Wading into the world of investing can be confusing. There are myriad terms and a lot of numbers that can make deciding where to put your cash daunting.

As a start, some point to costs as one of the easiest things people can understand and control. It is recommended new investors pick a passive fund that charges very little, with returns in-line with a market index.

This is because costs can be one of the biggest things to eat into your returns. Assuming no investment returns, investing £100 in a fund charging 0.5% would leave an investor with £90.46 after 20 years. Doubling this to a 1% fee leaves an initial £100 pot at £81.79, while doubling the charge one final time to 2% would leave just £66.76 – roughly a third lower.

So keeping costs down can be vital – particularly if returns are naturally going to be lower across the board in the future, something that analysts at Capital Group have said could be the case in the coming decade.

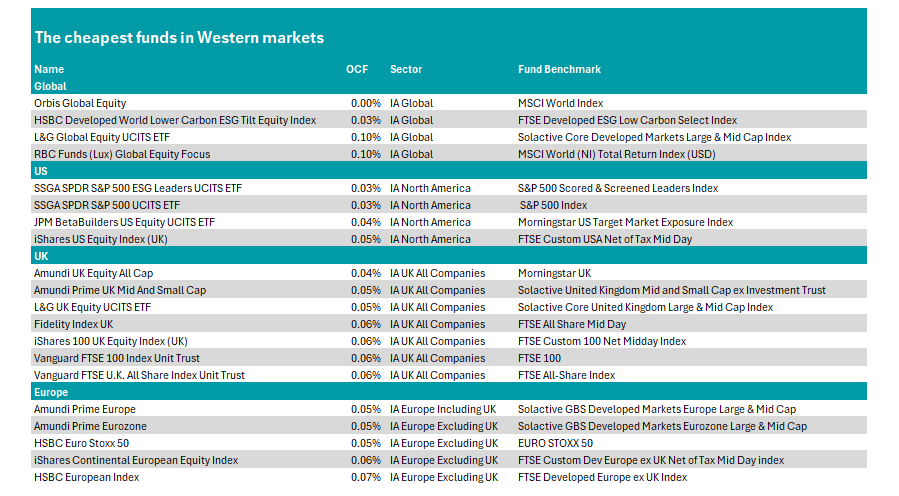

Below, Trustnet has looked at the cheapest options in the Investment Association universe, including multiple funds with different benchmarks, so investors can choose which they prefer to track.

We have split these into two tables. The first shows the Western funds – those investing the US, UK, Europe and in global portfolios – while the latter focuses on portfolios in Asia.

The cheapest option is Orbis Global Equity, which has a unique fee structure. Indeed, the fund is not free even though it has an ongoing charges figure (OCF) of 0%.

If it fails to beat the MSCI World index, it does not charge a fee. More than that, some 40% of the underperformance is paid back, with refunds offered to investors. When it does beat the index, however, 40% of the outperformance is taken as a performance fee.

Source: FE Analytics

Outside of Orbis’ unusual structure, HSBC Developed World Lower Carbon ESG Tilt Equity index is the cheapest in the IA Global sector, charging just 0.03%. The fund tracks the FTSE Developed ESG Low Carbon Select index and uses environmental, social and governance (ESG) screens to weed out companies that do not fit its criteria. This means that it can look markedly different to other more traditional benchmarks.

The next-cheapest global fund is another sustainability option: L&G Global Equity UCITS ETF, which tracks the Solactive Core Developed Markets Large & Mid Cap index. It charges 0.10% in ongoing charges, as does the RBC Funds (Lux) Global Equity Focus portfolio, which tracks the more traditional MSCI World.

It is part of a theme in the table above, with sustainable options dominating the list of cheapest funds in the major Western markets.

For investors who want to invest specifically in the US, the cheapest options here are SSGA SPDR S&P 500 ESG Leaders UCITS ETF and SSGA SPDR S&P 500 UCITS ETF – both costing just 0.03%. They track the S&P 500 although the former has a sustainable criteria.

