Value investors don’t have as broad a choice as growth enthusiasts when it comes to selecting funds and trusts, with the number of active managers buying unloved stocks dwindling after almost a decade of growth superiority.

Two prominent names are Ian Lance and Alex Wright, managers of the Temple Bar and Fidelity Special Values investment trusts respectively.

Despite implementing the same investment style, focusing on undervalued UK equities, the two strategies are only 78% correlated to each other and have outperformed their benchmark, the FTSE All Share index, at different times.

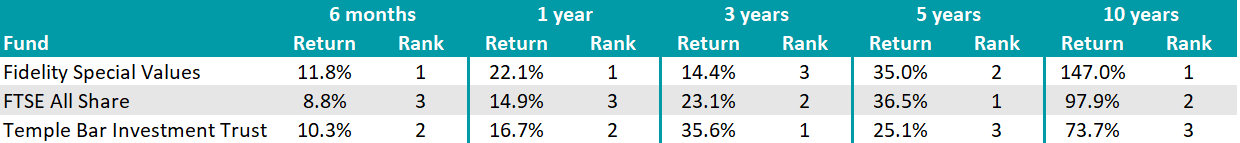

The Fidelity vehicle had the upper hand over the past 10 years and 12 months, while Temple Bar stood out over three years, as the table below shows.

However, as noted by QuotedData senior analyst Matthew Read, Ian Lance is only responsible for the performance since 2020, when he was appointed manager together with Nick Purves. Since then, there has been “a noticeable improvement in performance”.

This is during a time when macroeconomic considerations have generally outweighed individual stockpicking decisions, said Read, which is “problematic” for these portfolios.

“Generally, both styles has faced headwinds as inflation has moderated and investors have preferred growth but, despite this, both have produced respectable numbers,” he noted.

Performance of trusts against and index

Source: FE Analytics

Both funds are predominantly focused on the UK market, which makes up 72% and 80% of their portfolio respectively, and have long track records,

They trade at similar share price discounts to net asset value (10.6% Fidelity, 8.3% Temple Bar) and have “experienced and well-regarded” managers at their helms.

As for their portfolios, the Fidelity vehicle has had a strong allocation to financials for many years, which accounted for 27.3% of the assets under management at the end of August, as Read noted.

“Wright has felt that financials have fallen into the ‘underappreciated quality’ camp for a very long time, and the trust has benefited from an environment of higher interest rates, which have added to these companies’ bottom lines, along with a benign environment for loan losses,” he said.

“Interestingly, Temple Bar has also had a significant allocation to financials in recent years and this is up from around 26% six months ago to 30% today, on the back of strong performance.”

But there are differences too. Fidelity Special Values has a larger market capitalisation (£1bn versus £756.7m for Temple Bar), while Lance and Purves’ portfolio is cheaper, with an ongoing charges figure (OCF) of 0.56% compared with Wright’s fund’s 0.7% cost.

Temple Bar also has more of a focus on income, with a yield of 3.88%, compared with Fidelity Special Values’ 3.03%.

Despite a “strong case” for investing in both, Read ultimately chose Temple Bar for its deeper value approach, which “should benefit more as the UK market comes back in vogue”.

He added the improvement in performance since Lance and Purves took over “isn’t fully appreciated” and, assuming this trend continues, there is more potential for further upside and discount narrowing.

