The end of US exceptionalism, a plateau in the artificial intelligence (AI) rocket ship and uncertain geopolitics all make for an interesting time to be an active global fund manager.

Many have struggled in an era where US tech giants have grown to become so dominant that overweighting them has become almost impossible for a prudent, risk-aware stock picker.

But the tide could be turning. Last year, the S&P 500 was the worst-performing major index and investors are starting to take note of the opportunities elsewhere.

Below, Trustnet asked fund managers which areas they are closely watching this year.

US smaller companies

Michael Walsh, solutions strategist and portfolio manager at T. Rowe Price, remains constructive on the American market but believes investors need to look further down the market capitalisation spectrum to the lesser-owned small-cap space.

The firm has moved overweight smaller companies in recent months, as earnings and valuations should be supported by interest rate cuts by the Federal Reserve.

“The actions of the Trump administration should also act to boost the prospects of smaller US stocks. We’d highlight the increased focus on deregulation in industries such as financial services and energy,” he said.

“The effects of the fiscal stimulus contained in the One Big Beautiful Bill should also be felt more fully by companies and consumers in 2026.”

Lastly, stronger M&A and IPO activity is picking up after “a couple of more moribund years” following the Covid pandemic, which should boost the small- and mid-cap segments in particular.

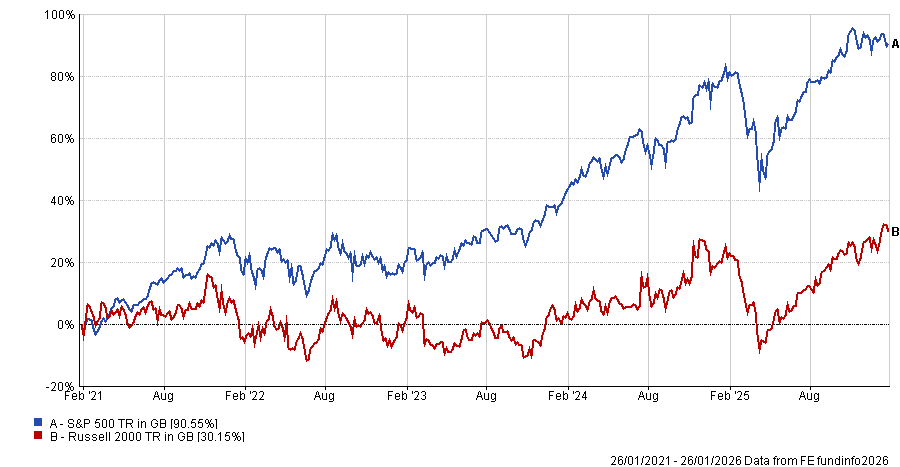

Performance of indices over 5yrs

Source: FE Analytics

“We expect equity market gains to be more broad in the coming year. Despite recent strong performance, we believe these factors, as well as potential for overlooked winners tied to the AI build-out, continue to make smaller companies in the US relatively attractive,” he concluded.

Emerging markets

Not everyone stuck to developed markets, however. While the US has outperformed most other regions significantly over past five years (largely thanks to tech), there are now signs that returns are broadening out to emerging markets, according to Paul Middleton, senior global equity portfolio manager at Mirabaud Asset Management.

“We expect the US to continue to do well, but we believe that other regions are also becoming more attractive. One of the regions that we are getting more constructive on is emerging markets, where earnings are expected to grow 22% this year (vs US 14%) and valuations are cheap,” said Middleton. Emerging market stocks sit on a price-to-earnings (P/E) ratio of 13x compared with the US at 22x.

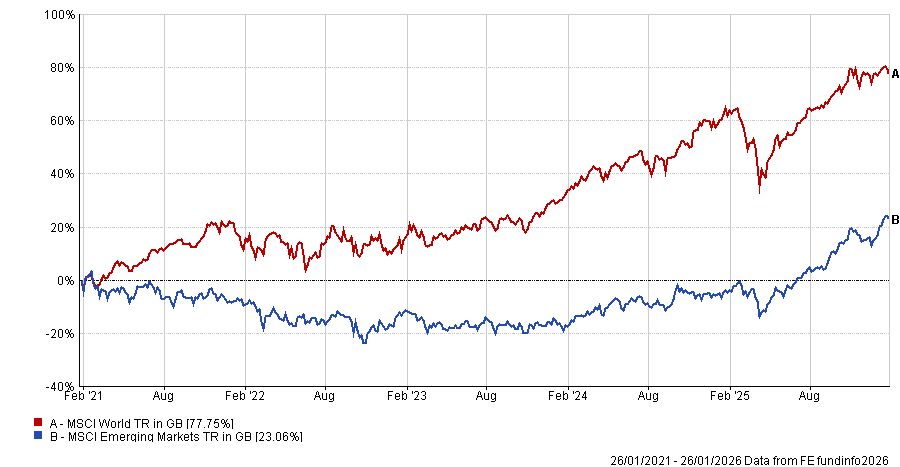

Performance of indices over 5yrs

Source: FE Analytics

His conviction in emerging markets could grow even stronger if the dollar weakens, as any decisive move lower would drive significant flows into the asset class.

