Indian equity funds topped the performance charts last month, in spite of the disappointing election result for Narendra Modi.

While the market was expecting a landslide victory for the incumbent prime minister of the most populous country in the world, Modi failed to win an outright majority.

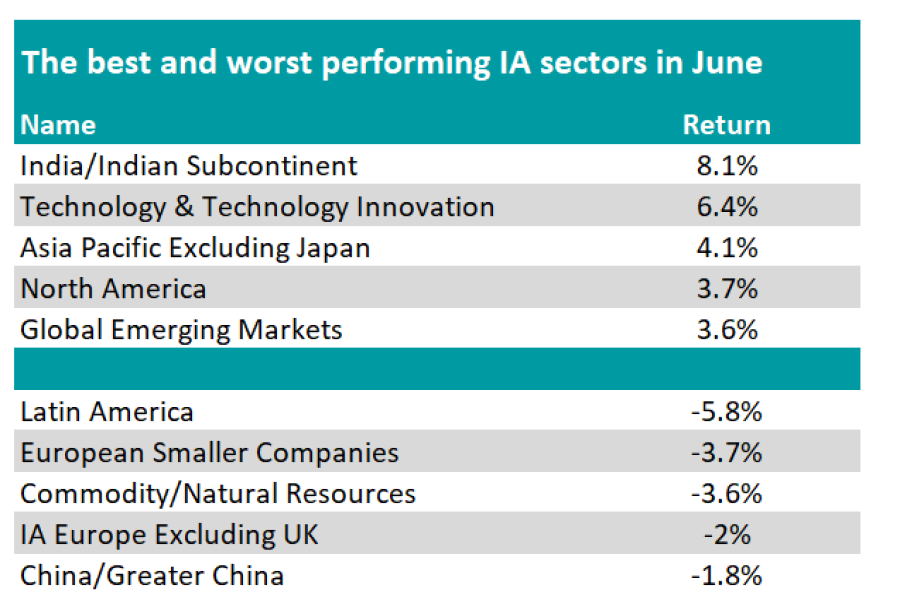

After an initial knee-jerk reaction at the beginning of May, Indian equities rebounded and continued their meteoric rise, with the IA India/Indian Subcontinent sector gaining 8.1% in June alone.

Ben Yearsley, director at Fairview Investing, said: “Fund managers who invest in India say the crucial aspect of the coalition is that it still has infrastructure spending as the key priority.”

Source: FE Analytics

The IA Technology & Technology Innovation sector finished second, gaining 6.4% last month.

Nvidia briefly overtook Microsoft as the world’s largest company, with both companies, along with Apple, now valued at over $3trn.

The IA Asia Pacific Excluding Japan sector secured the third position, followed by IA North America and Global Emerging Markets.

At the bottom of the tables, Latin America was the worst-performing sector in June, dropping 5.8%. Mexican equities, the second-largest component of the MSCI Latin America index, declined by 10% as the market reacted negatively to the election of Claudia Sheinbaum.

Yearsley said: “The Mexican market fell sharply on the news as Sheinbaum is seen as very left wing, [although] it has recovered slightly over the course of the month.”

European equity markets were roiled by French President Emmanuel Macron’s decision to call a snap parliamentary election. As a result, the IA European Smaller Companies, IA Europe Excluding UK and IA Europe Including UK sectors all performed poorly in June.

Although the US and UK elections are yet to play out, the French vote is causing the most concern,. Yearsley said.

“The reality is that in the US, Biden and Trump aren’t a million miles away on policy nor are the Tories and Labour in the UK. France may well be the one to watch as that could cause EU earthquakes especially if the exit polls are correct.”

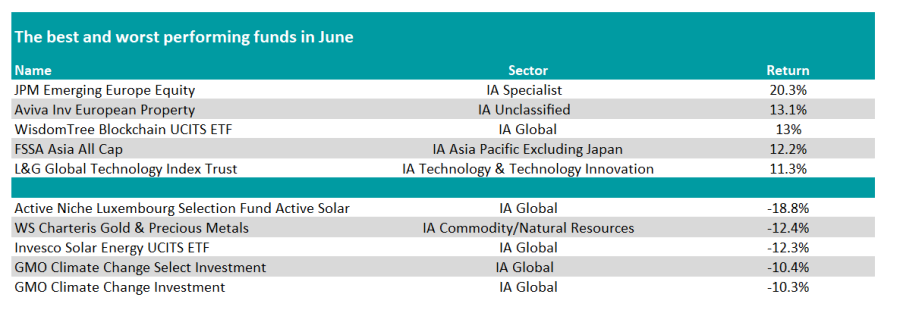

At the funds level, the top 10 was dominated by funds from the IA India/Indian Subcontinent and IA Asia Pacific Excluding Japan sectors, including Stewart Investors Indian Subcontinent Sustainability, Alquity Indian Subcontinent and FSSA Asia All Cap.

However, JPM Emerging Europe Equity took the top spot, returning 20.3% in June.

Yearsley said: “For context, this fund has lost 98.9% over five years due to Russia’s invasion of Ukraine, so the sharp rise is small comfort.”

Source: FE Analytics

Climate change was a common theme for funds at the bottom of the table, with seven out of 10 of the worst performers being climate or energy transition funds.

Active Niche Luxembourg Selection Fund Active Solar was the poorest-performing fund of the month, tanking 18.8%.

