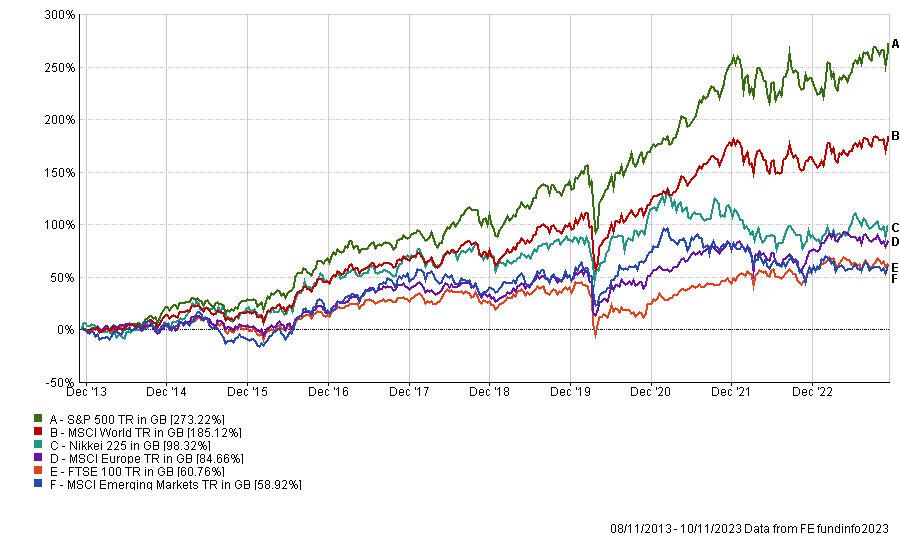

Emerging markets have not rewarded investors over the past decade, as they have significantly underperformed other major markets. For instance, the MSCI Emerging Markets is lagging the MSCI World by 126 percentage points over the period.

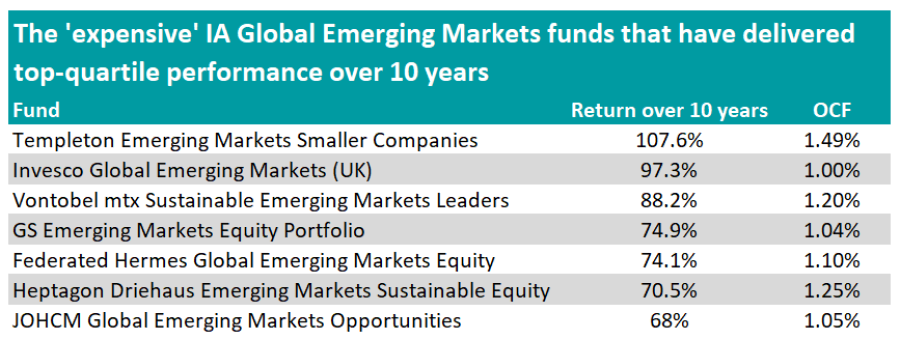

Yet, paying a higher ongoing charge figure (OCF) for an active fund would have, in some cases, enabled investors to get better returns from what is often considered a riskier sector.

Below, Trustnet has researched the ‘expensive’ emerging markets funds that have made top-quartile returns over 10 years. We have defined expensive as any fund in the IA Global Emerging Markets sector with an OCF of 1% or more. Another pre-requisite for a fund to make the list was to have beaten its own benchmark as well as the MSCI Emerging Markets index.

Performance of indices over 10yrs

Source: FE Analytics

The best performing expensive fund in the IA Global Emerging Markets sector over that period has been Templeton Emerging Markets Smaller Companies, which invests in smaller companies that investors are unlikely to be exposed to via a more vanilla emerging markets fund.

Many of the smaller companies in emerging markets are under-researched, which means that the managers of this fund can potentially discover significantly undervalued names.

Yet, investors have to be aware that emerging markets small-caps can severely suffer during market stress and that there can be a lack of liquidity in many of the underlying names.

Performance of fund over 10yrs vs sector and indices

Source: FE Analytics

Another high performing expensive emerging markets fund is GS Emerging Markets Equity Portfolio, which looks to invest in sound businesses trading at substantial discounts to their intrinsic value.

Analysts at Square Mile consider this fund as a sound option for long-term investors seeking a broad exposure to the region.

They said: “We like the consistency that Hiren Dasani and Basak Yavuz have applied in the running of this portfolio and have a high regard for their ability, which is a crucial feature in a region where markets can be influenced by a host of factors.

“We think this fund will appeal to investors who are looking for a more ‘blended’ style of management, that will sit nicely between their value and growth choices.” Yet they also warned that the fund is likely to be more volatile than the index.

Performance of fund over 10yrs vs sector and indices

Source: FE Analytics

Federated Hermes Global Emerging Markets Equity also provided superior returns for investors relative to the index.

