Picking funds run by veteran managers could be pivotal in the current uncertain landscape, with some placing a premium on experience and trusting those that have been through many different market cycles.

One way of weeding the top names is to invest with those who have gained the FE fundinfo Alpha Managers title. Alpha Managers are given the title based on their ability to create risk-adjusted alpha, outperformance in both rising and falling markets, and those who consistently beat their benchmarks. The top 10% of the investment industry are given the coveted title.

Given their stature, many funds run by the recipients of this coveted award are large and well known, but there are some who run portfolios with less than £250m in assets under management (AUM).

As such, in the first of a new series Trustnet highlights funds run by top managers that might have slipped under the radar.

Starting with the IA Global sector, investors have a plethora of choice when it comes to investing globally, peer group home to some 560 portfolios. Of these, there are 15 that have less than £250m in AUM despite having an Alpha Manager at the helm.

Under the radar global funds run by alpha managers

Source: FE Analytics

Some top fund groups appear on the list above, including Schroders, where Alpha Managers Charles Somers and Scott MacLennan helm the £247m Schroder Global Sustainable Growth fund. It is the largest fund to match our criteria, so arguably closest to investors’ radars.

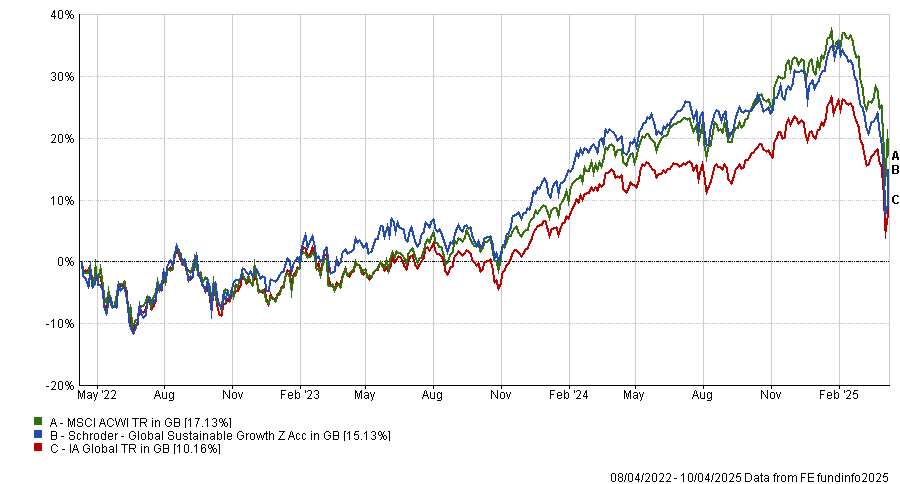

Last year, Somers' work on this fund and his other strategies won him the title of New Alpha Manager of the Year. The pair took over the fund in August 2022 and over the past three years it has made 15.1%, a second-quartile result.

Investors have soured on the fund in recent years, which peaked with an AUM of £440m last year. It slightly outperformed the sector average in 2023 and 2024 but is down more so far in 2025.

The fund is the little cousin of the Luxembourg-listed Schroder ISF Global Sustainable Growth fund, which has £3.2bn in assets.

Performance of fund vs sector and benchmark over the past 3yrs

Source: FE Analytics

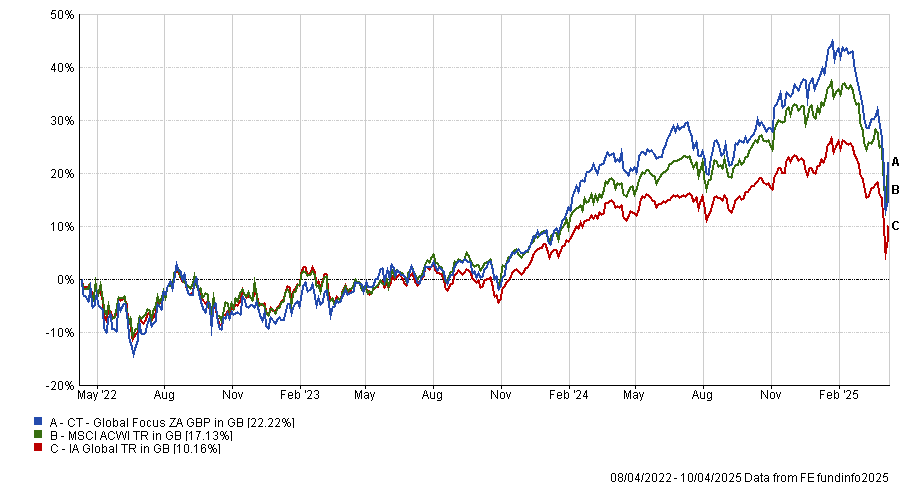

Another large firm on the list is Columbia Threadneedle, with the £242m CT Global Focus fund, led by Alpha manager David Dudding, also making an appearance.

