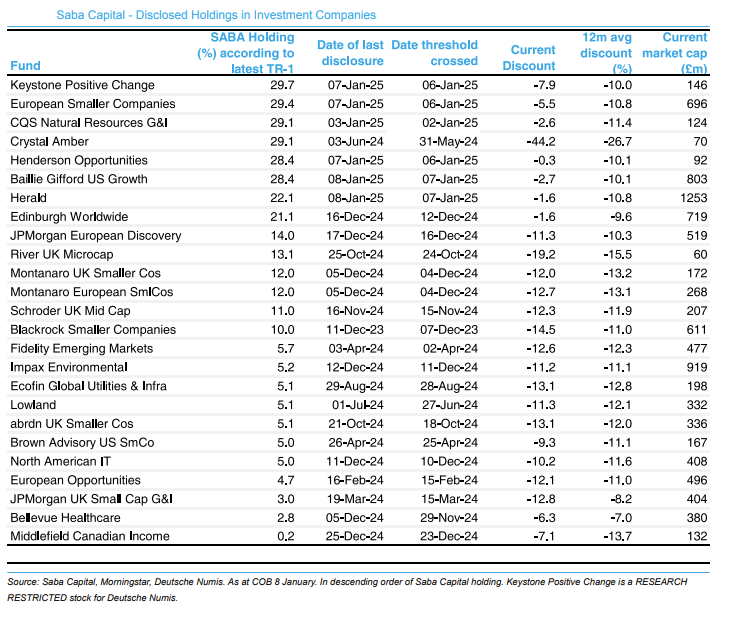

Activist investor Saba Capital Management is currently targeting seven investment trusts but it has built stakes in many others – which begs the question of which trusts, if any, Saba will approach next.

It has already requisitioned general meetings at seven trusts, which will take place in late January and early February, in a bid to replace the boards and investment managers, overhaul the trusts’ investment strategies and offer shareholders liquidity events.

Saba has initially focused on the trusts where it has the largest stakes of 21-30% (with the exception of Crystal Amber, which is already in wind up mode and where Saba has a 29% holding).

Yet it also holds between 10% and 14% of six additional trusts: JPMorgan European Discovery, River UK Microcap, Montanaro UK Smaller Companies, Montanaro European Smaller Companies, Schroder UK Mid Cap and BlackRock Smaller Companies.

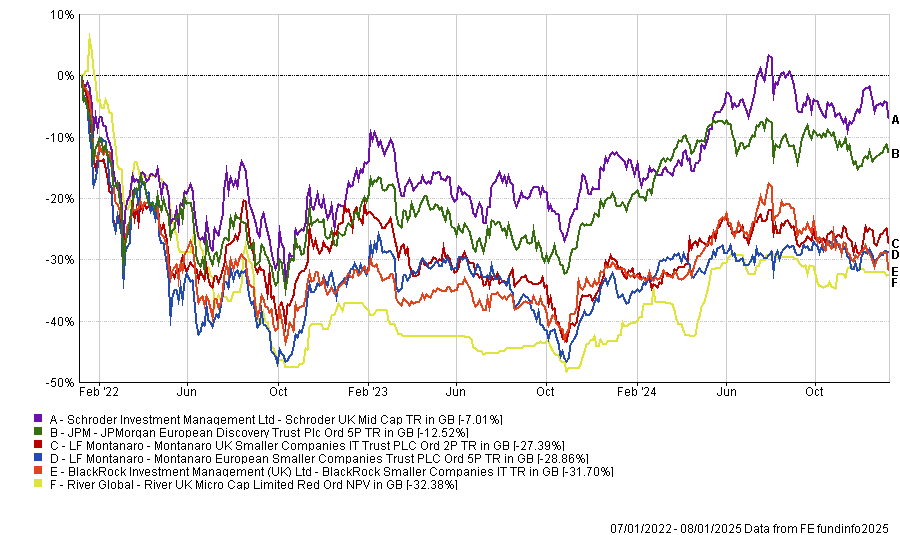

Saba’s current campaign hinges upon wide discounts and poor three-year performance. All six of the aforementioned trusts are trading on double-digit discounts, ranging from 12% for Montanaro UK Smaller Companies to 19.2% for River UK Microcap.

They have all lost money over three years to 8 January 2025 in total return terms, while JPMorgan European Discovery is the only member of the group to pull ahead of its sector.

Performance of trusts over 3yrs

Source: FE Analytics

A full list of trusts where Saba has disclosed a holding is below. The activist investor has close to 5% in another eight trusts, including Lowland, Impax Environmental and abrdn UK Smaller Companies.