Other underperformers include Invesco Solar Energy UCITS ETF, GMO Climate Change Investment and Schroder Global Energy Transition.

Yearsley said: “Is it the lack of rate cuts that is still doing the sector down, or is it more fundamental in that the energy transition will take much longer than previously indicated by (clueless) politicians?”

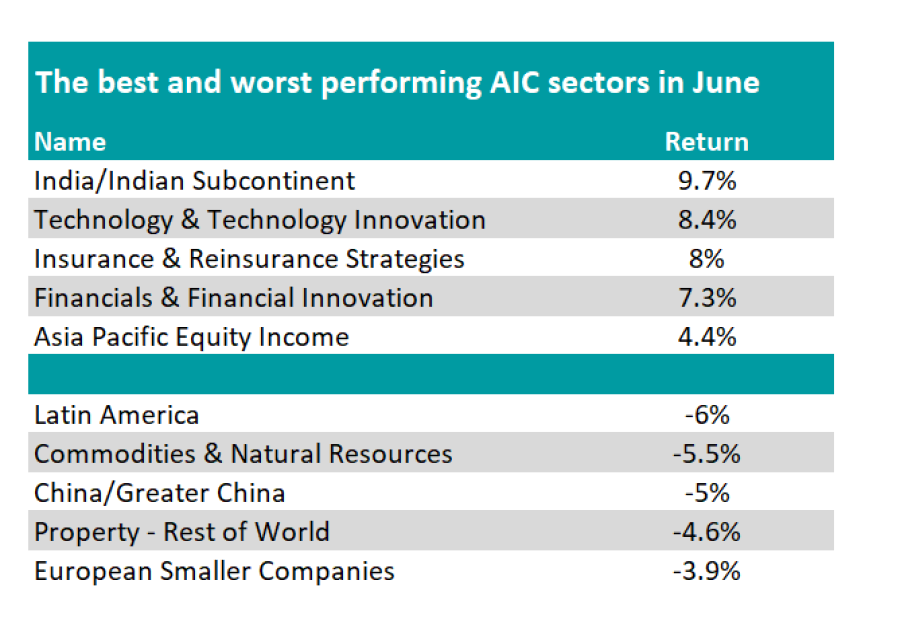

Amongst investment trusts, Indian equity and technology strategies ruled the roost, as with open-ended funds.

However, more specialist sectors came to the fore as IT Insurance & Reinsurance Strategies and IT Financials & Financial Innovation took the third and fourth spot.

IT Latin America was the worst-performing trust sector, falling 6%. It should be noted that the sector only has one constituent, BlackRock Latin American.

Source: FE Analytics

It was also a challenging month for the IT Commodities & Natural Resources and IT China/Greater China sectors, which lost 5.5% and 5%, respectively.

However, Yearsley noted that indicators are improving in China with signs of a pickup in activity driven by the service sector.

He said: “Stimulus measures have cranked up to offset the property downdraft. That appears to be paying dividends with the May PMI figure of 54 the highest since July 2023. Interestingly fund managers are starting to talk in more positive terms about China and that it might not be uninvestable after all.”

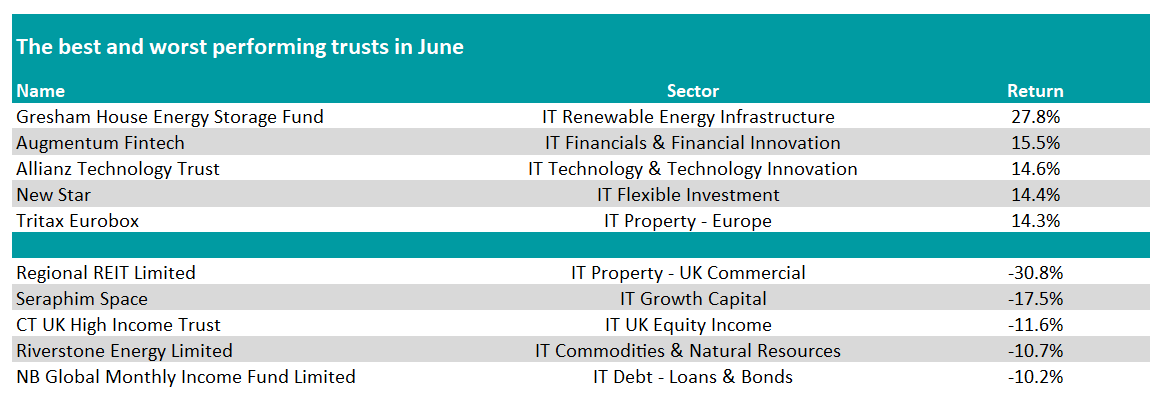

At the individual trust level, Gresham House Energy Storage Fund jumped 27.8% after announcing a battery leasing deal with Octopus.

Augmentum Fintech and Allianz Technology Trust finished second and third, after returning 15.5% and 14.6%, respectively.

Source: FE Analytics

At the bottom of the tables, Regional REIT Limited dropped 30.8% and is as such the worst-performing investment trust of the month.

Seraphim Space, the best-performing investment trust so far this year, also struggled in June, falling 17.5%.

Yearsley concluded: “Another interesting month for markets with the two most expensive areas, India and tech, leading the way. Will nothing derail these stories? In India it seems unlikely now the election is out the way, but will the lack of rate cuts eventually do for the Nasdaq?”