Investors are underestimating the risk of a sudden market dislocation over the coming year. Paul Wood, manager of the VT Woodhill UK Equity Strategic fund, is not making a precise forecast but believes the odds of a damaging break in markets are uncomfortably high.

“There’s a 40% chance of a sharp collapse over the next 12 months,” he said.

These concerns rest on how politics, monetary policy and markets could interact. As many commentators are noting, the US is running “crisis-type stimulus” at a time when the economy is already in reasonable shape.

A combination of fiscal largesse and politicised rate cuts could recreate the conditions that produced the market turmoil of the 1970s.

Wood drew a parallel with the Nixon era, when the White House encouraged policymakers to keep borrowing cheap despite rising prices.

“Nixon leant on the Reserve Bank and you ended up with the bond- and equity-market nightmare where they were both going down at the same time.”

If rates were pushed far below inflation again, the traditional investor playbook would break down. “Should I have equity, should I have fixed income… [This question becomes irrelevant because] there’s sort of nowhere to hide really.”

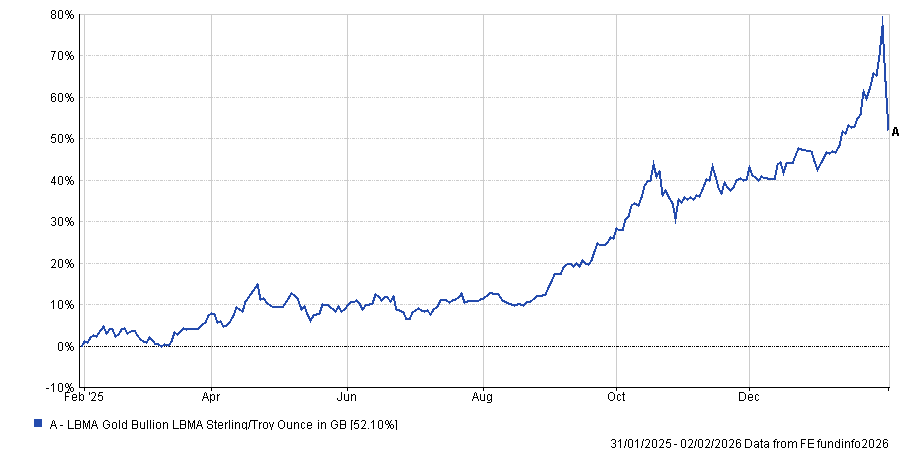

Even assets typically marketed as havens look questionable to the manager. Two years ago, he would have recommended gold as protection against geopolitical and monetary disorder.

“You could buy a bit of gold,” he said of that earlier period. “But I couldn’t say that honestly now. Even the safe assets are looking a bit dangerous because they’ve done so well.”

Performance of gold over 1yr

Source: FE Analytics

The scepticism about crowded trades and false safety is also evident in Wood’s broader philosophy, who has been worrying about strategies becoming fragile when too much money piles in behind the same idea.

Reflecting on the 1990s hedge fund boom, he noted that firms such as Soros Asset Management gradually outgrew many of their original opportunities. “They would get bigger and bigger, until the only thing left was currency, which was the only thing big enough to take that sort of volume of trading quickly.” The implication is that smaller vehicles can remain more flexible and selective.

At £36.5m, VT Woodhill UK Equity Strategic is small, even though many advisers instinctively prefer large, established products. Wood acknowledged that small funds can look unstable if staff leave or performance wobbles but thinks behavioural investor biases also play a role.

“It’s like the old corporate habit of buying IBM equipment simply because everyone else did,” he said. “If you buy something different and the thing you bought is a bit rubbish, then that’s a real problem. But if everybody’s IBM kit is rubbish, that’s fine.” For Wood, that herd mentality is exactly what a nimble fund can – and should – try to avoid.

Wood describes his approach as closer to credit analysis than traditional equity picking, with the aim to own high-quality companies across the market rather than making big sector bets. When they judge the balance of risks to be unfavourable, they hedge the portfolio using FTSE 100 futures.

He is keen to distinguish this from what he calls a “Texas hedge”, where a manager increases, rather than reduces, exposure to market risk by doubling down on an existing position.

Wood says his hedge tracks closely enough that, in stressed markets, his focus on quality can still generate relative gains. “When the market goes down, nearly always the high-quality firms do better than the more fragile ones,” he said, noting that the fund recently made about 1% in a month despite being fully hedged.

Wood is a critic of the idea that you must take more risk to get more return.

“Not all fund managers work to protect your money. They have goodwill but they won’t hedge, they won’t go to cash, they won’t do any of those things because it’s just too much career risk in it for them.”

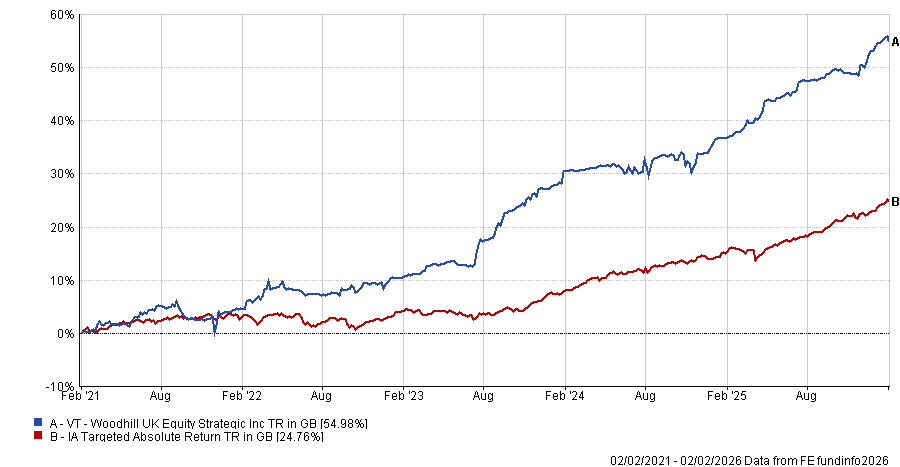

Performance of fund against index and sector over 1yr

Source: FE Analytics

VT Woodhill UK Equity Strategic achieved a maximum FE fundinfo Crown rating of five and holds about 40 to 50 large-cap UK stocks, chosen primarily for the strength of their balance sheets.

But the approach has not always worked smoothly. Covid was a painful episode because it did not fit the usual frameworks the team relies on.

Wood went into the pandemic hedged and initially protected the portfolio but removed the hedge too early as markets rebounded. The experience prompted a stricter, rules-based stop-loss policy.

Under that system, if the market falls 5% over five days, the fund now hedges fully and keeps that protection in place. If volatility is elevated, the team waits for a VIX reading of about 20 to 30 before easing off the hedge, to avoid trying to “catch a falling knife”.

Wood says the discipline is designed precisely to prevent the kind of mistimed decision that hurt them in 2020.