The London Stock Exchange is home to several rapidly growing, recently listed businesses across a range of sectors, from Fevertree Drinks to Tatton Asset Management and Auto Trader.

For fund managers and investors trying to spot the next big thing, identifying common factors between companies that have grown exponentially since their initial public offerings (IPOs) is a good place to start.

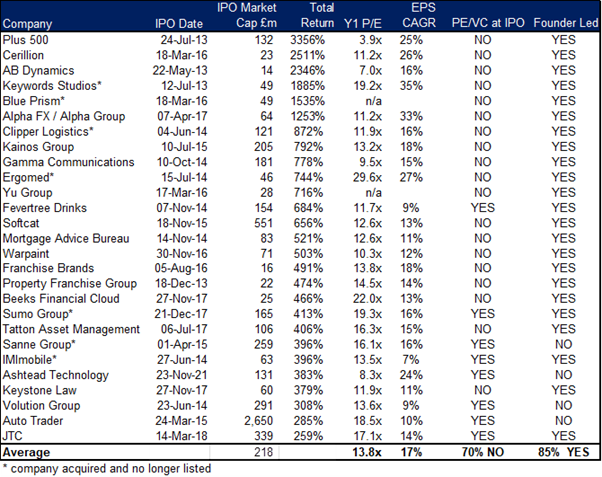

To that end, Whitman Asset Management researched more than 400 IPOs between January 2013 and August 2024 and found 27 companies that have returned more than 250% since listing.

These successful companies had three things in common when they listed: a market capitalisation under £250m; sensible valuations at the time of listing; and a founder-led management structure with no private equity involvement at flotation.

Best performing IPOs from 1 Jan 2013 to 31 Aug 2024 (gains >250%)

Sources: Whitman Asset Management, London Stock Exchange, admissions documents, Refinitiv, cash offer RNS announcements

High earnings and cash flow growth are other things to look for, said Joshua Northrop, who manages the WS Whitman UK Small Cap Growth fund and led the research. The 27 companies that delivered most value for their shareholders enjoyed average annual earnings per share growth since listing of 17%.

The majority (81%) listed with market capitalisations under £250m. “It’s easier for small companies to grow – elephants don’t gallop – and they have a longer runway for superior growth versus larger companies,” Northrop explained.

Almost all (85%) of the top-performing IPOs were founder-led businesses. Founders are better capital allocators because they invest for the long-term future of the business, whereas non-founder management teams are often incentivised over shorter time periods, he pointed out.

Company founders tend to use IPOs as an opportunity to raise capital for growth, not as an exit strategy for themselves. This means their valuation expectations are usually less aggressive, he observed.

Northrop believes companies listing on valuations of under 15x P/E are more likely to deliver the strongest returns. Most (85%) of the top performing IPOs listed at valuations below 20x and anything above this threshold should be avoided, he said.

At the other end of the scale, five of the six worst-performing UK IPOs of the past decade had significant private equity or venture capital presence, whereas 70% of the most successful IPOs had no private equity or venture capital investment when they listed.

“Private equity-backed IPOs often face overvaluation risks, as sellers aim to maximise their sale price, potentially inflating financial metrics in the run up to the listing. This can harm long-term growth, as short-term tactics like raising prices or cutting investment may be used to boost IPO valuations, increasing the likelihood of overpricing,” Northrop warned.

The Whitman UK Small Cap Growth fund currently holds eight of the top performers in the table above, including Ashtead Technology and JTC, and has previously owned four others.

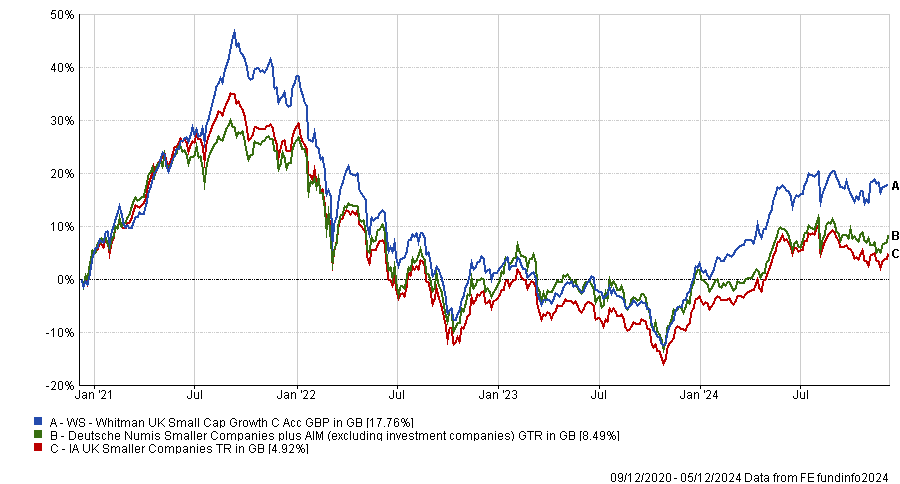

Performance of fund vs benchmark and sector since inception

Source: FE Analytics