Four new funds were added to Square Mile Investment Consulting and Research’s Academy of Funds list in the final month of 2024, while three were suspended.

The £1.2bn Royal London UK Government Bond fund is the largest of the newly rated portfolios. It has been given an ‘A’ rating and was included in the list as a “strong choice for investors seeking a long-term allocation to an actively managed, all-maturity UK government bond fund”, the analysts said.

Managed by FE fundinfo Alpha Manager Craig Inches and Ben Nicholl, who run several other portfolios including the firm’s £7bn Short Term Money Market fund, Square Mile analysts said this strategy provides investors with access to a “skilled and experienced” management team that takes a “thoughtful and disciplined approach” to investing in the asset class.

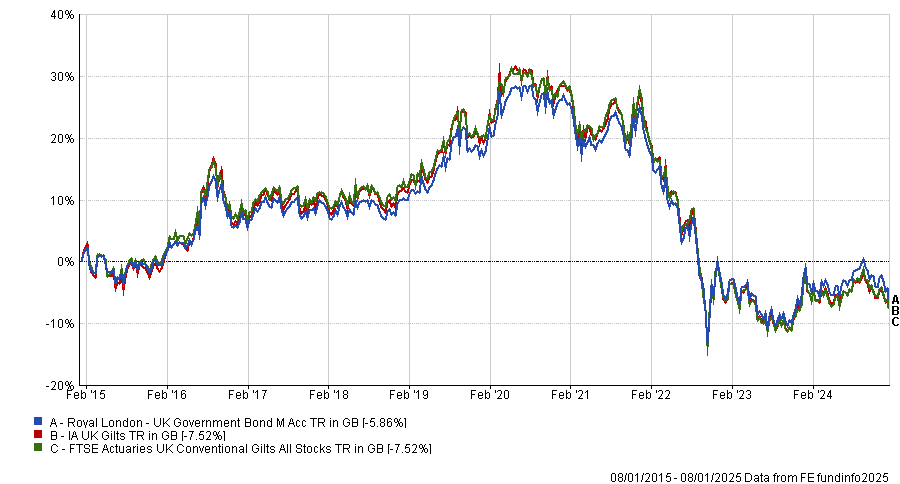

The fund has been a second-quartile performer in the IA UK Gilts sector over the past one, three and five years, and is in the top quartile over 10 years. However, it has made a loss in each of these periods as the gilt market has been a tough place to invest.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

This week, UK gilt yields hit a 27-year high, which was partly attributed to Donald Trump's election victory. The president elect is expected to bring in tax and immigration policies that will drive inflation, leading to rising yields in the US which could have a knock-on effect in the UK.

Richard Carter, head of fixed interest at Quilter Cheviot, said: “The Bank of England remains cautious about slashing interest rates too aggressively and the tepid demand from investors at the latest gilt sale underscores the uncertainty in the market.

However, he added that gilt yields “still present an attractive opportunity for long-term investors” as they are “well above expected inflation levels”, making them a “viable option” for cautious investors concerned about future rate cuts.

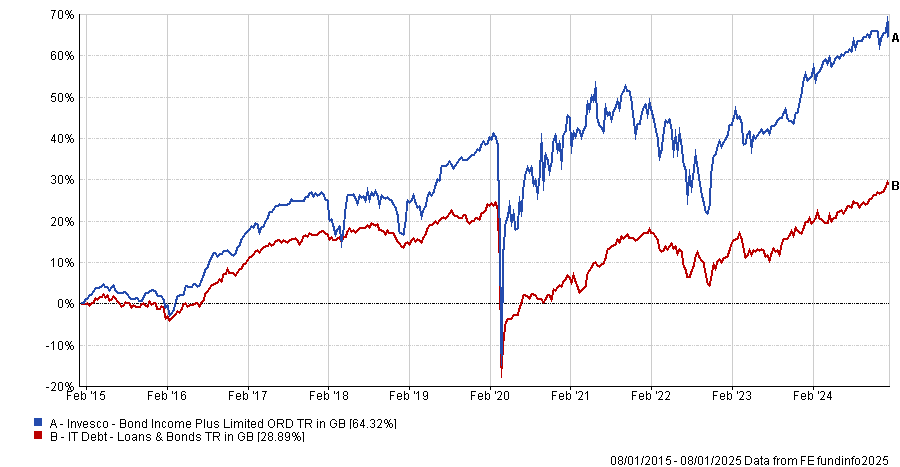

Also in the bond space, the £344m investment trust Invesco Bond Income Plus was also added to the Square Mile Academy of Funds despite a bottom-quartile return over three years in the IT Debts – Loans & Bonds sector. The trust, managed by Rhys Davies and Edward Craven, has failed to beat the peer group average over one, five and 10 years as well.

