Despite his many controversies, Elon Musk is one of the most exceptional entrepreneurs of the modern era and investors shouldn’t let personal feelings cloud their judgment about his companies’ prospects, according to Simon Raubenheimer, investment manager of the £1.7bn Contrarius Global Equity fund.

“A lot of people don’t like him and will therefore avoid investing in any of his companies,” he said. “But if you look past his polarising views and focus on what he has achieved as a businessperson at Tesla, SpaceX, Neuralink and X, it is remarkable and he will be someone history will remember in hundreds of years’ time.”

For most, it is likely more difficult to look past Musk’s controversies – especially given the impact this can have on the performance of his companies.

For example, Tesla’s share price has proven deeply sensitive to Musk’s public commentary. In June last year, the stock sank nearly 15% in a single day after Musk publicly attacked US president Donald Trump’s tax‑and‑spending bill.

However, Raubenheimer said “it is important to align yourself with the right entrepreneurs”.

“[Musk] is a big shareholder in his own businesses and we are quite comfortable to co-invest with him, solely based on what he has achieved in business and in terms of driving technology forward,” he said.

The two biggest positions in the portfolio reflect Raubenheimer’s confidence – one of them is Tesla, which made up 9.4% of the portfolio as of 31 December 2025.

However, the top holding in the portfolio – EchoStar – does not immediately suggest a connection to Musk.

Contrarius Global Equity has a 9.5% position in the global telecoms company – which ultimately gives it an indirect stake in Musk’s privately listed aerospace giant SpaceX.

“We only bought [EchoStar] in the second half of 2025 following a series of transformative transactions it has made, which has repositioned the company and changed the nature of the business,” Raubenheimer explained.

EchoStar previously set out to use nearly $30bn of spectrum (the licensed radio‑frequency airwaves that mobile and satellite networks use to transmit data) to build a national 5G network via its consumer wireless brand Boost Mobile.

However, high costs, delays and competition meant it missed crucial milestones and subsequently triggered an investigation by the US Federal Communications Commission last year into whether EchoStar was failing deployment deadlines and effectively hoarding spectrum.

This put the company’s heavily levered balance sheet at risk and prompted a pivot. EchoStar subsequently sold significant spectrum to AT&T and SpaceX, allowing it to pay down over $13bn of debt. Crucially, this also gave EchoStar an around 3% equity stake in SpaceX, worth $400bn at the time.

With SpaceX later valued at around $800bn, that stake now gives the Contrarius fund a rare, discounted route into Musk’s unlisted business.

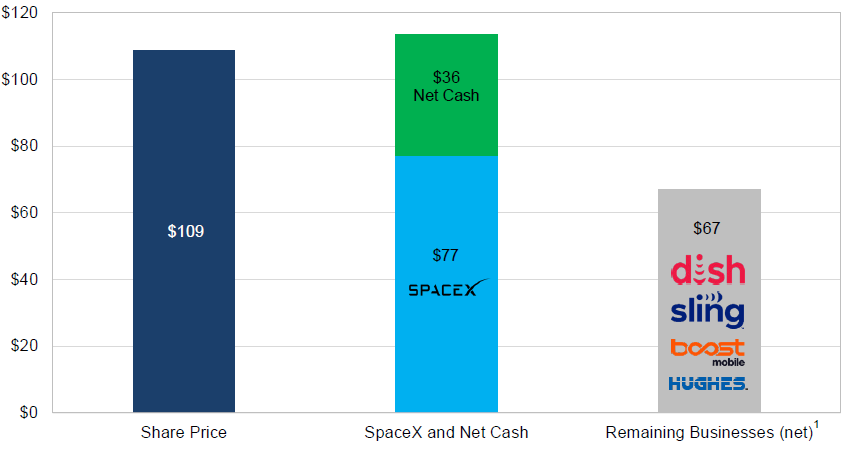

At the end of the fourth quarter of 2025, EchoStar traded at $109 per share, yet its SpaceX stake alone was worth roughly $77 per share and net cash added another $36, meaning the market was effectively assigning no value to its remaining businesses – a disconnect Raubenheimer said is a major opportunity.

EchoStar pro forma balance sheet and strategic assets ($ per share)

Source: Contrarius Research, EchoStar. ‘Remaining businesses’ (net) includes the estimated value of EchoStar’s operating businesses and spectrum assets, net of tax and other obligations (including the increased fair value of the convertible debt as at 31 December 2025).