FundCalibre analysts described it as a “concentrated, high-conviction portfolio”. It invests in high-quality capital businesses and will even dip into emerging markets if it finds stocks that match its criteria, making it a "genuinely global" strategy.

“Dudding has always had a clear philosophy and process which he has executed very successfully throughout his career”, analysts at FundCalibre said.

While analysts conceded that the quality-growth style would have struggled in specific market environments, the FundCalibre team said: “This is a fund and manager we hold in extremely high regard.” Over the past three years, it has delivered a top-quartile return of 22.2%, beating the MSCI ACWI. Unlike the Schroders fund above, the CT portfolio has been gaining AUM over the past 12 months, peaking at £274m in January before dropping back below our £250m threshold since.

Performance of fund vs sector and benchmark over the past 3yrs

Source: FE Analytics

Sticking with large fund groups, JP Morgan Asset Management made the list of unheralded gems led by top performers with JPM Global ESG Equity. Managed by Alpha Managers Timothy Woodhouse and Joanna Crompton, the fund is a relatively young portfolio, but it has been shooting the lights out with a top-quartile performance over the past three years.

This strong performance was partially due to more than 10% of the fund being invested in three of the Magnificent Seven.

This environmental, social and governance (ESG) fund has been gathering momentum this year after a stagnant couple of years in AUM terms when it hovered between £160m and £180m.

The fund is the smallest run by global equity specialist Woodhouse, who runs £12.3bn on behalf of investors in his five other strategies, including the JPMorgan Global Growth & Income investment trust.

Another top name with lots of funds under their belt is Mike Fox. On this list, Royal London Global Sustainable Equity (IRL) also qualified, although he is better known for his work on funds such as the £2.5bn Royal London Sustainable Leaders Trust.

It was not the only strategy from the Royal London team to be under the radar despite a very experienced manager. The Royal London Global Equity diversified fund(IRL) led by veteran manager Matt Kirby, also stood out.

However, Kirby is a relatively new addition to the team, having only joined in early November 2024, following the departure of former head of equities Peter Rutter and his team.

Performance of funds vs the sector and benchmark over the past 3yrs

Source: FE Analytics

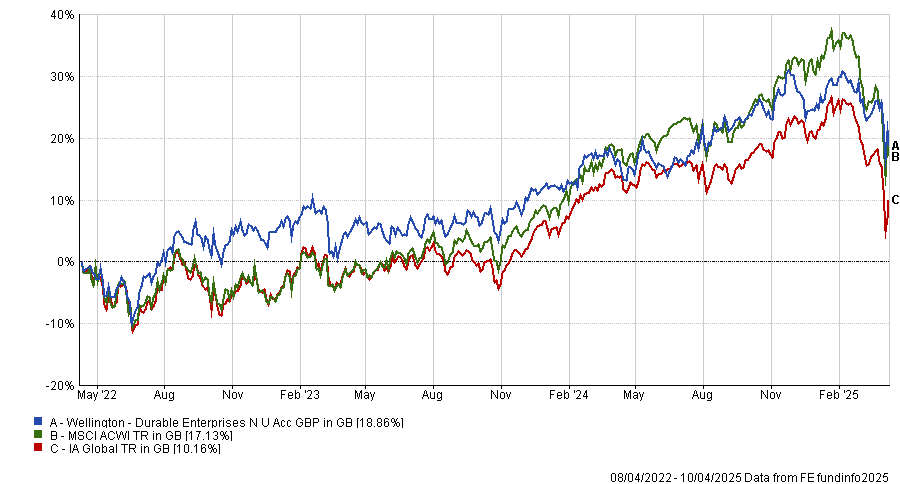

Turning to perhaps less recognisable names, the £230m Wellington Durable Enterprises fund also made the cut, led by Alpha manager Daniel Pozen.

It delivered a return of 21.3% over the past three years, a top-quartile performance. Notably, Pozen has achieved this with no major allocations towards the Magnificent Seven (Nvidia, Microsoft, Amazon, Tesla, Apple, Meta, Alphabet), which have led the market over this period.

Performance of fund vs sector and benchmark over the past 3yrs

Source: FE Analytics

Henrik Wold Nilsen’s Storebrand Global ESG Plus Lux fund is also eligible, with just £156m in AUM. Despite being an active equity fund, analysts at Square Mile explained that the fund aimed to replicate the “risk and return profile of the MSCI ACWI” but also reduce exposure to fossil fuels.

“The resulting portfolio has a significantly reduced carbon footprint, alongside reinforced ESG criteria. Overall, this fund should be ideal for investors who are looking to reduce the carbon footprint of their investment while maintaining exposure to global equities,” they concluded.

Finally, there are a handful of minnows within the IA Global sector led by veteran Alpha Managers. These included the likes of Comgest Growth Global and Comgest Growth Global Plus, Carmignac Global Equity Compounders, GQG Partners Global Quality Value, NB Global Sustainable Equity, Stewart Investors Worldwide Leaders, AllianceBernstein Low Volatility Global Equity and Vermeer Goshawk Global.