Over the past decade, the growth of the exchange-traded fund (ETF) market has been relentless, with global assets held in ETFs more than quadrupling from under $3trn to more than $14trn today. Crucially, much of this growth has occurred in recent years, with a compound annual growth rate (CAGR) of over 19% between 2018-2023.

As we look to 2025 and beyond, we anticipate that, although this rate of growth is likely to fall slightly, it will remain comfortably in double digits.

The continued extension of ETFs into new asset classes, the rising popularity of active ETFs and growing awareness and understanding of these products across investor categories remain a strong support, with global ETF assets under management expected to exceed $20trn by the end of 2028.

Tailwinds for ETFs in EMEA

The ETF market in Europe, the Middle East and Africa (EMEA) has continued to mature, with assets under management (AUM) more than doubling since 2019 to cross the $2trn mark this year. 2024 also marked the continuation of a pattern in which net new assets (NNA) into EMEA-domiciled ETFs doubles every five years, a rule that has held over three cycles since 2009.

With ETFs now firmly established, we forecast the annual rate of net inflows over the next five years to be double that of the past five years, with total AUM exceeding $4trn in 2029.

This growth will be driven by diversification in the range of investors using ETFs. We are seeing widespread adoption across the client spectrum, from core wealth and retail, both direct and digital, to institutional. Asset managers, insurers, pension funds and sovereign wealth funds no longer view ETFs as merely standalone investments, but as assets that can form part of an actively managed portfolio.

Through a product lens, we expect ETFs to fully cover all asset classes over the next five years, spanning both core and non-core exposures, and active and passive, contributing to $1.2trn of net inflows into EMEA-domiciled ETFs over the next five years.

Fixed income to continue to punch above its weight

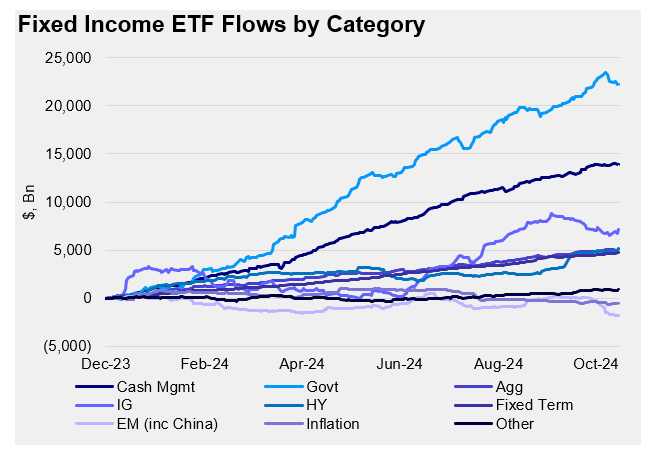

With $68bn of net inflows, 2023 was a record year for fixed income ETFs, and inflows in 2024 maintained a similar trajectory, standing at $57.6bn as of the end of November. Following this surge, fixed income ETFs are fast approaching the $500bn mark and positive tailwinds suggest they will remain amongst the fastest-growing ETF categories in 2025 and beyond.

Although equities remain the dominant ETF asset class, fixed income has led in terms of net new asset growth over the past five years.

The past two years have seen outsized interest in EMEA-domiciled fixed income ETFs, which have captured 35% of net inflows, well above their 22% AUM share.

Sources: Bloomberg, Invesco as at 14 Nov 2024

Factors behind this include institutional and retail investors alike now finding fixed income a more attractive asset class with yields at their highest levels since the financial crisis.

Nevertheless, flows have indicated that investors remain cautious, with cash management and short-dated government bonds accounting for more than 40% of net new assets in EMEA during 2024.

Inverted government yield curves and relatively flat credit curves have meant that, to date, there has been little need for investors to increase interest rate risk given the attractive level of yields available on cash and short-dated bonds.

Inflows have also been driven by the emergence of innovative strategies such as fixed maturity, which allow investors to navigate volatility through rising and falling-rate environments, resulting in steady net new asset growth of $4.7bn as of November.

