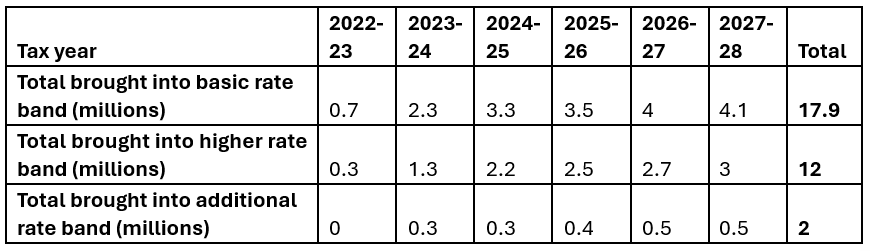

Close to 18 million Britons will be dragged into paying the basic rate of income tax by the 2027-28 tax year, a HM Revenue and Customs (HMRC) freedom of information request, obtained by Quilter, has revealed.

By freezing the income tax threshold for the next three years, the government’s ‘stealth’ increase on income tax will mean 17.9 million people will be required to pay the basic rate of income tax, 11.9 million of which will have to start paying tax in the next three years.

Tax thresholds have remained static since the 2021-22 tax year and will continue to be left unchanged for another three years until 2027-28.

Alongside the increase in basic-rate taxpayers, some 12 million will be pushed into the higher rate band, while 2 million are upped to the additional rate bracket.

Source: Quilter

Rachael Griffin, tax and financial planning expert at Quilter, said: “The lengthy freeze is resulting in a significant tax rise by stealth. As incomes rise, including state pension income, more people are being dragged into paying tax for the first time or into higher tax brackets, a phenomenon known as fiscal drag,” she said.

“Even without an explicit tax rise, the government will continue to collect more from taxpayers each year by keeping thresholds static.”

While there have been rumours that chancellor Rachel Reeves might opt to freeze income tax thresholds even further out to 2030, this seems unlikely to Griffin given the likely backlash and the government’s commitment not to raise taxes for working people.

Of those that will be brought into the basic rate tax bracket, some 8.2 million of the new taxpayers will be over the age of 60, suggesting those in receipt of pension income, including the state pension, will increasingly be forced to pay tax on their retirement income.

As the state pension rises, the personal allowance remains stagnant, with many pensioners soon finding themselves having to pay back a proportion of their state pension.

“Strategic financial planning has never been more important,” said Griffin.

“Some will be able to mitigate their tax burden with options such as salary sacrifice arrangements and increasing pension contributions, whereas retirees should explore how they are taking income to ensure they are not paying more tax than necessary.”

Last week, the full state pension has upped by £470 to £11,973 a year, an inflation-beating 4.1%. Yet, it still lags the amount needed for a basic retirement income.

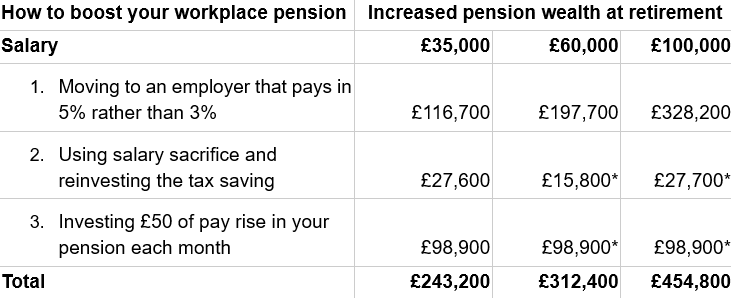

It’s therefore vital to make the most of personal pension savings, including workplace pensions and self-invested personal pensions (SIPP), according to Camilla Esmund, senior manager at interactive investor, who shared three tips that could boost retirement savings by £243,200.

First, one should look at their employer. Many pay the statutory minimum of 3% into workplace pensions, but some are more generous. Moving to an employer that pays 5% rather than 3% could boost workplace pensions by £116,700 by retirement for those who earn £35,000.

Second, salary sacrifice is “a particularly great deal” for basic-rate taxpayers, who can save £8 in National Insurance for every £100 they contribute to their pension versus £2 for anyone earning above £50,270. Directing the monthly national insurance saving to their pension – either a workplace scheme or a SIPP – could increase their pot by £27,600 over 40 years.

But there are options even after employer’s pension contributions have been maxed out.

Paying an additional £50 to a pension each month for 40 years would boost one’s retirement wealth by £98,900, assuming 5% investment growth and that they increased their total contribution by 2% each year.

Source: interactive investor

Finally, a bonus tip is to “dare to compare”.

“One of the key ways investors can boost their retirement savings is by checking how much they are paying in fees, and to make sure they are not overpaying,” Esmund concluded.