Other options to track the S&P 500 are available. The next cheapest are abrdn American Equity Tracker, Fidelity Index US, HSBC American Index and Xtrackers S&P 500 UCITS ETF. All cost 0.06% per year.

Turning closer to home, investors who want more in the domestic UK market may consider the Amundi UK Equity All Cap fund, which is the cheapest in the Investment Association with an OCF of 0.04% but tracks the Morningstar UK benchmark.

It is followed by a pair of ESG funds: Amundi Prime UK Mid And Small Cap and L&G UK Equity UCITS ETF – both with a cost of 0.05%.

To track the more recognisable FTSE All Share, the cheapest options are Fidelity Index UK and Vanguard FTSE U.K. All Share Index Unit Trust, while for large-cap investors the iShares 100 UK Equity Index (UK) and Vanguard FTSE 100 Index Unit Trust are the lowest-cost passives to follow the FTSE 100. All funds charge 0.06%.

Lastly, in Europe Amundi Prime Europe and Amundi Prime Eurozone come in at 0.05%. For those looking to invest without a sustainable mindset, HSBC Euro Stoxx 50 costs the same and tracks the more common EURO STOXX 50 index.

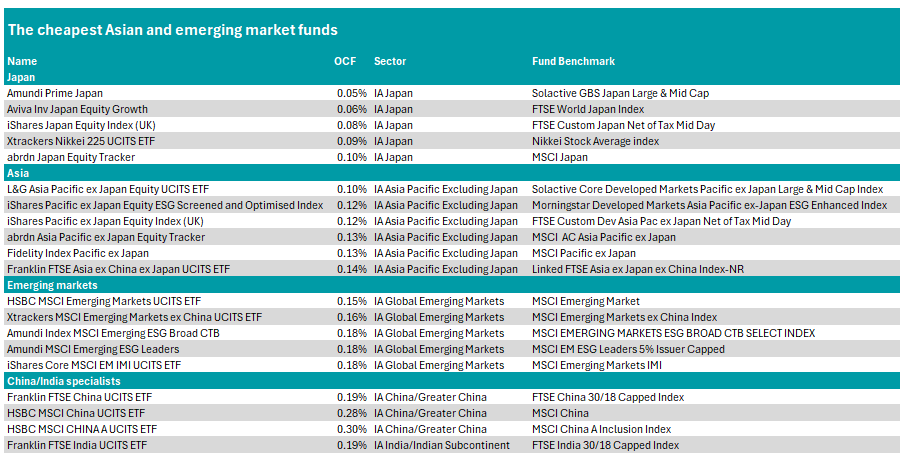

Meanwhile, in Asia, there are a range of options available to investors. Starting with Japan, which is the most developed market, Amundi Prime Japan has the lowest fee at 0.05%.

We have included five funds here, all investing in different benchmarks, including the FTSE World Japan Index, the Nikkei and the MSCI Japan indices.

From here, things get a touch more expensive. For Asia specialists, investors are better off looking at the IA Asia Pacific Excluding Japan, rather than those that include Japan.

L&G Asia Pacific ex Japan Equity UCITS ETF will set investors back 0.10% per year in ongoing charges (another sustainable tracker), while those who want to put their money in funds that track more recognisable indices from FTSE or MSCI will pay 2-3 basis points more.

Source: FE Analytics

Emerging markets are more expensive still, with the HSBC MSCI Emerging Markets UCITS ETF costing 0.15% - the cheapest in the peer group. Xtrackers MSCI Emerging Markets ex China UCITS ETF is next at 0.16%, although it excludes Chinese stocks.

The emerging markets and Asia are both dominated by two countries: China and India. As such both have their own specific Investment Association peer groups. To buy Chinese or Indian stocks directly, investors will pay a minimum of 0.19% through either the Franklin FTSE China UCITS ETF or Franklin FTSE India UCITS ETF.