While the fund has no particular bias towards either the growth or value investment styles, the managers use a top-down approach, looking at both country and sector factors. They pay a particular attention to governments’ policies and reform agendas, central banks and the interest rate cycle as well as the state of the fiscal current account and foreign direct investment.

Formerly managed by industry veteran Gary Greenberg, lead manager Kunjal Gala has been on the fund since 2020, taking charge in 2022. He invests in quality companies trading at attractive valuations, with moats and defensible franchise, improving cash flow generation and consistency of revenue and earnings.

Moreover, the portfolio invests in several themes such as the Internet of Things, 5g, healthcare, financials, logistics and premiumisation.

Performance of fund over 10yrs vs sector and indices

Source: FE Analytics

Other expensive funds that have made the most of investors’ money by delivering top quartile performance over 10 years include Invesco Global Emerging Markets (UK), Vontobel mtx Sustainable Emerging Markets Leaders, Heptagon Driehaus Emerging Markets Sustainable Equity and JOHCM Global Emerging Markets Opportunities.

Source: FE Analytics

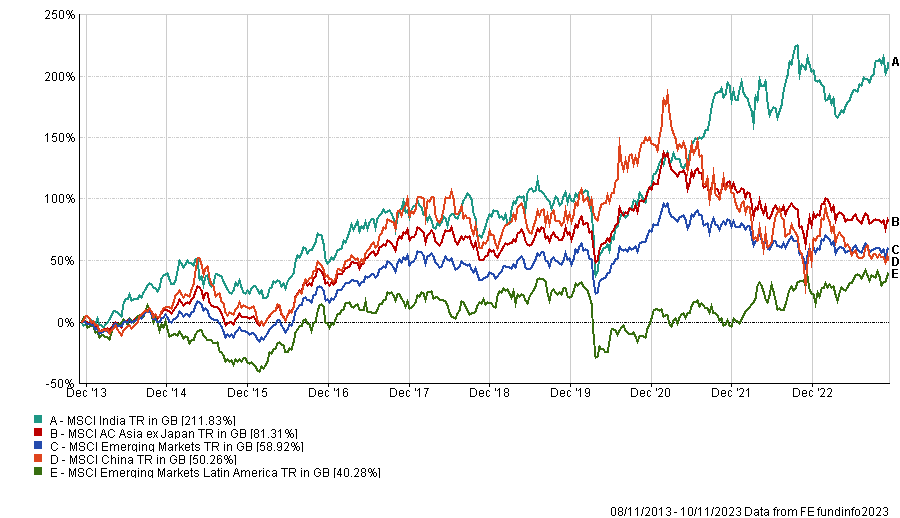

While global emerging markets indices have provided dismal returns over the past 10 years, some emerging markets regions have experienced significantly different fates. For instance, Asia ex-Japan and India have largely outperformed broader emerging markets indices, while China and Latin America have done even worse.

Performance of indices over 10yrs

Source: FE Analytics

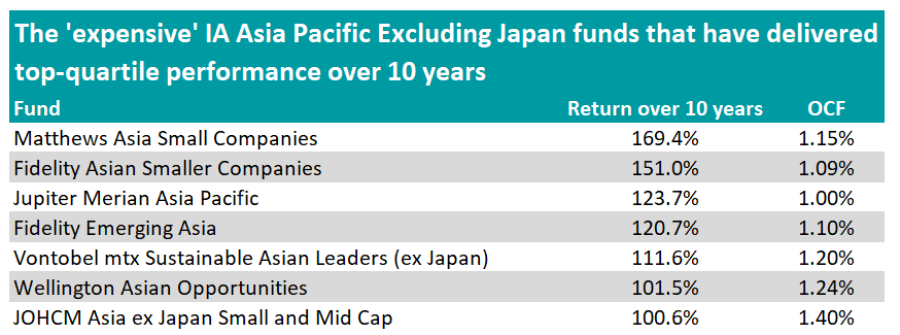

In Asia ex-Japan, smaller companies funds, such as Matthews Asia Small Companies, Fidelity Asian Smaller Companies and JOHCM Asia ex Japan Small and Mid Cap have put investors’ money to good use despite the higher fees they attract.

Yet, some expensive Asia ex-Japan large-cap funds also served investors well over the past decade, including Jupiter Merian Asia Pacific.

The fund overhauled its strategy after the global financial crisis in 2008, which analysts at Square Mile consider to have been a “blessing in disguise”, enabling the management team to become more nimble and less reliant on a specific style.

They said: “The market fall in early 2020 was the first time the new strategy was properly tested and it was able to cope, the fund fell broadly in line with its benchmark.

“This promotes our belief that the strategy in its current form is more refined and has greater robustness in all market conditions. Ultimately what we like here is that the team are willing to allow the process to evolve over time.”

Fidelity Emerging Asia, Vontobel mtx Sustainable Asian Leaders (ex Japan) and Wellington Asian Opportunities are other expensive funds in the IA Asia Pacific Excluding Japan sector that have made top quartile performance over 10 years.

