Investors have been pouring research into high-flying parts of the market such as tech stocks and the US, figures from Trustnet suggest, but it’s an India fund that witnessed the greatest uptick in interest.

With millions of pageviews a year to its fund factsheets, Trustnet’s traffic figures can offer insight into what investors have been researching. In this article, we reveal the sectors and funds that Trustnet users spent more time researching in 2024 compared with the year before.

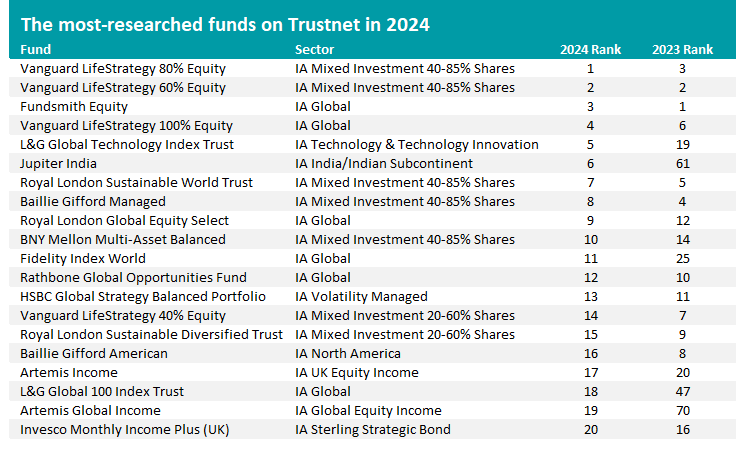

In terms of overall visits to factsheets, Vanguard LifeStrategy 80% Equity was the most researched fund in 2024 after accounting for 1.3% of all pageviews within the Investment Association universe. This was an improvement on 2023’s numbers, when the fund was the third most popular with Trustnet users, and has caused it to knock Fundsmith Equity off the top spot.

Source: Trustnet, Google Analytics

The table above shows how much movement there has been among the most-researched funds in the past year, with the likes of Jupiter India, L&G Global Technology Index Trust and Artemis Global Income making big climbs up the leaderboard to get into the top 20.

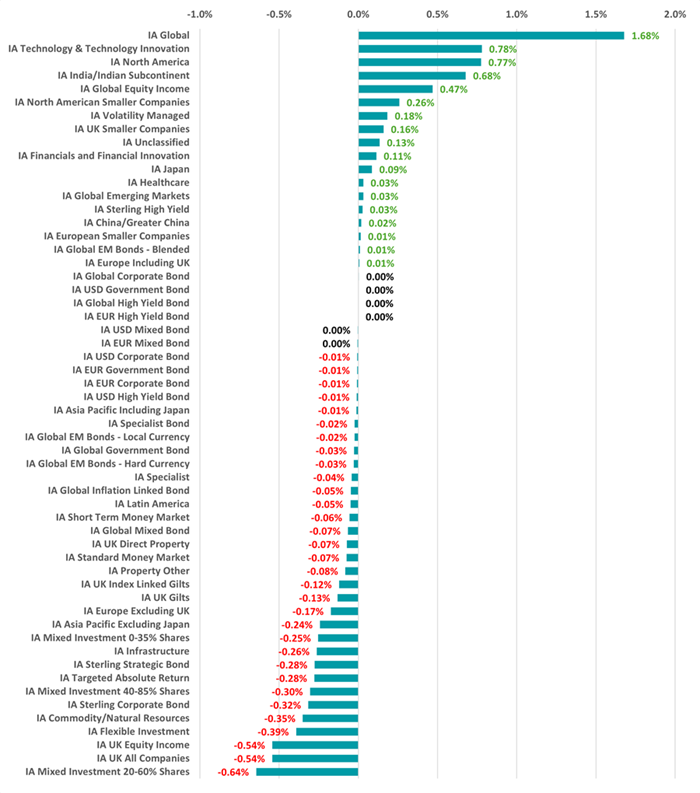

On a sector level, the five most-researched peer groups were IA Global (which accounted for 16.2% of pageviews in the Investment Association universe), IA Mixed Investment 40-85% Shares (9.1%), IA UK All Companies (8.5%), IA Volatility Managed (5.9%) and IA North America (5.1%).

But there were some changes in the research share won by each sector in 2024, compared with 2023. As noted above, funds in the IA Global won 16.23% of pageviews but this was up from 14.55% in the previous year – an improvement of 1.68 percentage points.

This was significantly higher than IA Technology & Technology Innovation and IA North America, the next two sectors increasing their research share by the most. However, all three sectors are likely drawing interest from the same themes: the US exceptionalism narrative, enthusiasm for artificial intelligence (AI) and the ‘America First’ agenda of US president-elect Donald Trump.

Source: Trustnet, Google Analytics

Other ‘Trump trade’ beneficiaries include the IA North American Smaller Companies and IA Financials and Financial Innovation sectors, as smaller US companies could profit from Trump’s ambition to boost domestic business while banks would be helped by any deregulation of the financial sector.