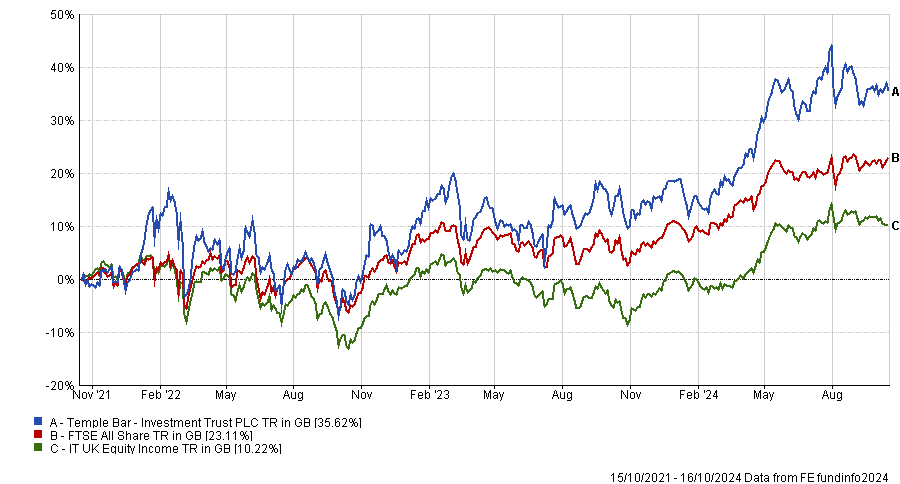

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Read was a lone voice among the experts, however, with everyone else backing Fidelity Special Values. FundCalibre managing director Darius McDermott liked it for its tilt to small-cap stocks, which “should provide potential for higher returns in the medium term”.

“As interest rates and inflation normalise, we expect valuations in this corner of the market to rebound,” he said.

“Therefore, although Temple Bar has recently outperformed, if I had to pick one for the next five years, I believe Fidelity’s small-cap exposure makes it the more compelling option in the current market environment.”

According to Peel Hunt’s head of investment trust research Anthony Leatham, Wright “has an edge in stockicking”, and his actively-managed valuation-focused style “continues to benefit from ongoing mergers and acquisitions”.

“One aspect that might constrain the Temple Bar approach is the yield objective and, whilst the dividend was rebased as part of the transition to the new manager and income-generation from the underlying portfolio has been robust, this might present an important consideration in stock selection which Fidelity Special Values does not face,” he said.

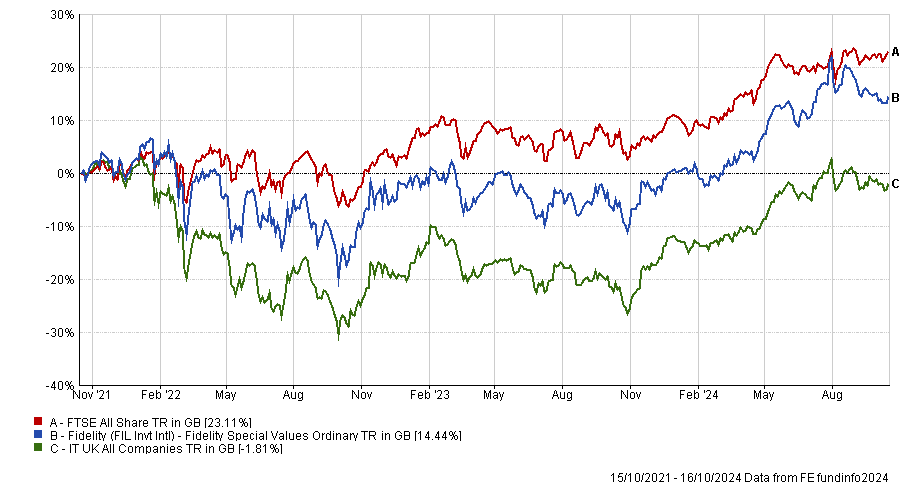

Performance of fund against sector and index over 3yrs

Source: FE Analytics

Finally, Winterflood head of Investment trusts research Emma Bird* said Wright’s stewardship since 2012 has been “impressive”.

She particularly appreciated his focus on “the potential for positive change, with downside risks mitigated by the already relatively low valuations of UK shares”.

While the fund primarily targets capital growth, it also offers a “decent” dividend yield of 3.1% and has a “good” dividend growth record, having increased its payout for 14 consecutive years.

*Fidelity is a corporate broking client of Winterflood Securities.