Stock markets are being plagued with uncertainty following president Donald Trump’s ‘Liberation Day’ tariffs, as investors struggle to navigate his rapidly changing policies, whether on trade or his feud with the Federal Reserve.

In this uncertain market, Ken Wotton, manager of Strategic Equity Capital, said UK shares have become a “relative safe haven”.

While trading around headlines is perilous, below, UK and global stockpickers point to a range of UK shares that they have been adding to in the current market volatility.

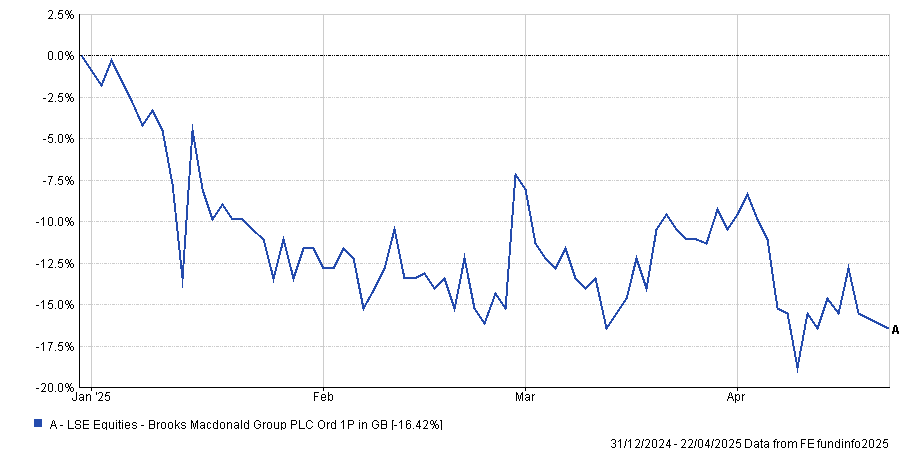

Brooks Macdonald

Wotton purchased more of his highest conviction holding, wealth manager Brooks Macdonald, during the recent market volatility. The wealth manager now represents more than 10% of the total portfolio.

Year to date, Brooks Macdonald’s share price has slid 16.4%. This is part of a bleak period for the firm over the past 12 months, with shares down 25%. However, this decline in the share price enhances an “already compelling valuation opportunity", according to Wotton.

Share price performance YTD

Source: FE Analytics

He explained: “We believe the business is at an inflexion point as it seeks to restart its ambitious growth plans and drive shareholder value over the coming years.”

The fundamentals look increasingly promising, with low financial leverage, high margins and beneficial structural tailwinds, he added.

For example, it is now listed on the main London Stock Exchange following a move from the AIM market, while it also purchased three new advisory businesses and sold its international branch to fund share buybacks, indicating it has capital to spend. As a result, it is poised for long-term growth despite the current market volatility.

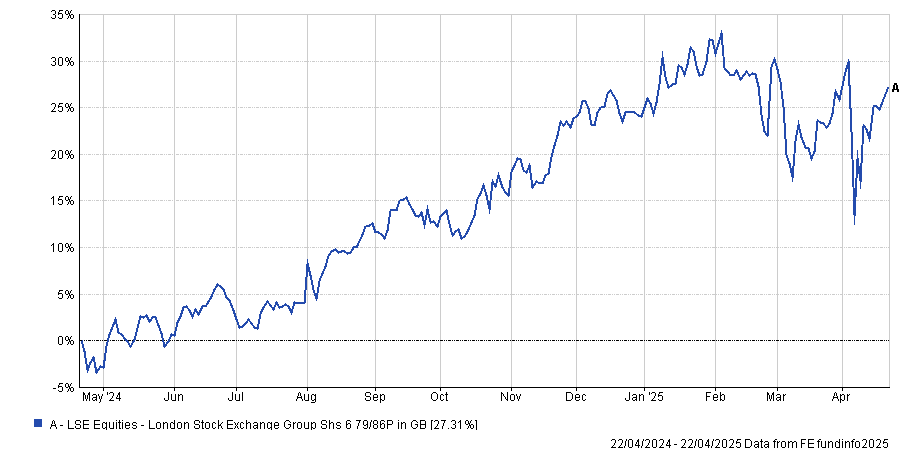

London Stock Exchange Group

Elsewhere, Ben Van Leeuwen, deputy manager of the Lindsell Train Global Equity fund, pointed towards the London Stock Exchange Group.

Its share price is up by 3% this month, despite a dip following Liberation Day. This builds on a strong longer-term track record, with shares up 27.3% over the past year and 52% over the past five.

Share price performance over the past year

Source: FE Analytics

Leeuwen added that the firm’s electronic trading platform is used by a range of end users as an essential part of their day-to-day work. As a result, the business has enormous pricing power and a loyal customer base, which makes it resilient in challenging macro-environments.

