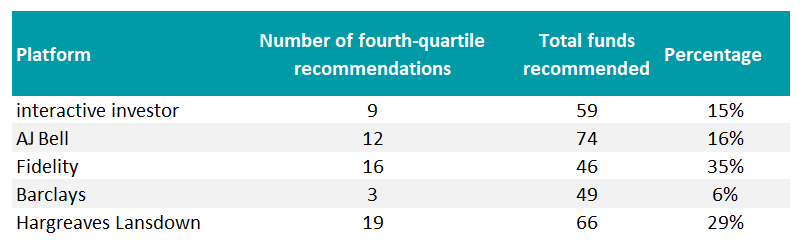

Hargreaves Lansdown and Fidelity had the highest proportion of fourth-quartile funds on their best-buy lists over the past year, according to Trustnet data.

Our study examined the one-year performance of funds featured on 2026 best-buy lists from the major UK investment platforms and assessed how many landed in the fourth quartile of their respective sectors last year.

As with yesterday’s analysis of top-quartile performers, the review covered one-year returns for all funds on each platform’s buy list, excluding strategies in the specialist commodities, unclassified and absolute return sectors. All quartile rankings are relative to sector peers, meaning some fourth-quartile funds still posted positive returns in absolute terms.

While no provider avoided underperformers entirely, some lists proved more resilient than others in a year marked by sharp style and regional rotations. It is worth noting, however, that these lists are not designed over a one-year time horizon and not all funds will outperform at the same time.

Hargreaves Lansdown had the largest number of bottom-quartile funds overall, with 19 of its 66 recommended strategies in the fourth quartile of their sectors over one year, representing 29% of its list.

Fidelity followed, with 16 fourth-quartile funds from a smaller list of 46, giving it the highest proportion among the platforms at 35%.

AJ Bell ranked third by number, with 12 bottom-quartile performers from 74 recommendations, or 16% of its list. Interactive investor had nine fourth-quartile funds from 59, equating to 15%.

Barclays stood out, with just three of its 49 recommended funds, or 6%, finishing in the bottom quartile.

Source: Trustnet

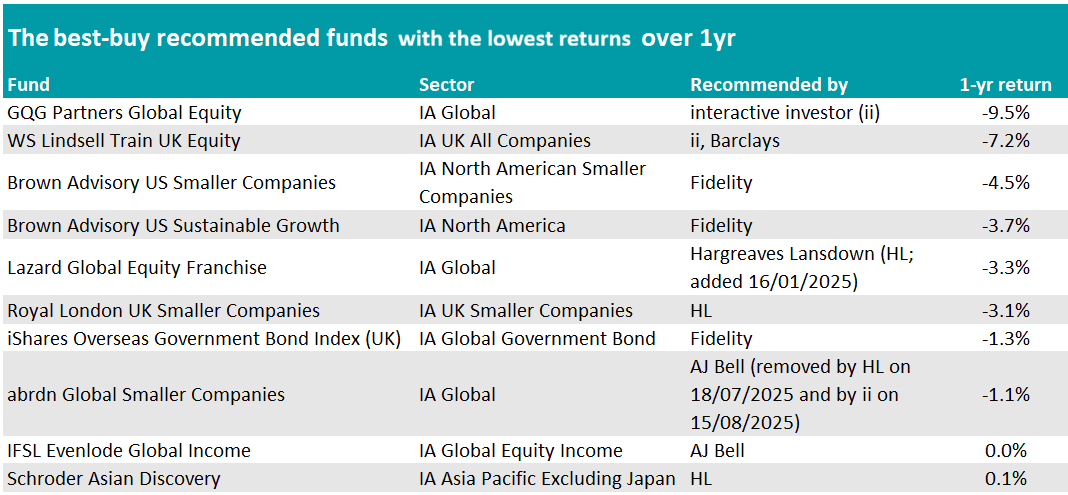

Turning to individual funds, the weakest performer among all buy-list recommendations was GQG Partners Global Equity, backed by interactive investor.

The global equity strategy fell 9.5% over one year, finishing last not only among recommended funds but also within its 565-strong IA Global peer group.

It was the only buy-list selection to post a loss close to double digits and represented interactive investor’s poorest-performing recommendation over the period.

Second from the bottom was WS Lindsell Train UK Equity, which lost 7.2% and was recommended by both interactive investor and Barclays. The result underlined the continued difficulties faced by one of the UK’s most widely held active strategies in a market that favoured recovery, value and smaller companies.

Another high-profile franchise, Fundsmith Equity, also featured among the bottom-quartile recommendations. Backed by interactive investor, the global fund returned 0.8% over one year.

Veteran manager Terry Smith invests in quality-growth stocks. Last year marked the first in the fund’s history that it made a bottom-quartile return over a calendar year, although it has failed to beat the average peer since 2022.

In third and fourth position were Brown Advisory funds – the only house to appear twice among the weakest buy-list picks. Both Brown Advisory US Smaller Companies (down 4.5%) and Brown Advisory US Sustainable Growth (-3.7%) are recommended by Fidelity. They finished in the bottom quartile of their respective North American sectors.

