Rolls-Royce has become a stock market darling with a 95.6% return over the past 12 months and the impetus of increased defence spending. But beyond this poster child, the rest of the UK’s industrial sector tends to get ignored. Other sectors such as technology, healthcare, consumer staples and energy attract much more limelight.

Blake Hutchins, manager of the Trojan Income and Trojan Ethical Income funds, thinks industrials often get overlooked because the sector is a relatively small part of the FTSE All Share, people don’t think of the UK as an industrial economy and the sector is so diverse it is hard to make easy categorisation.

Yet scratch beneath the surface and there is a cohort of world-class, market-leading, UK-listed industrial companies with strong margins. “You could create a fantastic portfolio within the UK market [from] the broad industrial sector,” he said.

Hutchins has been gradually adding industrial names to the Trojan Income fund during the past three to five years. Data businesses RELX and Experian are top 10 holdings, as is distributor Bunzl. The fund also owns pest control specialist Rentokil, testing and inspection company Intertek, distribution group Diploma and engineering company Smiths Group.

“It's a very diverse sector but, on average, these companies make more than 20% margins and 20% returns on capital. They're not capital intensive, their cash conversion is good, they’ve got good balance sheets. And the nice thing about a lot of these companies is they're very hard to disrupt,” he said.

Last month, he initiated a position in Spirax Sarco, which he described as “one of the UK's best engineering businesses”.

Spirax’s valuation became excessive a couple of years ago, approaching 50x earnings, when interest rates were low and environmental, social and governance (ESG) investing became fashionable.

Spirax’s Watson-Marlow business makes high precision pumps that serve the life sciences sector, among others, and were used to make vaccines. Demand was high during the Covid pandemic and Watson-Marlow ramped up capacity, but the pandemic ended faster than expected and demand has normalised since then.

Spirax’s steam and electric heating business also faced some issues, creating a perfect storm for the company, which performed poorly last year and went through several earnings downgrades.

From its peak in November 2021 to the trough in January 2025, the share price fell more than 50%.

Performance of Spirax over 5yrs

Source: Google Finance

Hutchins thinks Spirax’s downgrade cycle is coming to an end so he has initiated a small position. Spirax has always commanded a premium valuation of 20-25x earnings and he believes the current valuation of 20x with a dividend yield of 2.5% to 3% is an attractive entry point.

Spirax is still a high-quality business with a lot of recurring sales, high profit margins, high returns on capital and a good track record of growing its dividend, he said.

“Our dream stock is a really high-quality business that is a little bit out of favour, which gives us a good valuation opportunity,” he explained.

Entry points are key to the strategy. For instance, Hutchins invested in LSEG a couple of years ago at a share price of £70-£75. The business was struggling with indigestion following its acquisition of Refinitiv, which was completed in January 2021, but has recovered since then to reach a share price of £111 at the time of writing. He is hoping to repeat this success with Spirax.

Performance of LSEG over 5yrs

Source: Google Finance

Hutchins initiated a position in another UK engineering business, Halma, in January 2024. Halma and Spirax are “regarded in the UK market as two of the highest-quality engineering industrial businesses with fantastic track records”, he said.

“There is a nice ESG angle to that stock as well. When all of these ESG funds were getting massive inflows, at a time when rates were really low, there was a bit of price-insensitive buying and Halma and Spirax were carried along with that.”

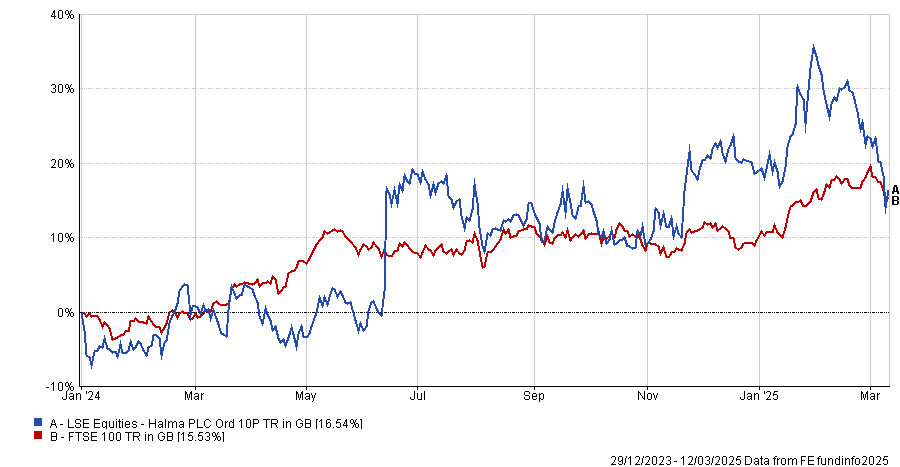

He bought Halma on 20-22x earnings, a big reduction from its peak of 40-50x, and the stock has performed well since then. Halma’s share price has climbed 16.5% since the start of 2024.

Performance of Halma vs FTSE 100 since Jan 2024

Source: FE Analytics

Incidentally, Hutchins doesn’t own Roll-Royce because, despite its fantastic recent performance, “it's quite capital intensive and goes through big cycles; it's not got that predictability we like to see”.

He prefers stocks with predictable cash flows and dividends that deliver steady, compounding returns for investors. These defensive characteristics enable the fund to hold up well in bear markets, he said.