Performance of fund vs sector over 10yrs

Source: FE Analytics

The analysts maintained however that the fund is “an attractive option for investors looking for a stable high level of income from a diversified portfolio of high-yielding credits” and gave it an ‘A’ rating.

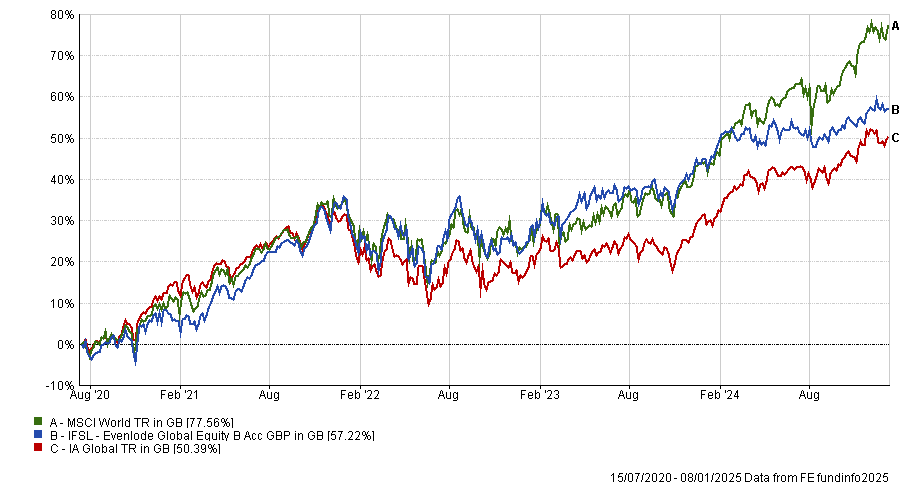

Turning to equities, Evenlode Global Equity was also given an ‘A’ rating, having beaten its average peer since its launch in 2020. Its 57.2% return was good enough to place it in the second quartile of the IA Global sector during this time.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

Managed by Chris Elliott and James Knoedler, the fund follows others in the Evenlode suite by buying high-quality companies. It is the latest addition to the firm’s fund offering and is the first without an income mandate.

“As such, it offers a decent level of differentiation from both its sister funds,” the analysts said. They added that this is a “fairly concentrated portfolio of quality companies” and “an attractive option for investors seeking a long-term global equity strategy”.

The last of the new additions was Charlotte Ryland’s CCLA Better World Global Equity, which was granted a ‘Responsible Positive Prospect Rating’ by the firm, despite below-average performance in the IA Global sector since its launch in 2022.

“This fund provides investors with a robust global equity proposition, run by fund managers committed to diligent stewardship, stringent ESG [environmental, social and governance] criteria, and alignment with investors’ values, ultimately driving positive societal and environmental outcomes,” the analysts said.

As well as the four additions, two fund ratings were suspended by the firm pending further review. RGI European’s ‘A’ rating is under threat after it was announced lead manager James Sym is moving to Goodhart Partners, a London-based global equity boutique.

“Although he is departing River Global, he will continue to manage the RGI European fund on a sub-advisory basis. Therefore, the fund’s investment process and approach are expected to remain the same. The Square Mile analysts aim to meet with Sym when he is at his new group and will make a decision on the fund's rating thereafter,” they said.

Meanwhile, Ninety One UK Sustainable Equity’s ‘Responsible A’ rating is under threat after the firm proposed it would be merged into the Ninety One Global Sustainable Equity fund.

For the merger to be approved, 75% of the votes cast must be in favour of the proposal, with a deadline of 13 January 2025.

The analysts said there is a “high chance that the merger will be approved and have therefore taken the decision to suspend the Square Mile rating pending the outcome of the vote”.

Lastly, having been suspended previously, Aegon Ethical Cautious Managed retained its ‘A’ rating despite Euan McNeil leaving the firm.

McNeil was appointed co-manager alongside Audrey Ryan in January 2024, replacing the head of UK fixed income and long-standing co-manager Iain Buckle, who will return as co-manager.