Hargreaves Lansdown has added Vanguard Global Small-Cap Index to its Wealth Shortlist.

The addition is the first of the year for Hargreaves but not the first recommendation for this particular strategy, which also made its way into interactive investor’s Super 60 list exactly a year ago, on 30 January 2025.

The analysts’ judgement is that the category’s growth potential and different return patterns justify exposure, provided investors can tolerate volatility and have a long time horizon.

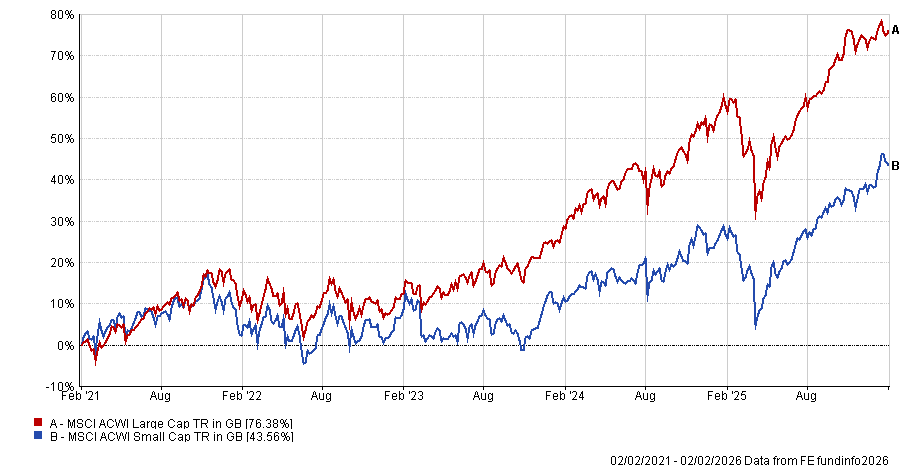

“While smaller companies have lagged their larger counterparts in recent years, they’ve performed better over the long term,” passive investment analyst Danielle Farley said.

“We think they offer strong growth potential for the future as they’re often among the most innovative businesses and have plenty of room to grow.”

Performance of indices over 5yrs

Source: FE Analytics

The fund tracks the MSCI World Small Cap index, which holds about 4,000 stocks. Vanguard uses full physical replication, buying every constituent at its index weight. It is a trading-heavy approach because small-cap indices change often and require frequent rebalancing, which pushes up costs, as FE Investments analysts noted.

To offset that drag, Vanguard lends some of the portfolio to approved counterparties in return for a fee. This can reduce tracking difference but adds risk.

The fund’s ongoing charge is 0.30%. FE Investments warned that if asset flows were to reverse, those economies of scale could unwind and fees could drift higher. Vanguard runs only physical trackers, so while there are no derivative counterparties, the fund still relies on brokers and securities borrowers that Vanguard must monitor internally.

On tracking, Hargreaves expects the fund to follow the index closely, given Vanguard’s scale and trading capability.

“The fund invests in all the companies in the index and in the same proportion. This should help it track the index closely,” Farley said.

“[Vanguard] has a large investment team with the expertise and resources to help its funds track indices and markets as closely as possible, while having scale to keep costs down. We rate Vanguard’s index team highly.”

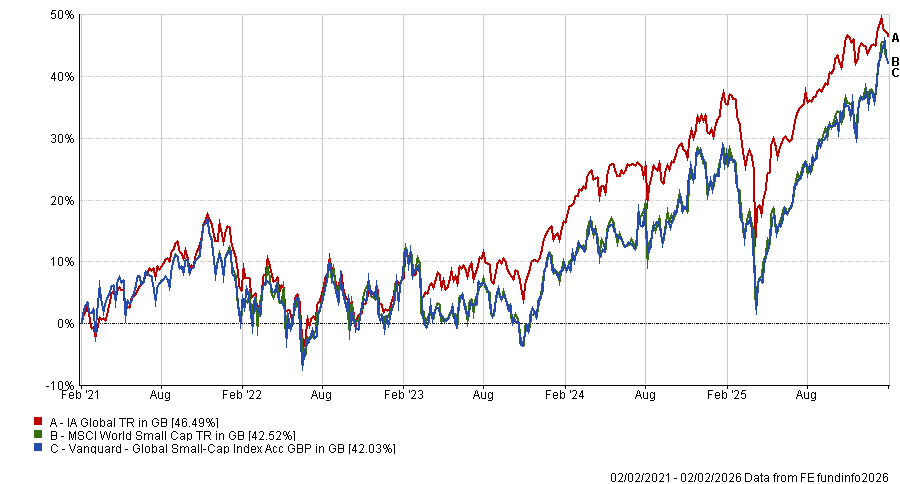

Performance of fund against sector and index over 5yrs

Source: FE Analytics

Farley also cited portfolio construction as another rationale for the addition.

“This fund could be a good way to gain broad exposure to smaller companies. It could also provide some diversification to an investment portfolio focused on shares in larger companies, as they tend to perform differently.”

Hargreaves stressed that shortlist additions are not recommendations to trade.