Rising political unpredictability in Washington, record market concentration and an increasingly dominant artificial-intelligence trade have left many investors uneasy about their US exposure.

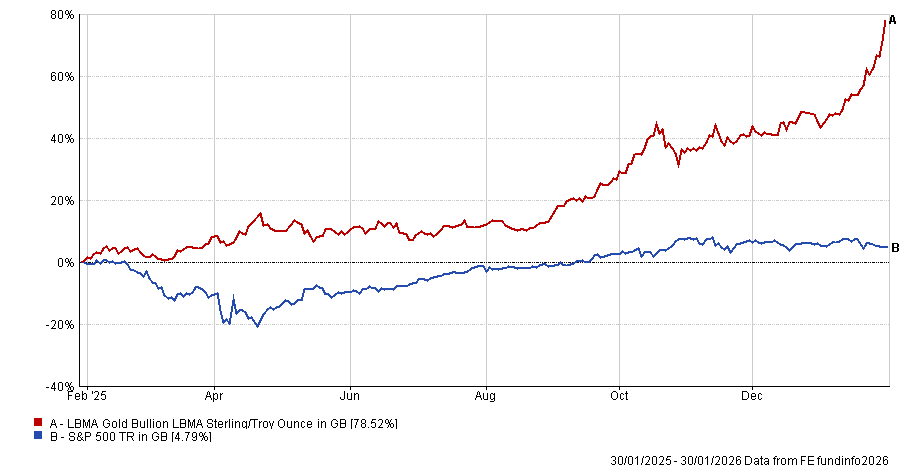

As a result, North American equities have cooled while gold prices pushed to record highs, as the chart below shows, even if the latter half of that move has started to come off the boil in recent days.

Performance of indices over 1yr

Source: FE Analytics

While investing in the US used to be a no-brainer, it now comes with a ‘wall of worry’.

The wall of worry

Managers describe a set of problems that make owning the US feel trickier than in the past. Tom Kynge, portfolio manager for multi-asset strategies at Sarasin and Partners, said the core issue is that policy has become harder to predict.

“Probably the most significant issue is the unpredictability of the administration’s actions, which is unhelpful for businesses making long-term capital-allocation decisions,” he said.

He pointed to episodes of direct government involvement in listed companies, such as Intel, as a departure from historical norms that could chill investment behaviour over time.

There is also unease about the market’s reliance on a single theme. Kynge said he is not bearish on artificial intelligence (AI) in the near term, but warned that the eventual unwinding of the AI trade “could be materially challenging for many investors” if the rest of the economy fails to pick up enough momentum to cushion the blow.

At a macro level, Hugh Gimber, strategist at JP Morgan Asset Management, highlighted a more unusual risk. “The US is running crisis-type stimulus at a time when the economy is already in reasonable shape”, he said.

While this is currently supportive for growth and markets, it leaves less room for manoeuvre if the economy were to slow sharply and ties equity performance more closely to political incentives ahead of the midterms.

Finally, valuation concerns are becoming harder to ignore. After years of outperformance, parts of the US market look stretched relative to other regions, making it uncomfortable to hold ever-larger US weightings simply by default.

The case for staying invested

Despite the above, most professionals still see powerful reasons to keep America at the core of portfolios, the first being: The foundations of US exceptionalism remain largely intact.

Its market structure is far more skewed towards technology than any other major region, a bias that has historically delivered higher growth and profitability. There are also hard data points that make it difficult to abandon the market.

Jack Caffrey, manager of the JPM America Equity fund, pointed to a run of positive economic surprises, with GDP forecasts suggesting real growth above 5% and a steady stream of earnings beats, especially outside of the Magnificent Seven stocks.

For growth investors, the argument goes beyond the cycle. Dave Bujnowski, investment manager on Baillie Gifford’s US Equity Growth team, said amid “dizzying news flow” the most reliable guide remains fundamentals.

Trade tensions, fears of irrational exuberance around AI and bouts of volatility have come and gone, but the companies that have endured are those with resilient earnings. Within the Russell 3000 Growth index, firms with rising earnings per share forecasts held up materially better during the 2022 drawdown when valuation multiples compressed.

Today, his portfolios are still seeing revenue growth of around 20%, improving operating leverage and higher EBIT (earnings before interest and tax) margins.

“Our job is to keep asking a simpler question: what is most likely to drive growth and compounding over the next five to 10 years?” he said, pointing to structural themes such as digitisation, cloud computing and America’s enduring AI advantage.

But investors are changing how they own the US

If the US still looks compelling, the way managers are investing in it has somewhat shifted. At Baillie Gifford, Bujnowski said recent activity has all been about portfolio construction.

“[We have been] taking profits from some larger and volatile winners, increasing our ‘enduring growth’ exposures and recycling capital into higher-conviction ideas, helping reduce volatility and tracking error while keeping the portfolio anchored to long-term engines of growth that appear intact and, in places, accelerating.”

At Sarasin, the adjustments have been more defensive. Given the unpredictability of policy, Kynge said his team has been gradually reducing exposure to companies with direct links to the US government, such as contractors.

At the same time, it has been increasing exposure to emerging markets, which it expects to benefit from a structurally weaker US dollar.

“The key thing to keep in mind for UK investors with US exposure is currency risk,” he said. With the dollar potentially under pressure from fiscal policy, Sarasin has been trimming dollar exposure through hedging. It has also looked to store-of-value assets, such as gold and silver, as a way to monetise that view.

From a fund-picker’s perspective, valuations are also prompting shifts. Sheridan Admans, executive officer of Infundly, said many investors have ended up with far more US exposure than they realised simply by owning global, tech, healthcare and infrastructure funds.

That was not a terrible outcome in recent years, but it is harder to justify now. “You look at valuations out there, it’s hard to feel comfortable,” he said.

Within the US, he has been moving some exposure from pure growth strategies towards value. More broadly, he has been encouraging clients to lean a little more into the UK, Europe and China, where valuations look more attractive and diversification benefits are clearer. “Holding big chunks of portfolios based in the US is a lot more challenging,” he said.