Source: FE Analytics

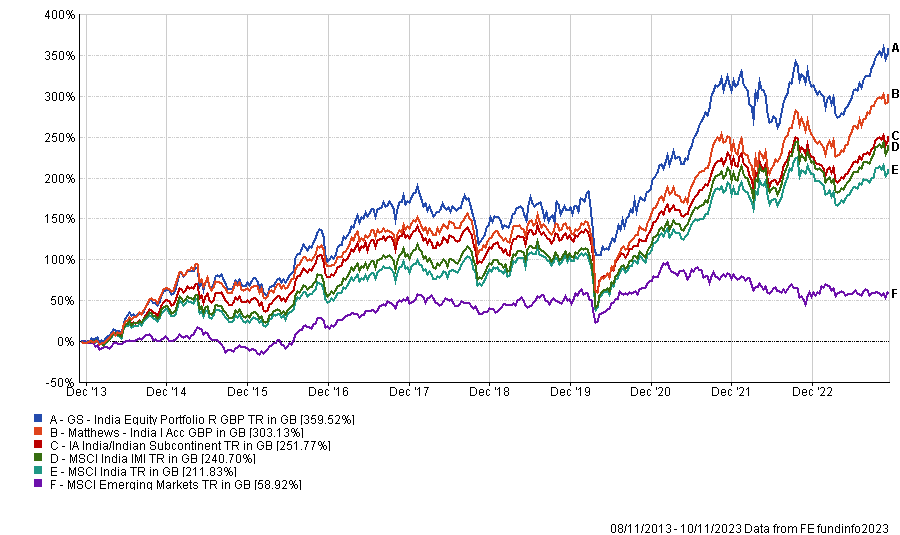

Indian equities have outperformed their global emerging markets peers by an even wider margin. For instance, the MSCI India has beaten the MSCI Global Emerging Markets by almost 193 percentage points over 10 years.

Yet, some expensive active funds in the IA India/Indian Subcontinent sector, such as GS India Equity Portfolio and Matthews India, have trounced their benchmark and richly rewarded investors as a result.

Performance of funds over 10yrs vs sector and indices

Source: FE Analytics

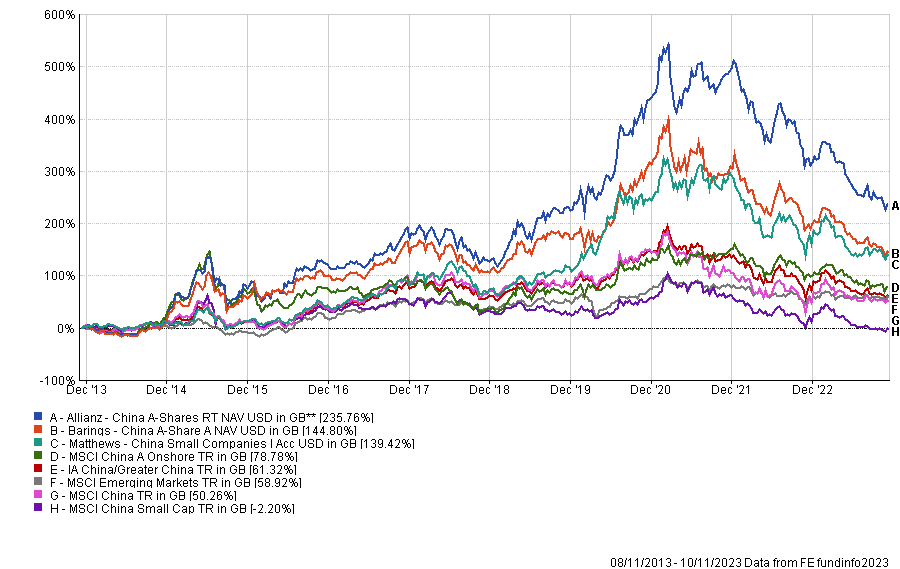

Unlike India, China has underperformed global emerging markets. Yet, some expensive active funds in the IA China/Greater China sector have delivered returns in excess of not only the MSCI China index but also the best performing global emerging markets funds.

That includes Allianz China A-Shares and Barings China A-Share. Both funds invest in China A-shares, which are listed on stock exchanges in mainland China (e.g. Shanghai and Shenzhen), denominated in yuan and generally only accessible to Chinese citizens.

They are less commonly held by international investors and less liquid than H-shares, which are traded in Hong Kong dollars and listed on the Hong Kong stock exchange.

Matthews China Small Companies, which focuses on Chinese small-caps, also delivered better returns than the best performing global emerging markets fund, despite a higher OCF.

Performance of funds over 10yrs vs sector and indices

Source: FE Analytics

No fund in the IA Latin America sector reflected our criteria, as none were able to outperform the MSCI Emerging Markets index over 10 years, including those charging 1% or more.

Latin America has been the weakest emerging markets region of the past decade, with the MSCI Emerging Markets Latin America lagging the MSCI Emerging Markets by almost 19 percentage points.