Investors are split on the outlook for gilts in the wake of the volatility that followed last week’s Budget, but analysts at Hargreaves Lansdown think investors should consider locking in the higher bond yields currently on offer.

Gilts yields have been rising – and therefore prices falling – since mid-September for a few reasons, with one being uncertainty around the first Budget of the new Labour government.

Bond investors were nervous about expectations of higher future borrowing. This, along with factors such as interest rate expectations and the US election, meant the yield on 10-year gilts had risen to around 4.3% the day before the Budget.

Yields climbed further after chancellor Rachel Reeves finished her Budget speech last Wednesday, in which she announced £40bn in tax hikes and new fiscal rules that allow more government borrowing.

At the time of writing, six days after the Budget, the 10-year gilt yield was around 4.47%.

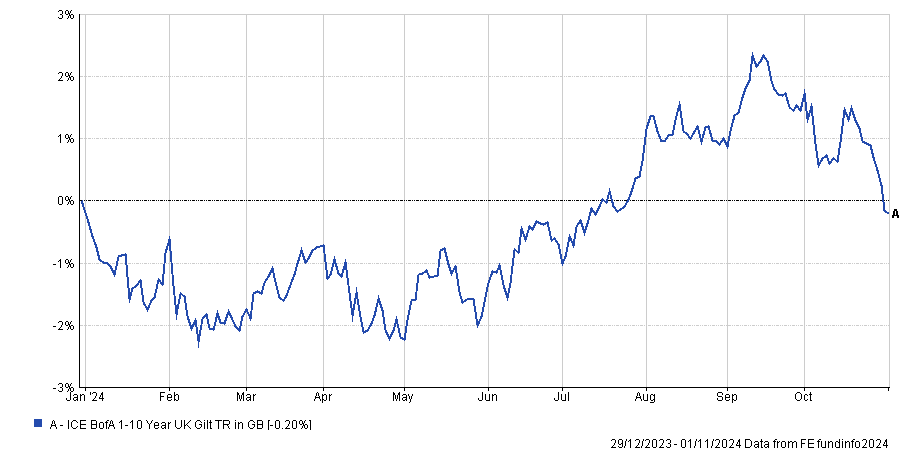

Performance of gilt prices over 2024

Source: FE Analytics

The volatility of the gilt market has left investors spilt in their outlooks.

Althea Spinozzi, head of fixed income strategy at Saxo, said investors should stay bearish on UK government bonds following the announcements in the Budget.

“Looking ahead, there are compelling reasons to anticipate that gilt yields may continue to rise,” she said.

“Inflationary pressures stemming from the budget – such as higher minimum wages and increased employer National Insurance contributions – could prompt markets to expect a more cautious approach from the Bank of England concerning rate cuts.

“This mix of increased inflation risks and higher supply expectations is likely to exert sustained upward pressure on yields over the longer term.”

However, BlackRock Investment Institute UK chief investment strategist Vivek Paul welcomed the measures in the Budget, arguing that they are “an attempt to turn around the UK's economic fortunes”.

He said that by creating headroom for more government borrowing but not using it all at once, Reeves is trying to signal to markets that there is a runway to support growth further but spending will be used “judiciously”.

BlackRock remains overweight UK equities and gilts, citing the UK’s relative political stability thanks to the summer's decisive election result and its view that the Bank of England is likely to cut rates more than markets currently think.

Hal Cook, senior investment analyst at Hargreaves Lansdown, sees some merit to investing in bond funds at the moment despite the tick-up in volatility and the forecast this will continue into 2025 on shifting interest rate expectations and political instability.

“With the 10-year gilt and US treasury yields both still above 4%, bonds are broadly as attractive today as they’ve been all year,” he explained.

“Taking a long-term view, it’s likely that yields will be lower than 4% in future, meaning investing in bonds today gives the potential for capital gains as well as receiving the income that they provide.”

For investors thinking of buying a bond fund, Cook gave three strategies to consider.

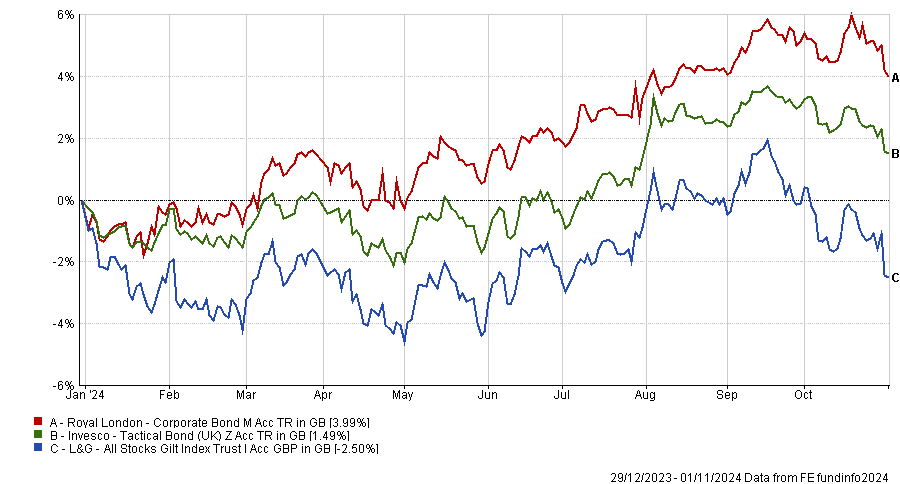

Performance of funds over 2024

Source: FE Analytics

First up was L&G All Stocks Gilt Index Trust, which tracks the broad movement in prices of all gilts currently in issue. Cook described it as a cheap and easy way to take exposure to the whole gilt market.

“It’s a great option for investors who are looking for specific exposure to gilts,” he said. “However, while it invests in lots of different gilts, as it is only invested in UK government debt, it is relatively concentrated compared to the wider bond market.”

He also pointed to Shalin Shah and Matthew Franklin’s Royal London Corporate Bond fund for investors who want to diversify a portfolio focused on shares. Most of the portfolio is in investment grade bonds, with some higher risk, high-yield bonds.

“[Shah and Franklin’s] edge comes from deep analysis of individual bonds, looking for those that offer higher returns. This can lead them to invest in bonds issued by companies that could be considered higher risk than peers,” Cook explained.

“But the individual bond analysis conducted by the managers means they are comfortable that any additional risk being taken is well rewarded.”

For investors seeking a more flexible approach to fixed income, the Hargreaves Lansdown senior investment analyst suggested Stuart Edwards and Julien Eberhardt’s Invesco Tactical Bond fund.

It invests in all types of bond and has the aim of generating both growth and income over the long term, with a focus on minimising loses during times of market stress.

“[Edwards and Eberhardt’s] focus on limiting losses has meant that their fund has typically had less ups and downs than the wider market,” Cook said. “Their active management approach also means they can stay away from areas of bond markets that they think could perform poorly, and means the fund is highly diversified.”

He said Invesco Tactical Bond could be a good option for investors seeking a fund that can take advantage of market volatility.