With yields at the best levels since the global financial crisis and ETFs now firmly established as an efficient means of accessing bond markets, we anticipate that fixed income will continue to punch above its weight, driving the category to 25% of AUM by 2029.

Smart beta and US equity ETFs remain in focus

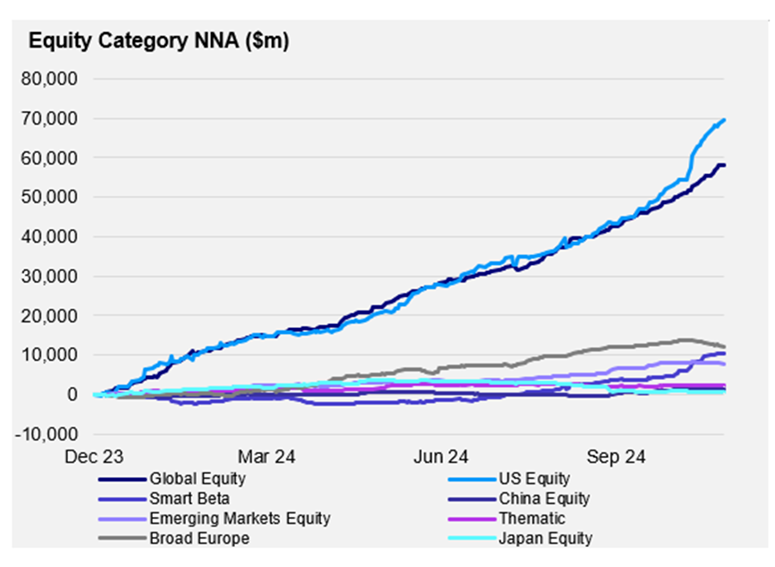

2024 was a standout year for equity ETFs in EMEA, with a record $180bn in annual inflows already reached by the end of November. Although inflows are clearly affected by the performance of equity markets, we anticipate that equity inflows will continue to rise as ETF adoption grows.

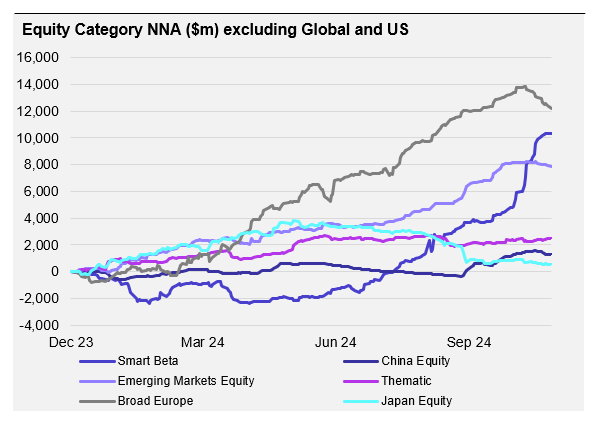

Equity flows in 2024 have been dominated by US and global exposures. This is a continuation of the long-term trend with demand for US equity exposure driven by the scale of the market within equity portfolios as well as recent dominance in performance.

Global product flows have benefited from the growth of direct investor flows with global equity ETFs acting as a simple, low-cost way of gaining broad equity exposure. Looking beyond these themes, we are seeing a notable increase in demand for smart beta, led by equal weight, as investors look to reduce concentration risk.

Sources: Bloomberg, Invesco, data to 25 Nov 2024

As we move into the new year, we expect these three categories to continue to thrive. In the two weeks following Donald Trump’s re-election, flows into US equity ETFs surged at the expense of European strategies, and barring a correction this is likely to remain the case. But so long as record levels of market concentration persist, the case for equal-weight approaches remains strong, with awareness of these strategies growing.

Lastly, further easing of monetary policy could spark a revival for thematic ETFs, which remained largely flat in 2024. Although a fall in rates could favour thematics tilted towards growth, a continuation of geopolitical uncertainty could see a reallocation towards low volatility and defensive sectors.

Sources: Bloomberg, Invesco, data to 25 Nov 2024

Chris Mellor is head of EMEA ETF equity product management and Paul Syms is head of EMEA ETF fixed income and commodity product management at Invesco. The views expressed above should not be taken as investment advice.