Investors who look too much into economic data “think they are investing but they are not”, according to Richard Bullas, who has claimed hedge funds, global macro funds and quant funds are “speculating” with client’s cash.

The manager of the £641m FTF Martin Currie UK Mid-Cap fund said this is a “frustration” to him, as he sees himself more as a “business owner”, rather than a trader.

“We want to be part of [a business] for value creation for another five,10,15, 20, 25 years, but when you get the volatility from other sources of capital, thinking they can trade around the margin in the short term, that bit can be frustrating,” he said.

His fund is 25 years old, during which time the manager has made 833% in returns for his investors.

But his strategy has struggled more recently, languishing in the bottom quartile over three and five years as mid-caps have come up against multiple headwinds.

Below he discusses the improving outlook for UK domestics, why he sold out Watches of Switzerland and how Boris Johnson helped his fund beat its peers in 2019.

If you had to describe your process in three sentences, what would it be?

We are style agnostic, which means we run a balanced portfolio across both value and growth names. At the heart of that comes our assessment of valuation across the market, which means we tilt the fund looking at value stocks on low and near-term multiples but also want growth at a reasonable price.

Fundamentally we are looking for undervalued situations where we can see above average returns. You can distil the process into three areas really. We do a lot of qualitative and quantitative assessments of business quality, risk and valuation.

What differentiates you from other funds?

We’re a pure FTSE 250 portfolio, so we only invest in the full list of companies in that mid-cap index. There are about six or seven other funds badged as ‘mid-cap 250 funds’ but we’re the only one with 100% of the assets in the FTSE 250, quite a few of the others will invest in the FTSE 100 and in small-caps.

We run a stock portfolio of about 30 positions currently and our range over the long-term is between 30 and 40 investments, so we’re quite concentrated, which means it is high conviction.

You were the top-performing fund in the sector in 2019. How did you do that?

The fund was up 42% versus 30% from the index, and a lot of that return came in the fourth quarter. It was really when Boris Johnson got a clear mandate with the election win in 2019 to deliver Brexit, rather than the infighting we had before.

That helped the domestic areas of the UK market, and the mid-cap index is more skewed towards the more domestic companies, as opposed to say the FTSE 100, which is more international.

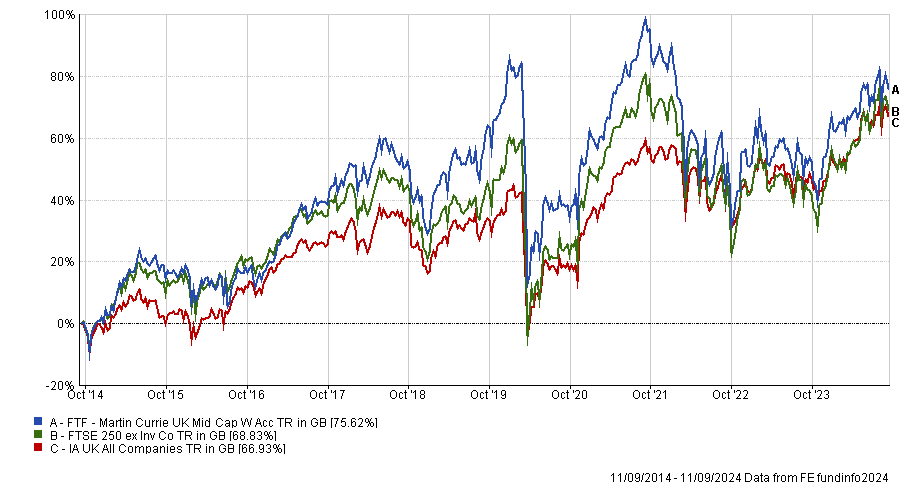

Performance of fund against sector and benchmark over 10yrs

Source: FE Analytics

Mid-caps have had a poor 18 months – why are they still a good investment?

The underperformance is the opportunity because it [recent poor performance] has left share prices and valuations looking very attractive.

For a good two years the mid-cap index has underperformed because there have been real concerns around the prospect of inflation being out of control, but also the implications of the cost-of-living crisis and the Bank of England’s response to interest rates.

There’s been this long-term concern that a hike in interest rates is going to choke off the economy and tip it into recession. That was the perceived risk. But we’ve been banging the table for 12-18 months that this hasn’t happened, it hasn’t materialised.

We're in the foothills of the recovery in the FTSE 250, because the economy has been more resilient than expected, which means businesses have been more resilient than expected.

The narrative of out-of-control inflation and the economy contracting or stagnating, has now shifted to one of recovery and growth, and mid-caps will do very well in that environment.

What was your best holding over the past year?

Bellway is up more than 50%. Housebuilders sold off quite heavily in 2022 and they were quite weak during the start of 2023 because investors were concerned about the near-term impact of [rising interest rates] on the housing market. So, valuations got very attractive and very low, trading on single-digit P/E’s [price-to-earnings multiples], trading on 50% their book value.

We started to buy and build bigger positions in some of the housebuilders. Now we’re getting rates starting to roll over, consumers starting to spend somewhat, housing market transactions starting to move again, and the market is starting to re-rate, so the outlook is looking better for profits, cash flows and returns.

And your worst?

Our worst was Watches of Switzerland. It sells high end watches and is a big supplier of Rolex watches, but about a year ago Rolex bought a retail business called Bucherer, which is the first time in 120 years Rolex has gone from purely supply into distribution.

It may favour its own distribution model, because they it gets a margin on selling that to the consumer. So that was the first signal and that caused the share price to de-rate somewhat.

The second catalyst was a poor Christmas trading update, which led to profit downgrades in January. It had a profit warning, shares fell, and we were down about 30% over the year. We exited the position in April this year.

What do you do outside of fund management?

My downtime is spent with my family: my wife, my two kids and my dog. My family time is really the centre of my universe. I also try to keep fit, so I’m in the gym three times a week with a personal trainer.