Being a contrarian investor can be a lonely road, as Joe Bauernfreund, manager of the £1bn AVI Global Trust knows all too well.

In a year when global equity markets have been dominated by the Magnificent Seven, going against the crowd caused a decline in relative performance for his flagship strategy, which fell into the third quartile of the IT Global sector.

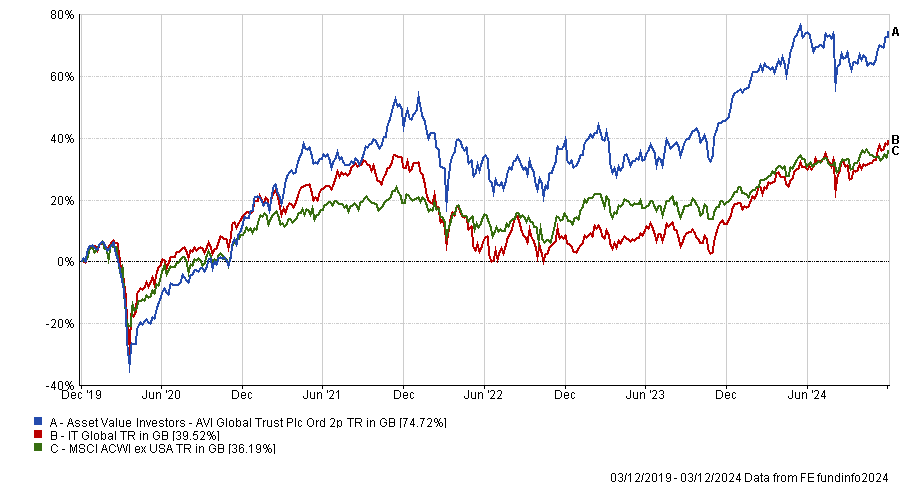

Nevertheless, performance has been better over the longer term, with the trust returning 74% over the past half a decade – more than double its benchmark. Moreover, the strategy has generated annualised NAV returns of around 15% in the past two years, in a market which has heavily favoured momentum trading, according to QuotedData.

Performance of AVI Global Trust over 5yrs

Source: FE Analytics.

Despite recent headwinds, Bauernfreund remains firm in his convictions and criticises his fellow investors for their lazy analysis. He explained that there is a tendency within value investing to buy cheap opportunities and let them handle themselves in the hope that they work out.

He argued: “Our strategy is different, because hope is not a strategy.”

Below, Bauernfreund explains what he sees as the biggest challenges of being a contrarian investor, why shareholders should remember that they are owners of companies, and why he has not given up on even his worst-performing holding.

Could you outline your investment philosophy?

The trust invests globally, particularly focusing on parts of the stock market that are neglected or overlooked by other investors.

Specifically, we’re interested in companies trading at discounts to their net asset value, where we believe there is likely to be some catalyst for unlocking that value.

What distinguishes you from your competitors?

When you look at our top 10, you won’t see any names that overlap with our global peers. We own different kinds of companies and are proactive in unlocking value across the board, engaging with management in all situations and sometimes pushing hard for specific catalysts.

With AVI Global you get something that is genuinely benchmark agnostic and a genuine diversifier.

Why is it important to proactively engage with the management of your holdings?

There are some investors who look at valuation anomalies and say, ‘Well this is a standout opportunity, it is cheaper than it’s ever been, let's buy it’ and then they hope for the best.

Our strategy is different because hope is not a strategy. When we find anomalies, we are very focused on what might occur to change that undervaluation and in certain cases, we are happy to be in the driver's seat to deliver that value.

If you go back to basics, a shareholder in a company is an owner. So many investors have forgotten that they are owners of businesses at the end of the day, and perhaps some boards of directors have forgotten that they are there to serve the needs of their shareholders.

What are the challenges of being a contrarian investor?

What we call ‘the market’ is made up of the views of millions of investors with varying degrees of information. If you are one lone contrarian investor, such as ourselves, and the market is telling you that you are wrong, it takes a certain type of personality to look back at the market and say ‘No, I’m right and you’re wrong’.

The challenge is really to understand what the market is thinking collectively and to analyse whether the market is missing a trick. And what enables us to do that is the quality of research that we do in-house with holdings such as D’Ieteren. That opportunity exists because there is not much research from the sell side, so the availability of information is less than for a company like Apple or Microsoft.

There is laziness from other investors and all these things are factors in understanding why the market might be wrong and why we might be correct.

What was the best-performing holding in the portfolio over the past year?

It was Apollo Global Management, which is up by around 92% over the year. Apollo has been a very strong performer and has been a feature of the portfolio alongside several other alternative asset managers since the Covid-19 sell-off in March 2020.

The attraction of Apollo was that we believed it to be cheap. We felt its growth in assets under management was likely to be very strong across all asset classes, but from a valuation perspective, we felt the market was undervaluing the balance sheet and predicted growth in earnings.

Apollo owns an insurance business called Eden, which has been a tremendous driver of profits. Having that permanent capital base, giving Apollo assets to manage has been very fruitful.

And the worst?

The worst performer was FEMSA, which experienced a share price fall of 29% over the past year.

FEMSA operates the largest and most profitable convenience store chain in Mexico and Latin America. What’s weighted against the share price is simply the fact that being a Mexican company and being in the sights of US tariffs has led to a weakening of the Mexican peso and general aversion amongst investors for emerging markets.

But we hold onto the investment firstly because it is a high-quality business. Secondly, from a valuation perspective, the earnings multiple has derated quite substantially and it trades eight times below its peers, which is low in absolute terms, particularly for a business growing at the rate that it is.

What do you do outside of fund management?

I really enjoy cycling, so when I have time away from my family and from my job, I get on my bike.