It has been a challenging year for European markets. Post-election stability failed to fully manifest, with market volatility rising after France and Germany's coalitions collapsed in November and December.

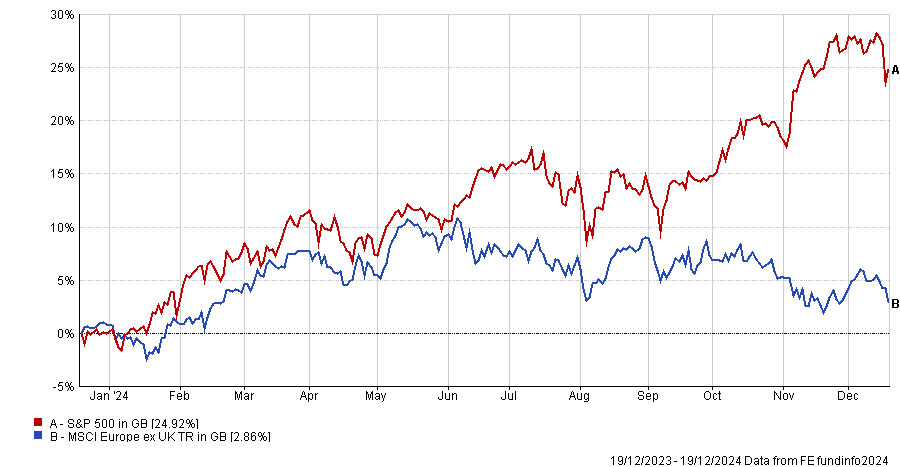

As a result, while the S&P 500 has surged ahead this year, Europe has struggled. Indeed, the MSCI Europe ex UK rose by 2.9%% this year, compared with the S&P 500 which jumped by 24.9%.

Performance of market indices over the past year

Source: FE Analytics

However, it is precisely this underperformance that has caught investors’ attention. In a global market where some stocks seem increasingly overvalued, European equities’ poor performance and the prospect of improved valuations has led to a renewed interest in the region from some investors.

Below, Trustnet asked leading asset managers for their outlook on the European market in 2025, covering topics such as artificial intelligence (AI), valuations and why the region might be poised for a turnaround.

BlackRock’s Jewell – US exceptionalism does not mean US only

Helen Jewell, chief investment officer on BlackRock’s fundamental equity team, reflected that it has been a fascinating year for most financial markets. While the big story of 2024 was the ongoing growth of AI as an investment theme and a resurgence in US exceptionalism, she cautioned investors not to forget the potential of other regions.

Jewell said: “US exceptionalism may continue, but it does not have to mean US only.”

She argued that while US valuations may look stretched, Europe does not have this issue. Indeed, she explained that Europe was home to unique investment themes at attractive prices that US-only investors would miss out on.

For example, Europe is home to “best-in-class luxury companies” such as LVMH, Prada and Hugo Boss, with strong fundamentals and a significant runway for further growth in 2025.

Moreover, Jewell reminded investors that “economies and stock markets are not the same thing”.

Indeed, she explained that almost 60% of European business revenues came from outside Europe. Of this figure, 26% came from North America, meaning that European investors can benefit from the US's unprecedented growth at Europe's significantly lower valuations.

Fidelity’s Stötzel – There are ample opportunities in Europe

Meanwhile, for Marcel Stötzel, portfolio manager of the £1.4bn Fidelity European Trust, there was reason for optimism in Europe for 2025.

He conceded that markets were expensive and he struggled to find opportunities in deep cyclical such as industrials, which he argued could be due to a downturn. As a result, he said that the Fidelity team remained “cautious in the near term” on Europe.

However, he argued that when you conduct a “like-for-like comparison with US peers” investors can still find ample opportunities. He added: “We remain slightly overweight IT, given the number of stocks here which meet our criteria in terms of being sustainable dividend growers with good quality-growth characteristics.”

Stötzel expected AI to remain a core theme for European semiconductor construction and software companies. Moreover, less obvious “picks and shovel plays” such as pharmaceutical stocks or data centre construction, would also benefit from a rising emphasis on AI.

JP Morgan’s Bloch – The outlook has rarely been brighter

For Jules Bloch, co-manager of the £515m JP Morgan European Discovery Trust, European smaller companies are poised for a resurgence in 2025.

He explained that macroeconomic trends have started to favour small-caps through developments such as a more favourable rate environment. While the current outlook may seem challenging, he argued that small-caps are particularly good at achieving meaningful growth from relatively small shifts in circumstances, meaning their growth in 2025 could take investors by surprise.

For example, he reminded investors that in the 2000s, members of the ‘Magnificent Seven’ such as Amazon would have been considered small-caps, while others like Meta did not yet exist.

He said: “The key takeaway for small-cap investors is that many of tomorrow’s market leaders could be today’s small-caps.”

He concluded: “We expect the confluence of attractive valuations, favourable macroeconomic trends, and long-term thematic developments to act as key drivers for European small-caps – in fact, we believe the outlook has rarely been brighter.”

Columbia Threadneedle’s Mergen – Opportunities in a new equilibrium

Melda Mergen, global head of equities at Columbia Threadneedle, said investors should remember that company fundamentals will be crucial in 2025. She argued that European businesses that have proven they can withstand the challenging market environment of recent years will continue to lead in the region in 2025.

Additionally, she explained that most of Europe's developed markets were now considered relatively cheap compared to their 10-year average, which would appeal to investors concerned about the US stretched valuations.

“While cheap versus expensive is generally not an effective investment thesis, it can be a useful data point to challenge investor assumptions and evaluate allocations at the country level,” she said.

“By focusing on companies with solid fundamentals and being open to opportunities beyond the US, investors can navigate this new equilibrium with confidence.”

HSBC Asset Management’s Little – Pessimism is unsurprising

For Joseph Little, global chief strategist at HSBC Asset Management, investors needed to have some caution regarding Europe in 2025.

He said that investor pessimism was not surprising given the weak performance of the MSCI Europe index compared to the US. He attributed this to weak global trade growth and developments such as the German Fortune 500 companies announcing more than 60,000 layoffs in 2024.

However, he argued that “the outcome of all this is that the European stock market now looks very cheap”. With the MSCI Europe trading on an average of 15x price-to-earnings (P/E), compared with 30x in the US, and particularly pronounced discounts in areas such as consumer staples and financials, there were clear opportunities for investors willing to look for them.

Moreover, with the potential for a recovery in China, increased investment in European brands and a surge in M&A activity due to “bargain hunting” private investors, there is an increased potential for a re-rating of European equities in 2025.