them segment their customer base and understand exactly what their customers are doing so they are able to stock and price the right things. B&M doesn’t have that and so that’s one reason it is losing share in its grocery segment.

What do you do outside of fund management?

I love to be outside – whether that’s going for a run, cycling, skiing, hill walking or running around after my son.