Investors have shown growing interest in funds investing in Indian equities and tech stocks over 2024 so far, as well as researching the Polaris range from St James’s Place.

Stock markets rose over the first six months of the year, although – as a recent Trustnet article showed – gains tended to be clustered into a handful of themes.

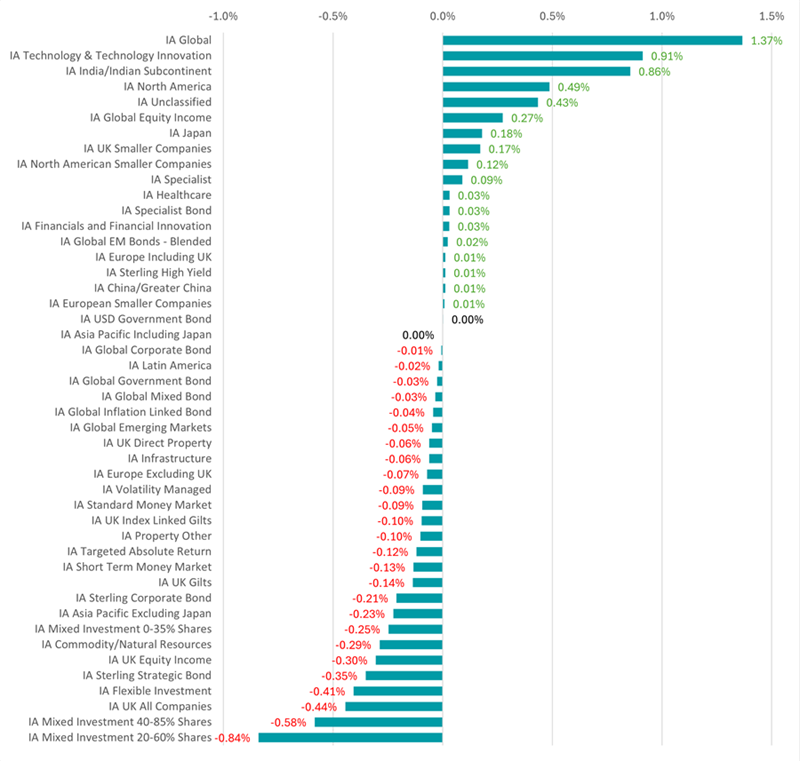

To see how this was reflected in fund research trends, we have compared each Investment Association fund’s pageviews on Trustnet during the first half of 2024 with their views across 2023.

The results of this on a sector level can been seen in the chart below, with the IA Global sector as the clear leader. This peer group was already the most viewed by Trustnet users in 2023, accounting for 15.12% of pageviews, but its research share increased to 16.48% in the first half of 2024.

Change in % of Trustnet pageviews in H1 2024

Source: Google Analytics

IA Technology & Technology Innovation was the sector with the second largest increase in Trustnet research share, moving from just over 2% of pageviews to little under 3%, while IA India/Indian Subcontinent funds more than doubled their share by going from 0.73% to 1.58%.

Smaller gains in research share were seen among sectors such as IA North America, IA Unclassified, IA Global Equity Income, IA Japan and IA UK Smaller Companies while investors spent less time looking at IA Mixed Investment 20-60% Shares, IA Mixed Investment 40-85% Shares, IA UK All Companies, IA Flexible Investment and IA Sterling Strategic Bond funds.

Turning to individual funds and it is a member of the IA India/Indian Subcontinent sector that has benefitted from the biggest jump in Trustnet pageviews: Jupiter India. This was the 54th most viewed fund factsheet in 2023 but has surged into fifth place this year.

Indian equities have rallied significantly this year. The MSCI India index made a 17.9% total return in sterling terms over the past six months, compared with a rise of 8.4% for the MSCI Emerging Markets index and 12.7% from the MSCI World.

The strong performance of Indian stocks in the first half of 2024 is down to robust economic growth, proactive government policies, strong corporate earnings, significant foreign investment, stable monetary policy and a growing middle class, which offset the hit to sentiment that came when prime minister Narendra Modi’s Bharatiya Janata Party failed to secure a clear majority in the general election.

Jupiter India, which is managed by Avinash Vazirani, made the sector’s highest total return over this period, gaining 22.9% versus 16.4% from its average peer. The £1.8bn fund is also in the first quartile over one, three and five years – although it must be noted that it has dropped into the bottom quartile over one and three months.

The strong rise of Indian equities has left some concerned about valuations, but in a recent update Vazirani said: “The Indian market has delivered good returns for investors in recent years, but valuations remain reasonable in the context of the superior earnings growth already visible and the long-term structural reasons that create potential for this dynamic to continue for decades to come.”

Liontrust India, Franklin India, GS India Equity Portfolio, FSSA Indian Subcontinent All-Cap and Fidelity India Focus are other members of the sector that have seen an increase in their research share on Trustnet over the past six months, although none to the extent of Jupiter India.

Source: Google Analytics

The table above, which shows the 25 funds with the biggest increases in research share over 2024 so far, reflects a few other trends.

The most obvious is the sustained interest in tech stocks, thanks to the continued outperformance of the ‘Magnificent Seven’ (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla).

IA Technology & Technology Innovation members such as L&G Global Technology Index Trust, Janus Henderson Global Technology Leaders and Liontrust Global Technology as well as specialist fund Sanlam Global Artificial Intelligence can be found in the table above.

However, global equity funds such as Royal London Global Equity Select, WS Blue Whale Growth and Aviva Investors Global Equity Income are also invested in these stocks. It is also worth remembering a global tracker will have a hefty weighting to tech – one-quarter of Fidelity Index World is in information technology stocks as is more than 40% of L&G Global 100 Index Trust.

Interest in equity income is also hinted at in the table, through the presence of Aviva Investors Global Equity Income, Royal London Global Equity Income, Artemis Global Income and Artemis Income. Just outside the top 25 funds highlighted above are the likes of Man GLG Income, Invesco Global Equity Income, Artemis Monthly Distribution, Aegon Global Equity Income and FP Octopus UK Multi Cap Income.

Finally, the jump in research into SJP Polaris 4 UT and SJP Polaris 3 UT mirrors the strong growth that the four-strong Polaris range has enjoyed since it was launched by St James’s Place at the end of 2022. Since then, the multi-asset range has gathered assets of £37bn.