Funds and trusts investing in Latin America topped the performance tables in January, FE fundinfo data shows, while Indian equities continued their struggles from 2025.

Commodities were the standout asset class in the first month of 2026 with a 7.7% return, while global equities gained 0.9%. Treasury and corporate bonds declined, hurt by persistent inflation concerns.

By region, the MSCI Latin America index surged and helped emerging markets to outperform developed markets. Energy and materials sectors were the best global equity sectors during the month.

This meant that funds and trusts focused on Latin American equities topped both the Investment Association and Association of Investment Companies universes, following on from their strong performance in 2025.

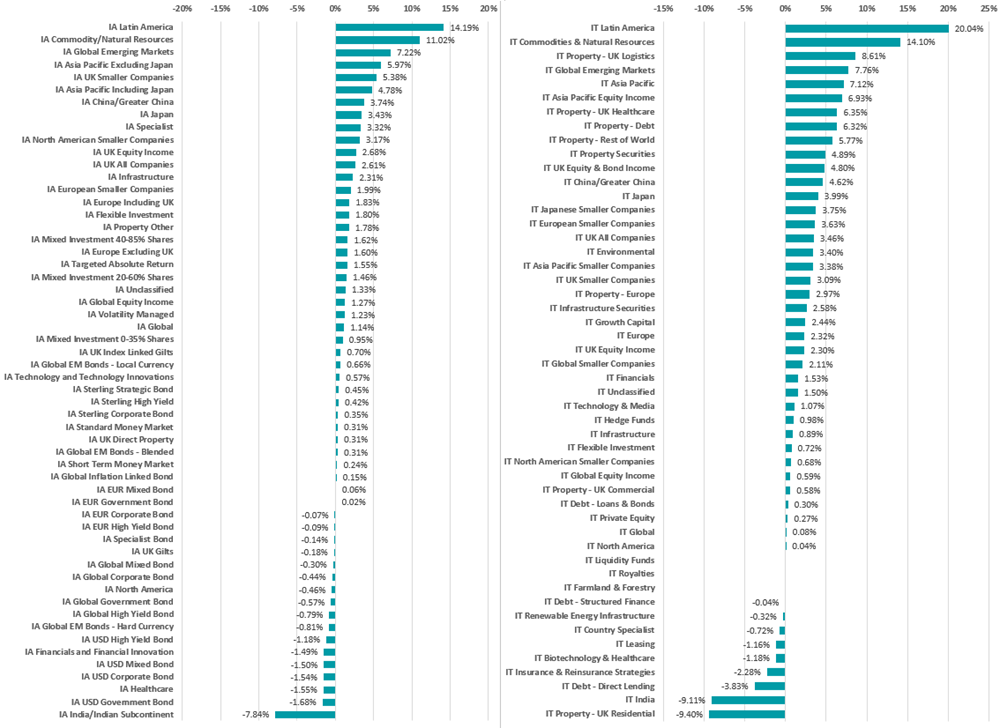

Performance of IA and AIC sectors in January 2026

Source: Finxl. Average return in sterling between 1 Jan and 31 Jan 2026.

The primary drivers for January’s performance include rising commodity prices that benefited resource-rich economies, a weaker US dollar that historically channels capital toward emerging markets and deeply discounted valuations, even among emerging markets.

Political catalysts also fuelled investor enthusiasm, particularly in Chile, where president Antonio Kast’s election in December 2025 triggered a market re-rating, and in Argentina where president Javier Milei’s market-oriented liberalisation reforms attracted significant inflows.

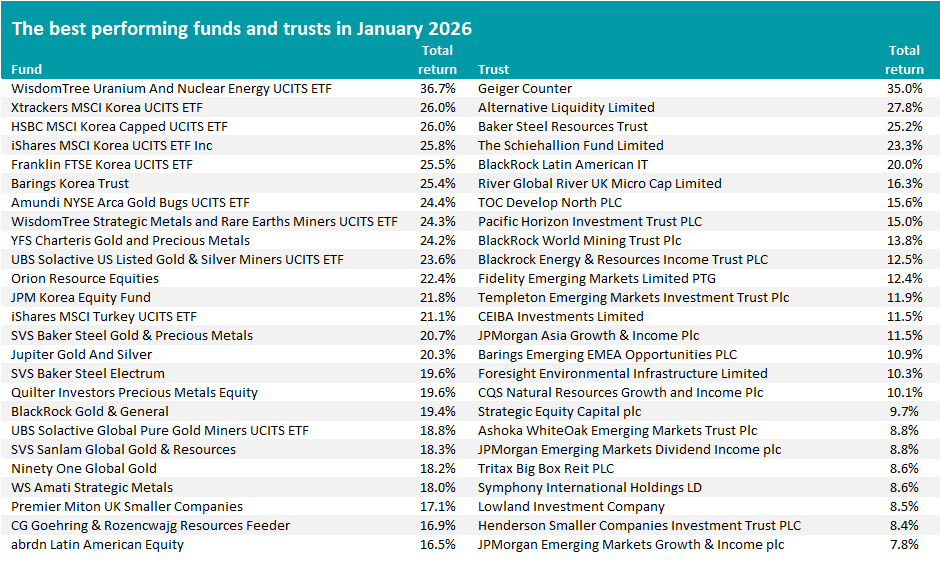

The best funds were abrdn Latin American Equity (up 16.5%), Liontrust Latin America (15.6%) and CT Latin America (14.3%), while BlackRock Latin American IT – the only member of the IT Latin America sector – made 20% in January.