“We have had many false dawns on emerging markets, with growth expectations often disappointing and so we target very specific areas where we believe the long-term growth prospects are underrated,” he noted.

One such area is Chinese insurance, where the firm has a position in Ping An Insurance in both of its global equity funds.

“The company is seeing very attractive growth in new business, while also seeing significant productivity improvements, for example in agent productivity, where better data is yielding better results,” he said.

South Korea

Despite the rise of Korean television programmes and the explosion of K-pop on to the music scene, Joe Bauernfreund, portfolio manager of AVI Global Trust, said the market remains “one of the most undiscovered opportunities for global investors”.

The South Korean market houses “numerous world-leading businesses across semiconductors, advanced manufacturing and biotechnology”, yet only accounts for 1% of the MSCI ACWI.

Corporate governance reforms have helped drive the market higher and start its re-rating journey but the ‘Korea discount’ remains.

The “extreme undervaluation” is in the crosshairs of the Korean government, which is aiming to close the gap through ‘corporate value-up’ initiatives.

“Following the election in June, reform has been bold and speedy, with the newly elected government already passing two amendments to the Commercial Act, which enhance previously lacklustre shareholder rights,” said Bauernfreund.

Since then, dividend tax reform was passed in December, while the third commercial act amendment is expected to pass in the first quarter of this year.

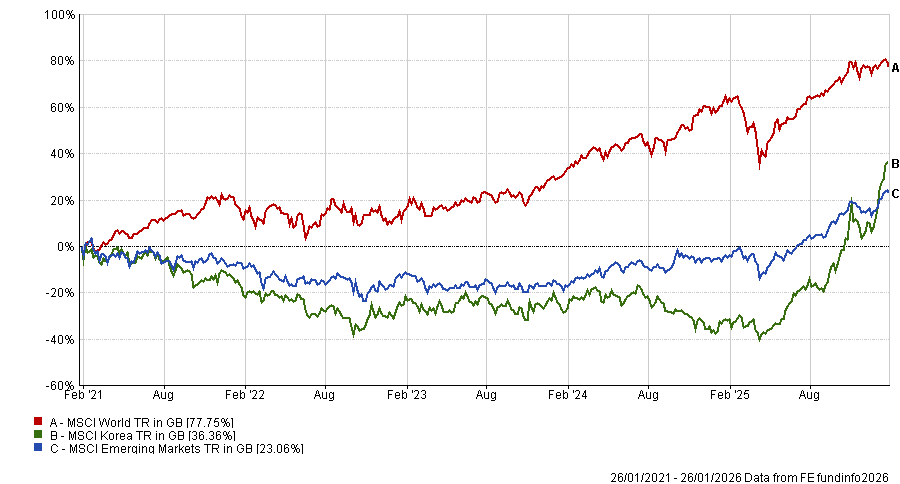

Performance of indices over 5yrs

Source: FE Analytics

Yet even without reform, the market is cheap on valuation grounds. More than two-thirds (68%) of stocks trade below book value. For stock pickers, 60% of companies receive no coverage from brokers, 50% of all volumes are driven by retail investors and low foreign institutional ownership makes the market an interesting proposition.

“We believe the combination of structural reform, demographic necessity and wide valuation discounts will prove difficult to ignore in the years ahead,” he said.

Japan

Staying in Asia, Nikki Martin, portfolio manager of the Sarasin Global Dividend fund, highlighted Japan. The market was once “close to the US in terms of global market size” but has spent the past few decades being “shunned” by global equity investors.

“This could now be its greatest advantage. Unlike much of the developed world, Japan is emerging from deflation rather than battling inflation, allowing earnings growth to be supported by improving pricing power, rising wages and firmer domestic demand,” she said.

Like Korea, the main story in recent years has been corporate reforms, which started with ‘Abenomics’ in 2012.

“Corporate behaviour is changing in meaningful ways. Governance reforms, balance-sheet optimisation and a growing focus on shareholder returns are translating into higher dividends, increased buybacks and more disciplined capital allocation,” Martin said, although she noted that there is still a lot further to run as many companies continue to hold significant excess cash on under-levered balance sheets.

However, expectations remain low and valuations are “reasonable”, in particular beyond the most crowded stocks in the market.

A weaker yen has benefited exporters for some time but this opportunity is now being spread beyond the simple export trade to areas such as automation, industrial technology, precision manufacturing and services.

“Japan also offers breadth, something that is fast becoming scarce in global equity markets. Beneath the headline indices lies a deep pool of mid-cap companies with strong niche positions, global relevance and improving governance standards,” she said.

“As investors look to diversify away from highly concentrated US markets, Japan’s quietly evolving equity story could prove to be one of the most compelling, under-appreciated opportunities in 2026.”