He concluded: “Durability and resilience have arguably not been at the top of investors’ shopping lists in recent years. If markets continue to exhibit heightened volatility in these uncertain times, perhaps that will change.”

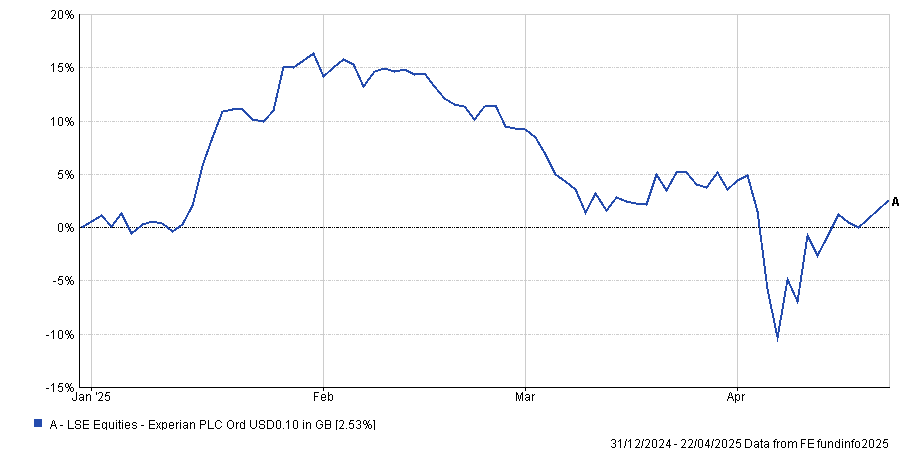

Experian

Lindsell Train’s Madeleine Wright, who is deputy manager of the Finsbury Growth and Income Trust, also pointed to credit reporting company Experian, which they have continued adding to after 2 April.

While data companies are correlated with US mega-cap tech, Wright argued it is a fundamentally different business. “Rather than having to be at the forefront of technology development in the same way as, for example, an Nvidia, the models of a stock like Experian rely on ownership of unique proprietary data that has been built up over many decades,” she said.

As this type of service is extremely difficult to tariff, the share price has performed well this year and is up by 2.5% in 2025 so far, despite an initial decline following Liberation Day.

Share price performance YTD

Source: FE Analytics

“We believe investors may be underestimating the extent to which earnings growth will accelerate for Experian,” Wright said.

The business is capital light, with more than 25% return on equity, she explained. Additionally, it is undervalued compared to its peers, hovering around a 30x price-to-earnings (P/E) ratio compared to US competitors such as FICO, which are closer to 60x.

As a result, despite being one of their worst detractors in the first quarter, the Finsbury team has added to the position in Experian because a small change in earnings growth “could deliver a big change in warranted value”.

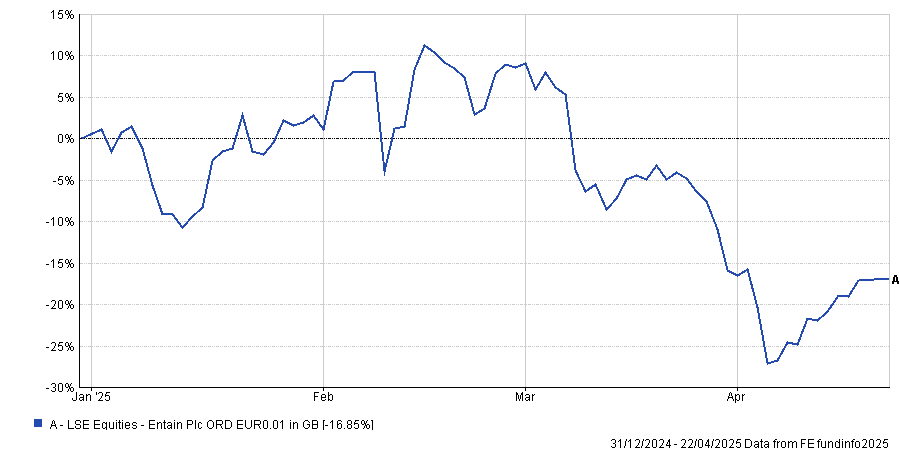

Entain

Finally, Wilfrid Craigie, investment analyst on the AVI Global Trust, identified Entain, the parent company of gambling giant Ladbrokes, as the UK share that caught his eye in 2025.

The share price has slid 16.8% this year, contributing to a total decline of 33% in the past 12 months. However, this means the business trades “at a steep discount to the sum of its parts”.

Share price performance YTD

Source: FE Analytics

Despite dropping in April on the back of the US tariffs, Craigie argued it is compelling as gambling businesses are relatively defensive, with extremely high barriers to entry and do not rely on exports or trading. As a result, Entain has the potential to do well, even if tariffs continue to dominate the news.

However, Derren Nathan, head of equity research at Hargreaves Lansdown, said that while Entain is in a strong position to grow, “question marks will remain over the strategy” until it can replace its chief executive officer, who departed in February.