“EchoStar basically went from being a highly indebted and asset-heavy builder of wireless networks to a leaner investor in satellite technology, by way of selling off some of its spectrum,” Raubenheimer said.

“We also expect SpaceX to potentially list this year at a valuation that we think would far exceed the most recent valuation round.”

While EchoStar offers a less obvious route into Musk’s world, Tesla represents the more familiar – and, in Raubenheimer’s view, surprisingly contrarian – side of the story.

“Tesla is a surprisingly contrarian position and is probably the share we have received the most pushback from clients on,” he said.

“We have held it for three years and we think it is probably the best beneficiary of real-world physical AI, as the company will benefit from the convergence of several unstoppable trends: electric vehicles, autonomous driving, green energy and robotics.”

Raubenheimer predicted that Tesla, as a result, is set to disrupt other companies and wider industries.

“If we look at Tesla’s potential four to six years out, we think the market capitalisation of the company now is a lot smaller than we expect that future market capitalisation to be,” he said.

Raubenheimer added that Tesla’s potential reflects a much bigger theme shaping the portfolio – AI.

This has prompted the management team to sort the market into three AI categories: the clear beneficiaries, the businesses likely to endure and those facing disruption from the wider AI build-out.

“We think the investing world still underestimates just how profound the impact of the current technological changes will be – this is far bigger than your average bog-standard disruption that happens every decade or two,” he said.

However, it is important to be discerning and avoid pockets of exuberance, he warned.

Raubenheimer said the AI “winners” are the businesses that will benefit directly from AI’s rollout, such as Oracle or TSMC. The former has been subject to scrutiny following its decision to aggressively tap debt markets to fund its AI ambitions.

“Oracle is a top 10 holding for us,” said Raubenheimer. “It is well-managed by Larry Ellison and we expect it to grow. It does have significant skin in the [AI] game but, if you look at the landscape, companies are spending more on AI – not less.”

Another concern is that over half of Oracle’s order book sits with OpenAI, meaning the company is arguably dependent on the success of the ChatGPT creator.

“We don’t think OpenAI will have any problems in the near-term raising money or increasing its rate of monetisation as it continues to grow its revenues fairly strongly,” said Raubenheimer.

The fund also hunts for “AI-proof” companies – those with products and brands that are likely to endure even as AI transforms industries. These include luxury houses like Kering and consumer brands like Diageo.

In contrast, Raubenheimer said they look to avoid companies that will be threatened by AI, which range from ride-hailing services to payments companies and banks.

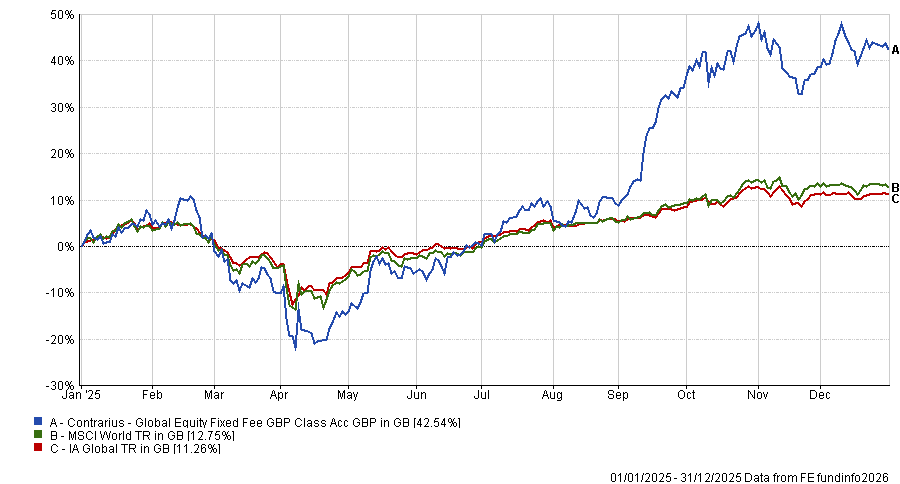

Contrarius Global Equity is in the top quartile for returns in the IA Global sector over one, three, five and 10 years. In 2025, the fund gained 42.5% versus the sector average of 11.2%.

Performance of the fund vs sector and benchmark in 2025

Source: FE Analytics