The abrdn Global Smaller Companies fund (-1.1%) lost its recommended status with Hargreaves Lansdown on 18 July 2025 and with ii on 15 August, but has retained AJ Bell’s approval so far.

Source: Trustnet

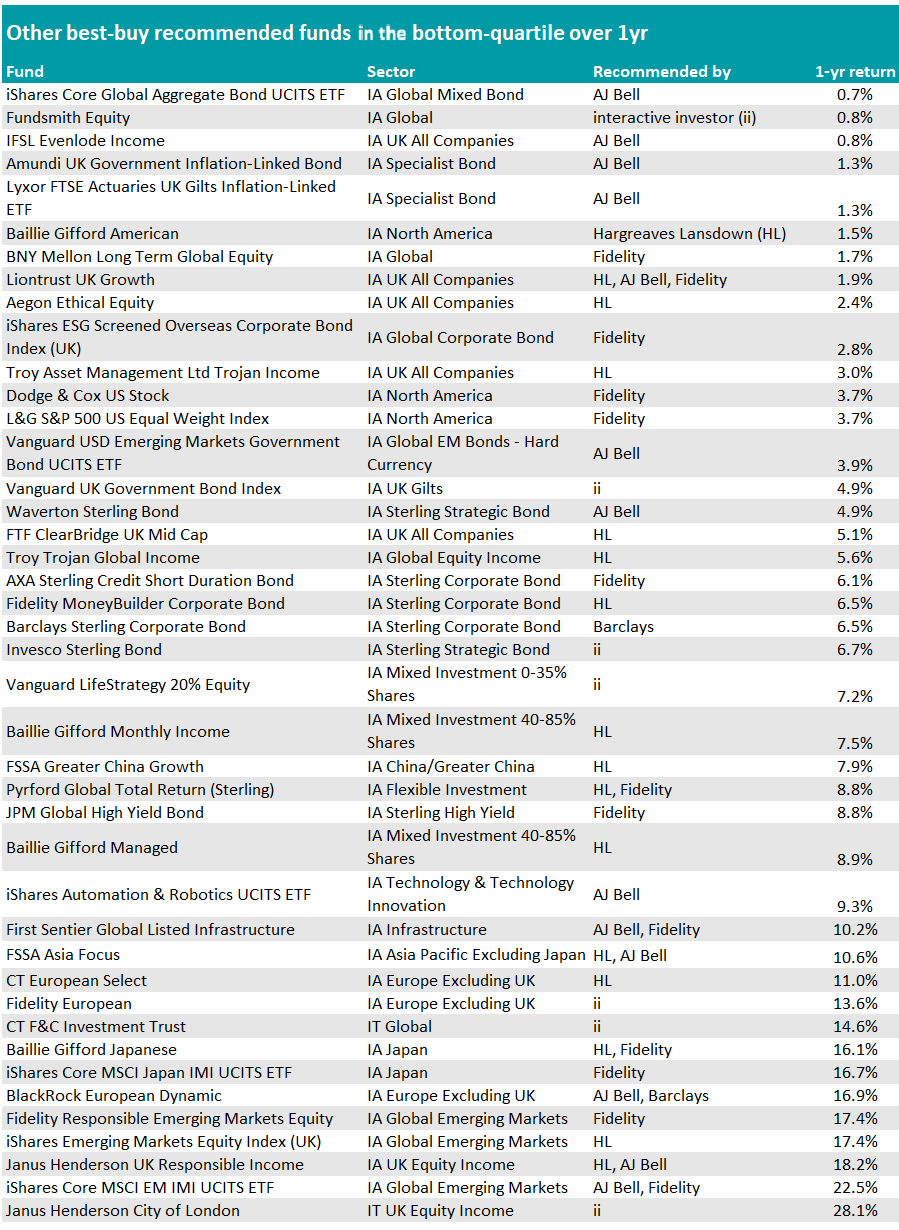

Further down the list, passive bond strategies were another consistent feature among the laggards. A number of index-tracking government and corporate bond funds finished in the fourth quartile despite delivering small positive returns.

These included iShares Overseas Government Bond Index (UK), Vanguard UK Government Bond Index and iShares Core Global Aggregate Bond UCITS ETF, all recommended by different platforms and all ranking among the weakest performers in their bond sectors.

Fixed-income strategies struggled as duration exposure and currency effects weighed on returns.

Elsewhere, several large active managers also featured repeatedly among the bottom-quartile selections. Baillie Gifford appeared with multiple funds, including Baillie Gifford American, Baillie Gifford Monthly Income, Baillie Gifford Managed and Baillie Gifford Japanese, all recommended by Hargreaves Lansdown or Fidelity and all finishing in the fourth quartile of their peer groups.

Fidelity likewise featured several times, both through house funds such as Fidelity European and Fidelity Responsible Emerging Markets Equity and via external strategies on its list.

Source: Trustnet