Commodities funds and trusts came in second place after a broadly strong month for the prices of metals and energy commodities. That said, the final days of January did see silver and gold, which staged dramatic rallies in 2025 and the start of 2026, hit with a significant sell-off that has continued into February.

WisdomTree Strategic Metals and Rare Earths Miners UCITS ETF (24.3%), YFS Charteris Gold and Precious Metals (24.2%) and UBS Solactive US Listed Gold & Silver Miners UCITS ETF (23.6%) were the three best commodities funds; Geiger Counter (35%), Baker Steel Resources Trust (25.2%) and BlackRock World Mining Trust (13.8%), the best trusts.

The charts above also show emerging market equities rallied in January. The asset class had lagged behind developed markets for an extended period but started to race ahead in 2025 and outperformed for the first time in five years, driven by AI-related enthusiasm, accelerating earnings growth expectations and the weaker US dollar.

The best-performing funds last month were Nomura Emerging Markets (16%), Liontrust Emerging Markets (12.9%) and Barclays GlobalAccess Emerging Market Equity (12.4%), while the trusts with the largest gains were Fidelity Emerging Markets (12.4%), Templeton Emerging Markets Investment Trust (11.9%) and Barings Emerging EMEA Opportunities (10.9%).

Among the fund and trust sectors losing money in January were those investing in Indian stocks (which also struggled in 2025), healthcare equities and dollar-dominated bonds.

Source: Finxl. Total return in sterling between 1 Jan and 31 Jan 2026. Trust sectors excluding IT Unclassified and VCT peer groups.

Turning to individual strategies, the best performing member of the entire Investment Association was WisdomTree Uranium And Nuclear Energy UCITS ETF, which resides in the IA Global sector, with a 36.7% total return. Geiger Counter topped the Association of Investment Companies universe after making 35% last month.

Both offer exposure to uranium exploration and production stocks, with both holding exploration and development company Nexgen Energy, uranium fuel producer Cameco and miner Denison Mines among their largest positions.

Uranium prices have been steadily rising after their lows of the 2010s. Although uranium was caught up in the wider commodity sell-off last week, nuclear energy is viewed by many as being one of the ways the world can meet rising energy demands.

Russ Mould, investment director at AJ Bell, said: “Uranium prices were weak going into Japan’s nuclear accident at Fukushima in 2011 and collapsed after the incident. A shift toward renewable sources of energy left nuclear energy well and truly out in the cold, and uranium with it.

“But a reassessment of nuclear power, thanks in part to rising energy demands worldwide and a review of its potential to act as a source power on a low-carbon basis, now seems to be underway. Japan is slowly reopening the reactors shut down some 15 years ago and China and India in particular are pressing ahead with new reactors, as are the USA, South Korea and UK.”

Korean equities had a strong month (after being one of the best markets in 2025), with Xtrackers MSCI Korea UCITS ETF, HSBC MSCI Korea Capped UCITS ETF, iShares MSCI Korea UCITS ETF, Franklin FTSE Korea UCITS ETF and Barings Korea Trust at the top of the Investment Association.

They benefitted from exceptional AI-driven semiconductor demand, with the KOSPI surging after chipmakers Samsung Electronics and SK Hynix posted record quarterly profits. The rally was also supported by president Lee Jae Myung’s investor-friendly corporate reform agenda modelled on Japan’s shareholder value initiatives, which helped the index surpass his campaign target of 5,000 points just months into his presidency.

The table above also includes plenty of commodities strategies, especially those that focus on precious metals. As noted previously, gold and silver prices have rocketed over the past 12 months but sold off aggressively in the final few days of January.

Source: Finxl. Total return in sterling between 1 Jan and 31 Jan 2026. Trust sectors excluding IT Unclassified and VCT peer groups.

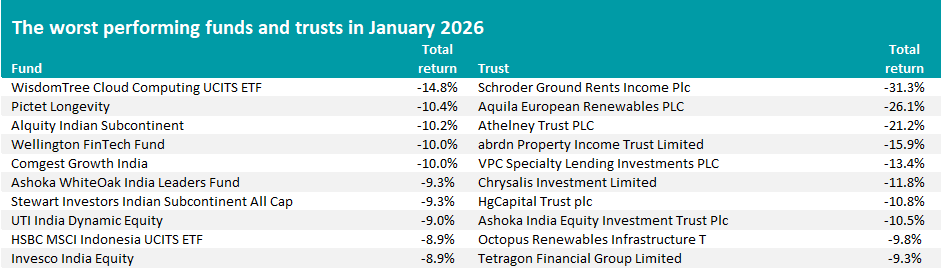

Several themes can be seen among the worst funds and trusts of January, including technology. WisdomTree Cloud Computing UCITS ETF and Wellington FinTech are among those losing money as investors worried that growth was slowing whilst valuations remained elevated.

Schroder Ground Rents Income posted the largest fall in the Association of Investment Companies universe, losing 31.3% after the UK government announced it would cap ground rents at £250 per year, eventually reducing to zero after 40 years.

Seven Indian equity strategies appear on the list with losses between 8.9% and 10.2%. Indian stocks fell over the month on a combination of sustained foreign outflows, a weak currency, mixed earnings and uncertainty ahead of the Budget on 1 February.

Other themes in the above table include UK renewable infrastructure trusts, property trusts, specialist lending and private equity.