GQG Partners U.S. Equity has been the best-performing young US fund over the past three years, beating numerous index trackers, according to data from FE Analytics.

It was the third-best fund in the IA North America sector in the three years between the start of 2022 and the end of 2024, up some 56.7%, thanks to particularly strong years in 2022 and 2024.

In its first full year of activity GQG Partners U.S. Equity made 8.1% at a time when the average peer lost money, while last year it was up 28.3%.

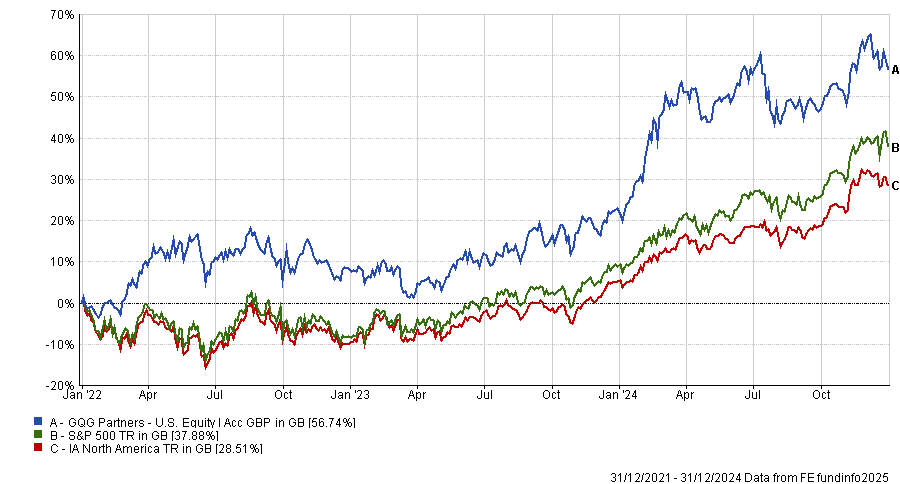

Performance of fund vs sector and benchmark over 3yrs to end of 2024

Source: FE Analytics

Recommended by analysts at FE Investments, the fund “combines a strong focus on quality companies with a flexibility to adapt to macroeconomic conditions which provides multiple avenues for generating outperformance”, they said.

“The macro ‘switch off’, whereby entire sectors can be exited quickly in the event of new risks emerging, has been highly successful at limiting damage in falling markets.”

The fund is managed by a trio of FE fundinfo Alpha Managers – Brian Kersmanc, Rajiv Jain and Sudarshan Murthy – and has hoovered up investors’ cash since its launch in March 2021, with assets under management of £1.6bn.

It is on the FE Investments ‘Approved’ list, with analysts highlighting the use of “non-traditional analysis”, making it “highly differentiated” and giving it a “competitive edge” against its peers.

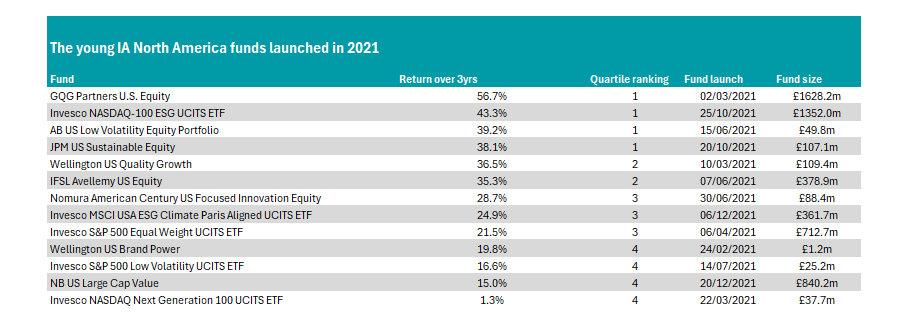

GQG Partners U.S. Equity was not alone in taking the Investment Association (IA) by storm in its first three full years in operation. Overall there were four funds from the 13 launched in 2021 that made top-quartile returns in the IA North America sector, as the below table shows.

Source: FE Analytics. *All data correct to the end of 2024.

Some 13 percentage points behind, but still in the top quartile of the IA North America sector, comes Invesco NASDAQ-100 ESG UCITS ETF. The £1.3bn passive fund tracks the technology-heavy Nasdaq index, with 59.7% invested in the sector, but also evaluates companies on the basis of their activities, controversies and environmental, social and governance (ESG) risk ratings.

