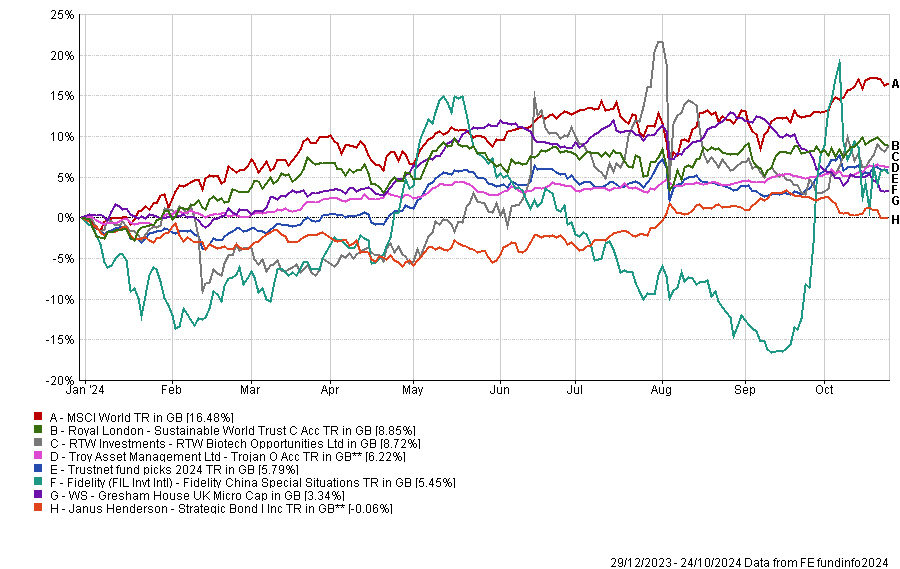

It has been a forgettable year so far for Trustnet’s fund picks. In January the editorial team selected portfolios we believed had a chance of outperforming markets in 2024, but so far we are not doing well. The full chart showing our woes is below.

As this is my last column of the year - I am soon to be off spending time with my new baby and family - I thought I would take a look at where we stand with two months to go and who I think has the best odds of coming out on top. To do this I am using the probability that any of our funds can catch up to, or overtake, the MSCI World index.

In truth, it looks like a tall task. Our top performers so far this year have made just half the return of the global market index, meaning we should have picked a tracker. All our funds appear to have little chance of beating the index, but below I will outline the glass-half-full reasons as to how they can turn the tables with two months to go.

Theoretically, the best chance we have to beat the index is senior reporter Matteo Anelli’s pick: Royal London Sustainable World Trust. It has made 8.9% so far this year, still a long way behind the MSCI World’s 16.5%.

With the likes of Microsoft, Alphabet and Amazon among its top 10 holdings, the fund will be geared towards the ‘Magnificent Seven’, which implies it is broadly in the same themes as the wider market.

However, it does not own Nvidia. This has been a hindrance this year, but should the semiconductor stock falter, the fund could soon catch up over the next two months.

News editor Emma Wallis’ RTW Biotech Opportunities is next, up 8.7% year to date. Healthcare has been a good place to invest in 2024, but would need a significant boost in the coming two months. Lower rates should help these growth stocks to outperform, while a sell-off in the tech sector would help arrest its relative performance to the index.

The third most likely to outperform, in my view, is Fidelity China Special Situations, the pick of former reporter Jean-Baptiste Andrieux. JB has left Trustnet to become an investment trust analyst, suggesting he is the most qualified of us to deliver these picks. This gives it credibility immediately.

However, the reason I think this is the third most likely to beat the MSCI World by year-end is because of how volatile the market has been in 2024.

Last week, James Klempster, deputy head of Liontrust Asset Management's multi-asset team, said Chinese equities are still cheap, while JP Morgan Asset Management emerging market macro strategist Nandini Ramakrishan added that China’s stimulus measures signify “a new chapter” for emerging market equities.

Last month the People’s Bank of China freed up about ¥1tn in long-term liquidity by reducing the reserve requirement ratio for banks by 0.5 percentage points, allowing them to lend more and support the economy.

The big overhang is the US election, with both presidential candidates likely to impose tariffs on Chinese goods, although Donald Trump is expected to be more punitive. If Kamala Harris wins, this could improve the outlook for Chinese exports, giving the market a boost.

Performance of funds and total portfolio vs MSCI World YTD

Source: FE Analytics

Turning to those that are less likely to beat the MSCI World, FE fundinfo head of editorial Gary Jackson’s Janus Henderson Strategic Bond fund would require a significant sell-off in markets over the final two months of the year.

Bonds have had a tough time in recent years as interest rates were ramped up to deal with high inflation, but they now offer attractive yields and are viewed as portfolio diversifiers once again.

If equities fall, bonds should hold up well, which is likely the main way this fund will overtake the deficit to the MSCI World.

Interest rates are expected to be cut again next week, which will provide a boost to bonds, but it seems unlikely this will be enough to cause this fund to leap higher.

It is a similar story for former reporter Matthew Cook’s Trojan fund, a defensive portfolio that will likely require a big shift in markets, with tech stocks tanking and its quality-growth names to remain unharmed.

The least likely to win out this year is my own: Gresham House UK Micro Cap. I think UK small-caps are heading in the right direction and lower interest rates should improve valuations on these high-growth stocks, but it is likely to be a 2025 story rather than a 2024 one.

I hope I am wrong, but with the fund up just 3.3% so far this year, it would take a minor miracle for it to top the charts by the end of the year.