Income investing has been struggling in recent years as the rise of artificial intelligence (AI) has helped growth companies that do not typically pay a dividend to surge.

Add in higher interest rates, which has allowed more cautious investors to return to bonds (and even cash) rather than relying on company dividends, and it has been a perfect storm for strategies where the largest selling point is their reliable income.

But with valuations of the tech giants now looking stretched and interest rates settling down, now could be a time to look back at the slightly unloved region of income investing.

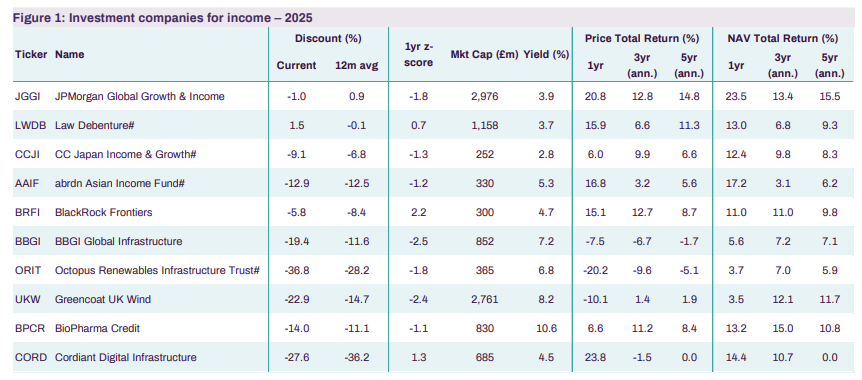

Peel Hunt researchers Anthony Leatham and Markuz Jaffe have put together a ‘playbook’ for 2025. Within it, they have highlighted 10 investment trusts that offer one or more of the following characteristics: a competitive or above-average yield; fully covered dividends; dividend growth; robust underlying cash flow profile; and balance sheet quality.

“We continue to place emphasis on companies that offer a source of differentiated yield and have delivered inflation feed-through, translating the higher inflation backdrop into meaningful dividend growth. The average dividend yield on offer across our top picks is 5.8%,” they said.

Below Trustnet highlights the five equity income selections. The full list of recommended trusts can be seen in the table at the bottom of this article.

Kicking things off, JPMorgan Global Growth & Income is the first name on the analysts’ team sheet. The trust buys quality-growth companies and dividends are supplemented by payments from capital reserves, which allows the investment managers to look beyond strict income requirements and invest in low- or non-yielding stocks, sectors and regions, the analysts said.

“In a market where leadership has been particularly narrow and concentrated in recent years, this flexibility has helped the trust compete with both the index and global equity fund peers.”

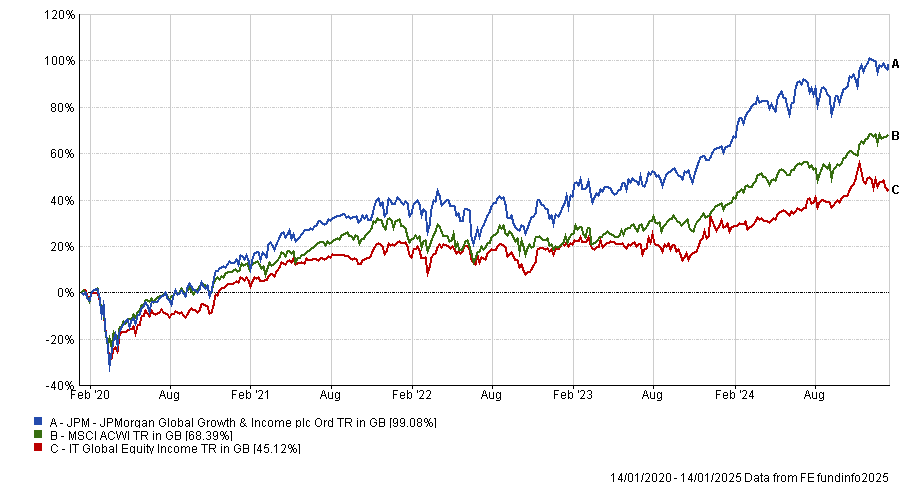

Under the current management team of FE fundinfo Alpha Managers Timothy Woodhouse and Helge Skibeli, JPMorgan Global Growth & Income has delivered a 4% annualised outperformance of the MSCI ACWI benchmark, the analysts said. Over the past five years it has made 99%, more than double the average peer and 30 percentage points ahead of the index.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

For 2025, it intends to pay a total dividend of 22.8p per share, a 23.6% increase from the previous year's 18.4p. This represents a prospective yield on the share price of 3.9%.

Closer to home, Law Debenture is the team’s UK pick. Managed by Alpha Manager James Henderson and Laura Foll, it combines an investment trust with an independent professional services (IPS) business that provides structured finance services, pensions trustee advice, corporate secretarial services and other business-critical activities.

The managers take a contrarian viewpoint, with top holdings such as Rolls Royce and Barclays performing well in recent years, while an increase in merger and acquisition (M&A) activity has benefited the fund.

Meanwhile, the IPS business continues to grow, with the last reported net revenues (to the end of June 2024) up 8.8% and This part of the trust has more than doubled in value over the past five years but remains “conservatively valued”, the Peel Hunt analysts said.

With UK stocks also inherently undervalued compared with overseas peers, “we see the equity portfolio as positively geared to an improving economic backdrop and expect the managers to make full use of the flexibility afforded by the income generation of the IPS business,” they concluded.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

In Asia, Japan Income & Growth has benefited from the country's shift towards improving corporate governance and is a strong option for investors looking to gain access to this change.

“The trust trades on a 9.1% discount and has a yield of 2.8%, which offers a premium to the Topix, with an unbroken track record of consecutive annual dividend increases, the analysts said.

Meanwhile, for broader exposure abrdn Asian Income is another good option for income seekers. “The trust offers a strong combination of attractive total returns, a yield premium over the market and peer group, supported by a consistent dividend track record,” the analysts said.

“We believe the disciplined focus on quality, dividends, valuation and growth, along with the constant reappraisal of companies in the portfolio and portfolio positioning, bodes well for both index outperformance and potential discount narrowing.”

Lastly, BlackRock Frontiers invests in smaller countries that can be overlooked by more mainstream portfolios. Investing in countries outside the MSCI World index, it focuses on macroeconomic calls on certain countries, before stock selection processes take place.

Although not specifically an income mandate, the trust yields 4.7% at present thanks to the strong dividends from its underlying holdings, while its portfolio sits at an average price-to-earnings (P/E) ratio of 8x, which the Peel Hunt analysts said was “cheap”, noting it was a “double discount” as this is lower than the 12x P/E for frontier markets more generally.

Source: Peel Hunt. #Indicates a corporate client of Peel Hunt.