At 10.6%, the top weighting is to iPhone maker Apple, while ‘Magnificent Seven’ staples include chipmaker Nvidia and software developer Microsoft, which also make up more than 10% of the portfolio.

The fund started out slowly and was one of the worst funds in the sector in 2022, down 23.2%, but has shot back in the past two years with back-to-back top-quartile performances.

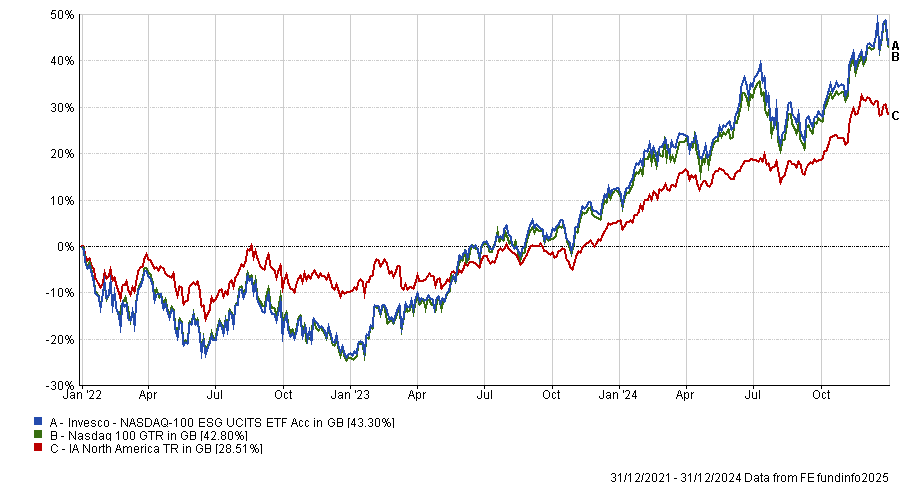

Performance of fund vs sector and benchmark over 3yrs to end of 2024

Source: FE Analytics

It was the only passive fund launched in 2021 to make strong gains however, with the rest of the top performers on the list all actively run.

AB US Low Volatility Equity Portfolio, managed by Alpha Manager Kent Hargis, came in third place on the table above with a total return of 39.2%, while JPM US Sustainable Equity headed by Danielle Hines and David Small rounded out the top-quartile performers.

These funds have failed to attract the assets of the two above, however – with portfolios worth £50m and £107m respectively by the end of 2024.

Two more active funds achieved better than average performance figures: Wellington US Quality Growth and IFSL Avellemy US Equity. Neither were able to beat the S&P 500 index, however, which was up 37.9% over the three years to the end of 2024.

There were three more in the third quartile of the sector, all of which achieved returns of more than 20% over the period. Nomura American Century US Focused Innovation Equity was the best of the bunch, up 28.7%, followed by Invesco MSCI USA ESG Climate Paris Aligned UCITS ETF and Invesco S&P 500 Equal Weight UCITS ETF.

Investors had more chance of picking an underperformer than a star had they invested in all of the funds on the table, with seven producing below-average returns.

The worst of the list was Invesco NASDAQ Next Generation 100 UCITS ETF, which tracks an index that invests in companies outside of the Nasdaq 100 index. With 107 names in the portfolio, the top holding – Alnylam Pharmaceuticals – has just a 2.1% weighting, meaning it is broadly diversified among these mid and small-cap names. It made just 1.3% over the three years to the end of 2024.

It was joined in the bottom quartile of the peer group by its cousin Invesco S&P 500 Low Volatility UCITS ETF, as well as active funds Wellington US Brand Power and NB US Large Cap Value.

The latter has taken in £840m in assets under management despite its 15% return over three years – the worst on the list. It started off strongly, making 11.4% in 2022, but has slipped back over the past two years.

Managed by David Levine and Eli Salzmann, the fund eschews many of the largest names in the US market as it looks for unloved companies that are mispriced.

Financials, healthcare, industrials, energy and consumer staples are all more heavily represented in the portfolio than tech stocks, which make up just 7.3%. Top holdings including oil producer Exxon Mobil, baby lotion seller Johnson & Johnson and Us bank JP Morgan Chase.