IA India/Indian Subcontinent funds have been researched more thanks to the country’s stock market rally while IA China/Greater China strategies became more appealing after Beijing announced an economic stimulus package. These factors also support more interest in the wider IA Global Emerging Markets sector.

Meanwhile, all four mixed-asset sectors have been getting researched less by Trustnet users over the past year, possibly reflecting the fact that market leadership remains narrow. As shown above, with US mega-cap tech stocks dominating for much of the year, research has headed towards the IA Global, IA Technology & Technology Innovation and IA North America peer groups.

The UK also remains unloved, despite attractive valuations relative to the US, with the falls in research into IA UK All Companies and IA UK Equity Income funds coming at the same time as continued outflows from the home market.

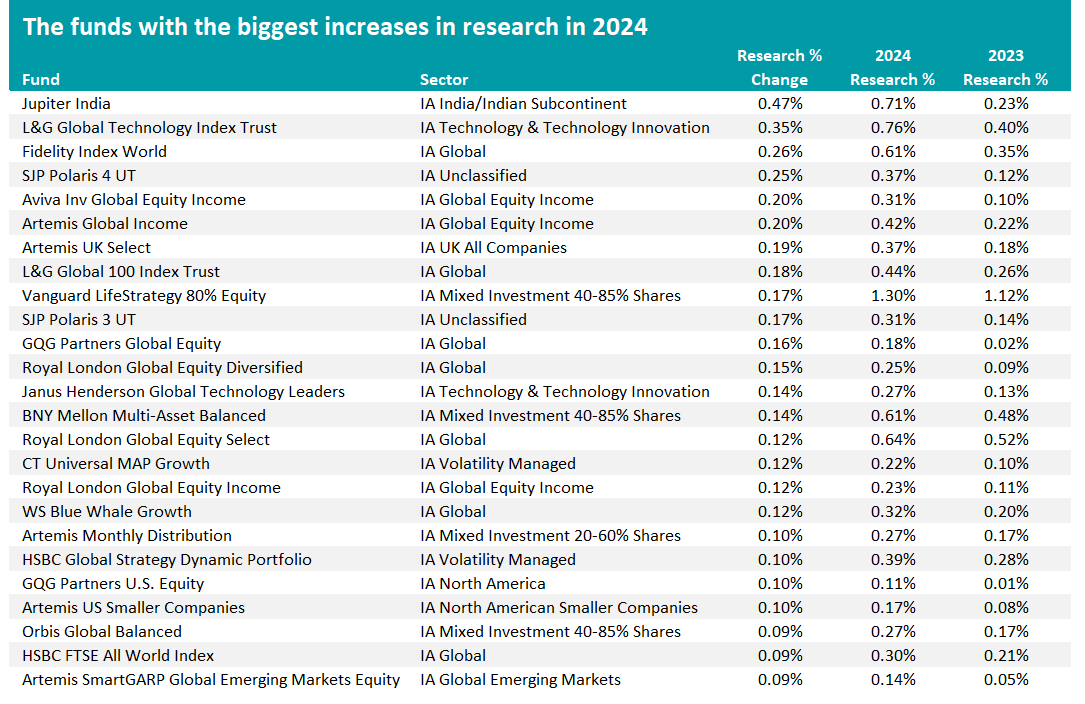

Turning to individual funds, Avinash Vazirani and Colin Croft’s Jupiter India increased its research share by the most last year; in 2023, it accounted for 0.23% of all factsheet views in the Investment Association universe but this jumped to 0.71% last year – enough to promote it from 61st place to sixth.

Source: Trustnet, Google Analytics

As noted above, Indian equities have had another strong year with the MSCI India index making a 13.2% total return (in sterling) in 2024. The IA India/Indian Subcontinent sector beat this with an average return of 17.6% while Jupiter India was up 24.1%,

Last year, Vazirani and Croft noted that valuations in some parts of the Indian market could be stretched following its extended rally. However, they added: “We follow a consistent and patient ‘growth at a reasonable price’ approach by striving to identify companies that could potentially generate higher returns at lower valuations than their peers.”

The rise in research into tech funds like L&G Global Technology Index Trust and Janus Henderson Global Technology Leaders, global funds such as Fidelity Index World and WS Blue Whale Growth, and US funds like GQG Partners U.S. Equity and Artemis US Smaller Companies, reflects the AI and Trump trade themes explored above.

Increased interest in global equity income strategies such as Aviva Investors Global Equity Income, Artemis Global Income and Royal London Global Equity Income comes as investors turn away from UK equity income funds.

However, one UK strategy has made it onto the list of the funds with the biggest increases in research: Artemis UK Select. Managed by Ed Legget and Ambrose Faulks, this £3.5bn fund is built around a high-conviction portfolio that often has a value bias; the managers are also able to short a small number of holdings, which differentiates it from peers.

Analysts at FundCalibre said: “This fund stands out as one of the premier UK equity funds due to the impressive track record of its managers. Ed Legget has consistently delivered exceptional performance over his career and alongside Ambrose Faulks the fund has thrived since their partnership began in late 2015.”