The launch of DeepSeek, a Chinese chatbot whose results rival ChatGPT, sparked a sharp sell-off in tech stocks during Monday’s trading session.

The DeepSeek-V3 model, which powers the chatbot app, was reportedly developed for less than $6m (a fraction of the cost of rivals) using approximately 2,000 reduced-capacity Nvidia chips amassed by founder Liang Wenfeng before they were banned from export to China.

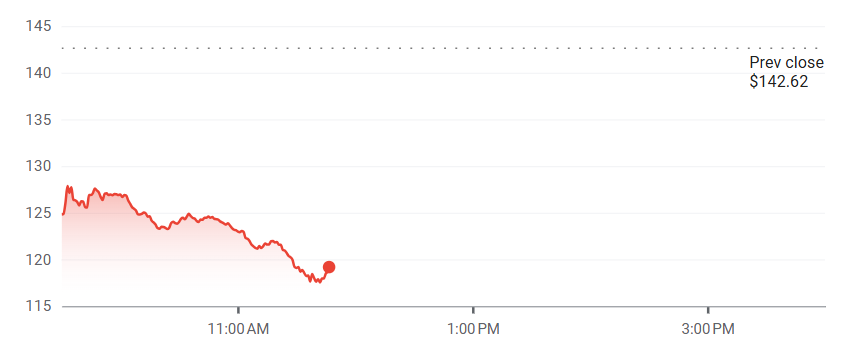

Nvidia – which has rocketed in recent years thanks to its graphics processing units (GPUs) being at the heart of the artificial intelligence (AI) revolution – plunged when the US market opened on Monday.

Nvidia’s share price in opening half of Monday’s session

Source: Google Finance

Other tech stocks were also caught in the sell-off, with the Nasdaq Composite dropping 3% when trading started.

Charles-Henry Monchau, chief investment officer at Syz Group, said: “DeepSeek is to AI what BYD is to electric vehicles.

“In a set of third-party benchmark tests, DeepSeek’s model outperformed Meta’s Llama 3.1, OpenAI’s GPT-4o and Anthropic’s Claude Sonnet 3.5 in accuracy ranging from complex problem solving to maths and coding.”

Investors now fear that the competitive advantages of today’s AI leaders will be destroyed by the development of a more efficient approach to AI processing. Previous barriers to entry – namely the need to spend billions of dollars on acquiring a large volume of Nvidia’s chips and building huge data centres – will be eroded if DeepSeek and other new entrants can develop AI apps with far fewer chips and a much lower cost.

As Oliver Blackbourn, a multi-asset portfolio manager at Janus Henderson Investors, said: “AI has been seen as a very complex area of development with those at the forefront viewed as having technological advantages which would keep them growing at a rapid pace out into the future. High expected earnings growth has been used to justify very elevated valuations, leaving them very exposed to any disappointment.

“The market reaction to a perceived sea change in the competitive landscape is proving vicious.”

Liontrust has been reducing exposure to AI capex names because of their asymmetric risk profile, said Mark Hawtin, head of the Liontrust global equities team. He also suggested that Nvidia’s “inflated margins” could be eaten away by DeepSeek.

“By cutting back on the compute needed and being able to handle tasks with just 5-12% of the energy consumption used by state-of-the-art models and an estimated 90-95% cheaper than OpenAI’s offerings, this raises the question of what now for capex spend and AI infrastructure names?” Hawtin said.

However, other managers such as Stephen Yiu, manager of the WS Blue Whale Growth fund, are waiting to see if the current panic turns into a buying opportunity.

Yiu thinks the emergence of DeepSeek will ultimately be positive for the AI industry as a whole by lowering the cost of entry for new players and potentially destroying the monopoly position of the largest tech companies.

Secondly, if more work can be done using a fraction of the computer power, then AI will become less energy intensive – and indeed, energy infrastructure has been a major bottleneck for AI so far.

Yiu is overweight Nvidia and underweight the rest of the Magnificent Seven. He has 1.5% of his fund apiece in Microsoft and Meta Platforms having slashed his exposure at the end of last year to take profits.

He is concerned about the huge amount of infrastructure spending to which Microsoft and its peers have committed, but is more positive on the recipients of that spending, such as Nvidia and Broadcom.

Yiu judges today’s sell-off in Nvidia shares to be an overreaction, potentially driven by passive investment vehicles. Even if Nvidia’s customers find a way to use half as many of Nvidia’s chips as they currently need for the same work, he does not expect them to cut orders or halve spending.

Rather, he anticipates that tech companies would continue amassing Nvidia chips and do twice as much with them, as they find new use cases for AI that have yet to be conceived.

In a similar vein, Yan Taw Boon, head of thematic – Asia at Neuberger Berman, perceives the current sell-off as a buying opportunity for tactical strategies.

“What DeepSeek has been able to achieve with open-source AI and some enhanced learning strategies, in training a reasonable strong AI model at only one-tenth of the cost, has sounded alarm for many US AI companies. Nevertheless, DeepSeek also said that its key bottleneck is in advanced AI / GPU chips. Without leading-edge chips, DeepSeek admits that it can’t scale up its model for a large user base,” he explained.

He expects the US to continue restricting China’s access to advanced AI chips and advanced semiconductor manufacturing tools, whilst ramping-up its own AI infrastructure to stay ahead in the AI race.

“If anything, the AI race will accelerate and this will continue to drive strong structural growth for semiconductors, especially for more efficient AI ASIC [application-specific integrated circuits] chips and data centre networking technologies,” he concluded.